Icon: enlarge

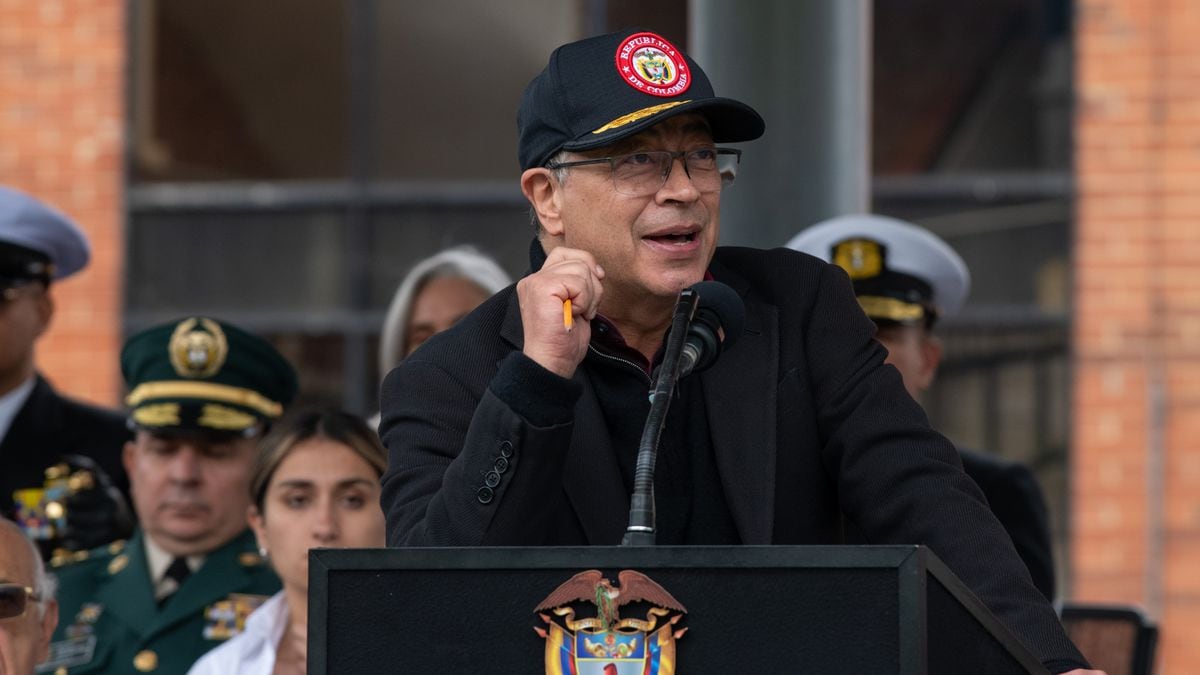

Lidl-Markt: The Schwarz Group is the largest grocer in Europe

Photo: Matthias Balk / picture alliance / dpa

For the Schwarz Group (Lidl, Kaufland), the Corona year 2020 has been more than normal so far.

According to estimates by the trade journal "Lebensmittel Zeitung (LZ)", gross sales are likely to rise by around 12 percent this year to just under 140 billion euros - and thus even more than in 2019. With a market share of 5.4 percent, the retail giant defends the strong expansion with its Lidl stores in Great Britain and Southern Europe, the pole position as the largest grocer in Europe.

The group currently has 12,492 stores in Europe - and the trend is rising.

The Corona crisis has thrown stationary retailers into a severe crisis, but has given food retailers a boost.

They are systemically relevant because people always eat.

Reason for Lidl founder Dieter Schwarz, who naturally belongs to the richest Germans, to expand vigorously in the USA as well.

The other three German industry giants,

Rewe, Aldi and Edeka,

should also increase their sales significantly this year, as the "LZ" ranking shows.

The estimates at the end of the third quarter are based on sales in euros and include all product groups as well as stationary and online retail.

On the basis of this forecast, the four German top dogs are represented among the top 7 largest grocery retailers in Europe and thus dominate the top group in Europe: Rewe has achieved sales growth of around 30 percent to 82 billion euros - also through strong acquisitions and takeovers.

With around 13,000 stores and a market share of 3.2 percent, the Rewe Group secured third place in the ranking, just ahead of the British Tesco (fourth place).

Aldi's growth weakens

The former German market leader Aldi comes in fifth with a forecast gross turnover of 71 billion euros: At Aldi, sales are only growing by around 7 percent across Europe - since there are hardly any growth opportunities in the home market of Germany, Essen is also looking to expand European neighboring countries.

With a market share of just 2.8 percent, Aldi still secured fifth place, just ahead of the French retail giant Carrefour (6th place).

The fourth German retail giant, Edeka, follows in seventh place and is likely to increase its gross sales in 2020 by around 6 percent to 65 billion euros.

The French and British competitors Leclerc, Auchan and Sainsbury's are relegated to places 8, 9 and 10.

Strong online growth: Amazon climbs to number 2, Alibaba to 22nd place

DISPLAY

The future of digital commerce

Purchasing as a request concertBy sponsored author SAP

Reinventing service - retail becomes hybrid

Successful on all channelsBy sponsored author SAP

But a look at traditional competitors such as Tesco, Carrefour, Auchan or Sinasbury's is not enough for the German food giants.

Just looking at second place in the ranking reveals which new competitors are not only attacking the industry, but also threatening to overtake it: The online retail giant Amazon increased its gross sales in Europe by 21 percent to 103 billion euros with offers such as "Amazon Fresh" increased - that's more than three times as much sales as three years ago when Amazon landed in 10th place in the ranking.

With a sales growth of around 30 percent, the US group has by far the strongest growth among the 15 companies with the highest sales, if you disregard the takeover-related jump in sales at the Rewe Group.

Amazon is not new to the industry as an attacker - but the growth of the US group is so strong in the food sector that it is rewriting the rules for the entire industry.

Those who do not develop their digital sales strategies any further are likely to drop out of the top 10 very soon.

Especially since Amazon is not an isolated case.

The Chinese online retail giant Alibaba has catapulted itself as a newcomer to 22nd place in the ranking - with rapid growth of 24 percent to around 22 billion euros in sales in Europe this year.

Alibaba is likely to have significantly expanded its current market share of just under 1 percent in the coming year and will be among the top 15 in Europe.

The Metro is one of the few food giants that suffered a loss in sales in 2020, with sales falling by 22 percent to almost 30 billion euros (14th place).

The German shopping chains Tengelmann and dm, which each ranked 35th and 36th with around 12 billion euros in sales, have at least managed to achieve a slight increase in sales - although dm is currently growing much faster.

In this race, too, the digital strategy should be the decisive factor for future success.