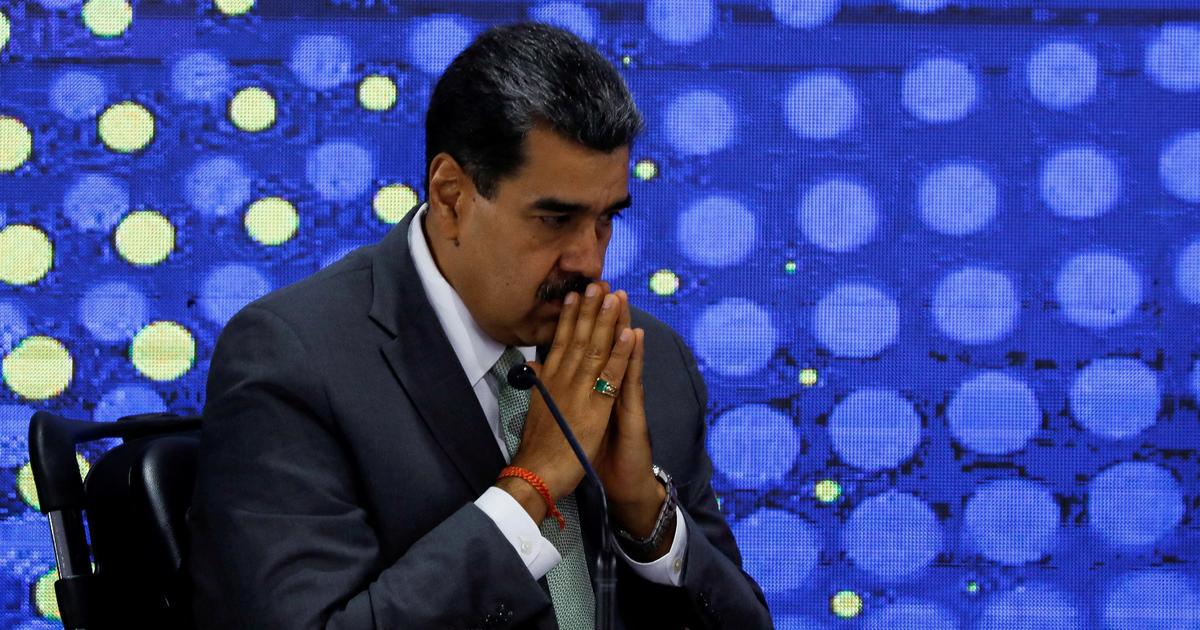

Nicolás Maduro, president of Venezuela, in the National Assembly this Tuesday.MANAURE QUINTERO / Reuters

Venezuela has taken another step in the country's dollarization this Tuesday.

The president, Nicolás Maduro, has announced his intention to "advance 100% towards a digital payments system in the country", in which the growing influence of the dollar on the battered Venezuelan economy continues to increase.

The US currency may be deposited in the national bank.

"We are about to authorize, under the supervision of the Superintendent of Bank Deposits, the opening of accounts in dollars at all levels," he said.

The Venezuelan president made these announcements on the occasion of his visit to the National Assembly, newly elected in the disputed elections of last December and now controlled by Chavismo, on the occasion of the presentation of his Memory and Account, the annual management report, a institutional gesture that Maduro had not made during the years in which the opposition controlled the Legislative Power.

Maduro's intention to fully digitize commercial transactions and standardize the influence of the dollar - already present in 70% of the economy - takes place in a country with four years of hyperinflation, a public finances devastated by corruption and a serious drop in their oil revenues.

The bolivar, the national currency, practically does not exist in paper money and a good part of the daily transactions and payments are made with points of sale [credit cards], bank transfers and alternative mechanisms such as mobile payment.

The use of the dollar is authorized, but low-denomination notes are rare, which makes elementary business operations difficult in the absence of exchange.

In this context, Maduro announced that the country's public transport will be canceled with the V-Ticket and V-Pos digital payment systems.

The Government already has digitized salary assignments, official bonuses and added subsidies from the public administration through the so-called Carné de la Patria, stimulates the use of cryptocurrencies and has created other similar payment mechanisms such as the Mobile Wallet.

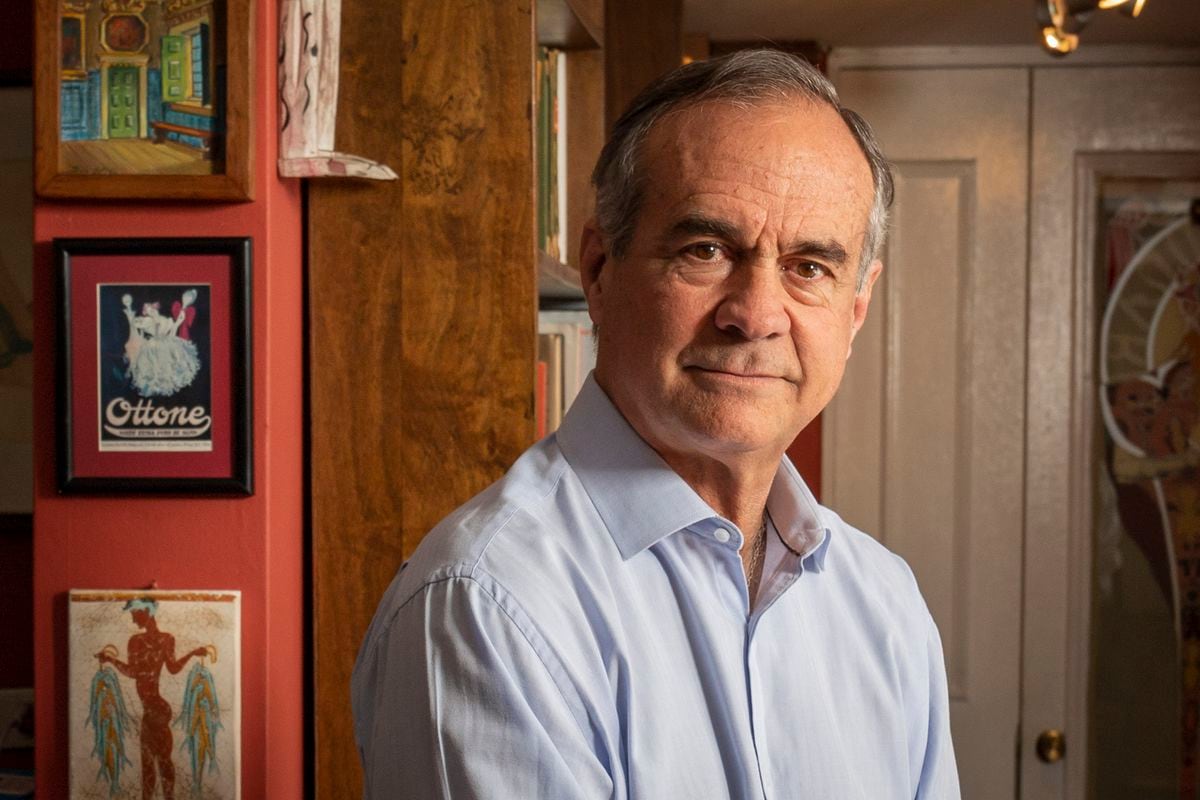

"The Maduro government today is very interested in minimizing the use of cash as much as possible," says Leonardo Vera, professor and member of the Venezuelan Academy of Economics.

“The main reason is that, in a context of hyperinflation, this mechanic of constantly printing banknotes is very expensive.

The useful life of each banknote is very short, it is a huge expense for the State. "

Every dollar is currently being sold for one and a half million bolivars.

The highest denomination Venezuelan banknote is 50,000.

The bolivar, the strongest Latin American currency for much of the 20th century, is worth nothing today.

“There has been talk of the dollarization of the economy.

I have said that expressions of trade dollarization have been and are an escape valve, ”said Maduro, whose administration continues to take hurried and silent steps to attract capital, ingratiate itself with the private sector, and boost foreign trade amid widespread questioning to your Government.

Until 2017, both Maduro and the Chavista leadership ranks almost daily blamed "the criminal dollar" and "the economic war of the bourgeoisie" as allegedly responsible for the economic sinking of the country.

Since taking office in 2013, the Maduro government has printed two families of banknotes that have soon become completely obsolete, eaten up by an uncontrolled price increase that already seems part of the landscape, and for which it has not been announced. no particular economic strategy.

Before the dollar was openly accepted in Venezuela three years ago, the absence of bolivars in cash gave way to fierce protests by the affected population, particularly in small towns because they were unable to collect their salaries.

"There is an ongoing trend, accentuated by the covid, for many economies in the world to digitize their transactions," says Vera, who states that, contrary to what may be thought, there is already a long way ahead in Venezuela on these issues due to pressure the Government out of necessity.

For the financial advisor Henkel García, director of the Econometric firm, the Government will find problems to massify this digitization: “In any case, by not solving the economic problem of the country, many people will be left out.

People need bolivars.

People who do not have a smartphone, who do not want to use it on the street for fear of the underworld.

It is impossible to set a goal of 100 percent digitization of payments.

Not even Sweden, a vanguard country in the world on these issues, has been able to do so ”.

"We will have a big problem for this objective: the weakness of the Venezuelan technological platforms and the few existing resources to catch up," says Vera.

"We may have a diversified digital media system in the future, but with very unstable platforms," he concludes.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/Q6GXUFDARZGI5BCOMCTHWWYV4Y.jpg)