Reports from leading construction companies indicate an increase in sales, especially in luxury apartments.

Investors have returned in a big way

Duo project of Africa Israel Residence in Tel Aviv.

NIS 652 million a month and a half

Photography:

Imaging: 3DIVISION

Produced by the Department of Special Supplements

Leading construction companies are reporting to the stock exchange this week on impressive sales peaks in Corona and an excellent year-end ending against expectations.

The figures are also impressive in luxury apartments, which mainly indicates the return of investors to the market, following the reduction of the purchase tax.

In two new luxury projects that have just come out these days, unprecedented sales have been recorded, as reported to the stock exchange.

Almost unexplained hysteria for this era, probably mainly in the search of apartment buyers for investments.

Thus, in the luxury project DUO Tel Aviv in the Semel South complex (in which Africa Israel holds about 52% of the rights), 127 applications were registered for the purchase of an apartment out of 277 units in the first tower in marketing, with a total financial volume of NIS 652 million. An extraordinary achievement considering the high price Of the apartments in the project and for the short time of about a month and a half in which these units were marketed.

This is a project located at the intersection of Ibn Gvirol, Arlozorov and Ben Saruk streets in Tel Aviv - a pair of 50-story towers with 668 housing units of 2 to 5 rooms and penthouses on the higher floors.

The project will offer its residents a variety of services and indulgences such as an infinity pool, 24/7 security, fitness club and more.

The project was designed by Avner Yashar and designed by Orly Shrem.

The development of the complex, including the construction of the two towers and commercial areas, is expected to generate income for Africa Israel Residential in the amount of NIS 1.9 billion (excluding some of the partners).

In addition, purchase requests (which have not yet matured into sales agreements) are pending in relation to 158 housing units at various sites of projects involving the company, with a total financial volume of approximately NIS 723 million.

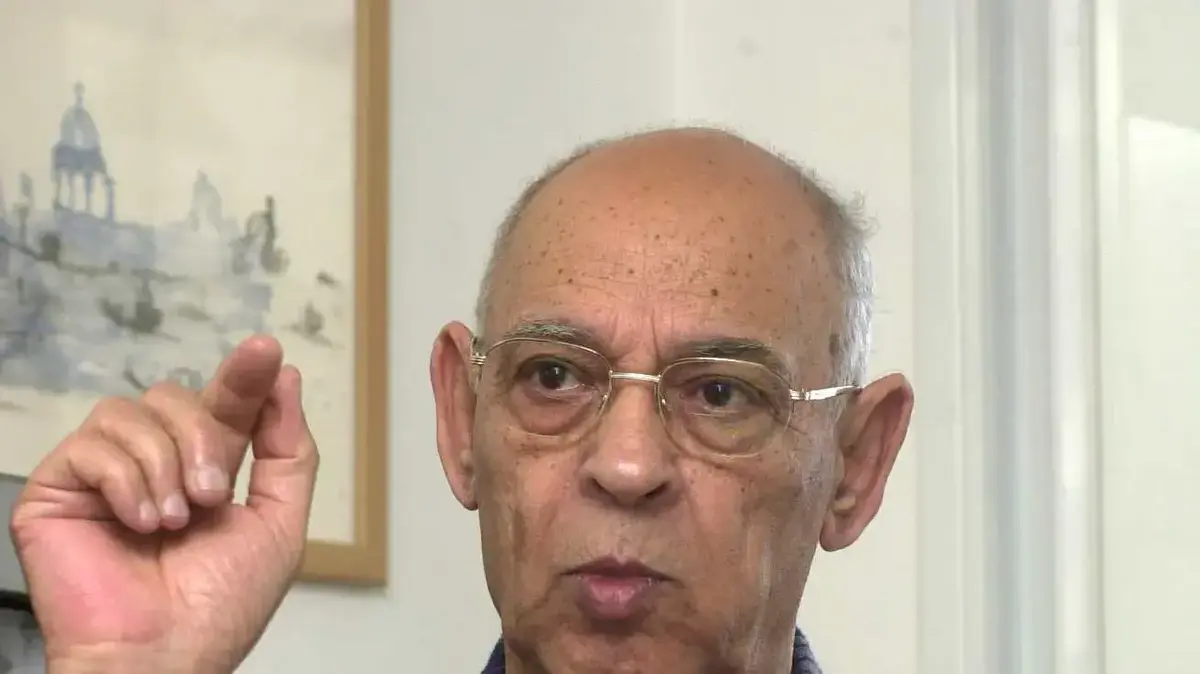

Dan Gingis, VP of Marketing at Africa Israel Residential: "The fact that today we can report 127 applications for housing units in a luxury project in Tel Aviv made in such a short time proves that careful planning, quality construction and high standards, still work."

A report to the Africa Israel Residential Exchange (AFRE) stated that during the past year the Company (either itself or through companies under its control) entered into sale agreements in relation to 426 housing units at various sites of the Company Group's projects (including joint projects with third parties), in financial terms A total of no less than NIS 940 million.

The EXCHANGE project of areas is another example of the return of investors.

In the building at Elite Junction in Ramat Gan, 154 apartments were sold in two months, amounting to NIS 476 million.

This is the project that most significantly impacted Azorim's sales volume in the fourth quarter, and is the company's flagship project in the coming years.

Marketing began last October, and as of the end of the year, 154 apartments with a total financial value of NIS 476 million were sold thanks to the project.

The company recorded a 32% jump in the number of apartments sold in the fourth quarter.

Azorim reported sales data for 2020 this week and presents a record figure with sales of NIS 2.1 billion, compared to NIS 2 billion in 2019. The number of apartments the company sold in 2020 was 972, while in 2019 the company sold 995 apartments.

The average price of an apartment in 2019 was about NIS 2 million, while in 2020 there was an increase to NIS 2.16 million per apartment.

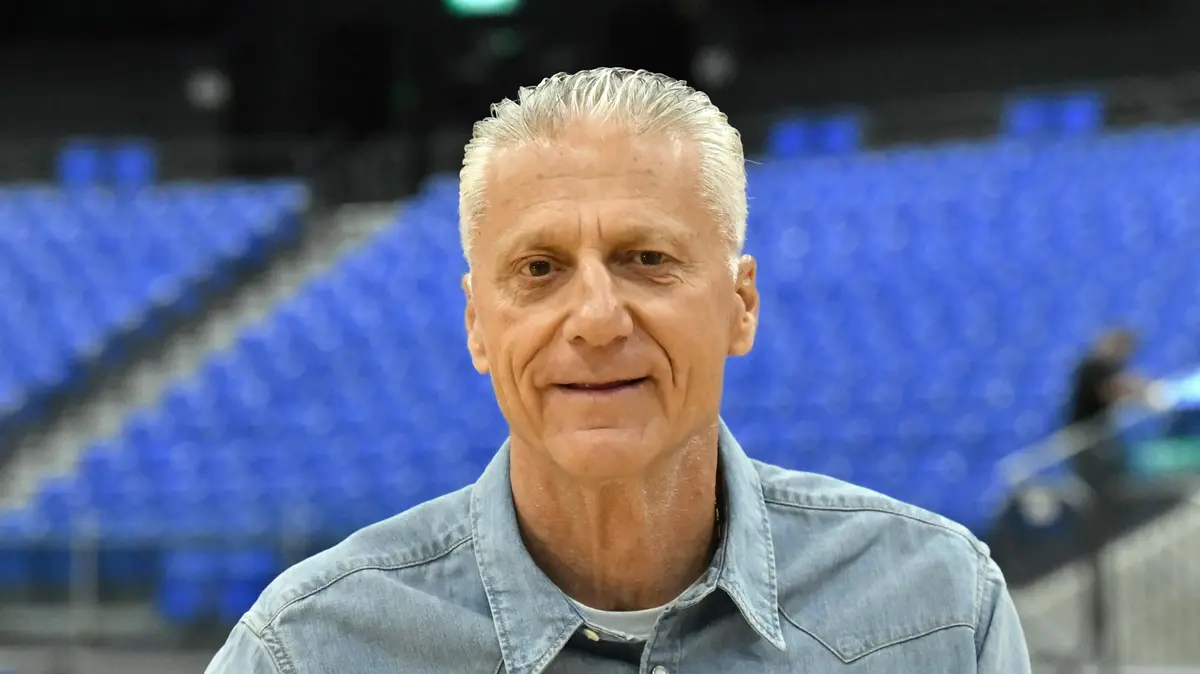

Ron Avidan, CEO of Azorim: “Despite the many challenges, closures and economic slowdown, the company has managed to record a consistent increase in sales and end 2020 with record sales.

In our estimation, prices are expected to rise.

"Many buyers who sat on the fence realized this and returned to the market, along with new buyers and the return of investors to the safe channel of real estate. The results are evident in the sales offices."

Y.H.

Damari reported a 43% increase in the number of transactions compared to 2019. In 2020, the company sold 778 apartments worth NIS 1.266 billion, compared to the sale of 544 apartments in 2019 worth NIS 961 million.

At the end of the last quarter of this year, the company sold 281 housing units worth NIS 516 million, compared with the corresponding quarter last year, in which the company sold 255 housing units worth NIS 428 million.

Amir Cohen, VP of Marketing and Sales at YH Damari: "The corona crisis has sharpened the need for many for the stability, safe investment and comfort of the residential apartment they own.

The size of the apartment and its availability with the addition of a balcony, roof or garden have become very significant for the buyers. "

Sales this year have set new records.

A high school builder reported a fourfold increase in sales compared to the previous year.

In 2020, the company sold 672 housing units worth NIS 977 million, compared with the sale of 191 housing units worth NIS 250 million in 2019.

At the end of the last quarter, the company sold 136 housing units with a total financial volume of NIS 285 million, compared with 62 housing units worth NIS 74 million in the corresponding period last year.

Sivan Peretz, VP of marketing and sales for high school builders: "The closure of homes has sharpened for many the need to own an apartment and stop paying someone else's mortgage (the landlord), or alternatively buy an apartment as an alternative to a safe investment."

A dramatic jump this year was also recorded in the Mizrahi & Sons Group, which sold 297 apartments for NIS 742.5 million, compared with 165 apartments for NIS 380 million in 2019.

"The increase in sales of money is approximately 95%, compared with an increase of about 80% in the number of apartments.

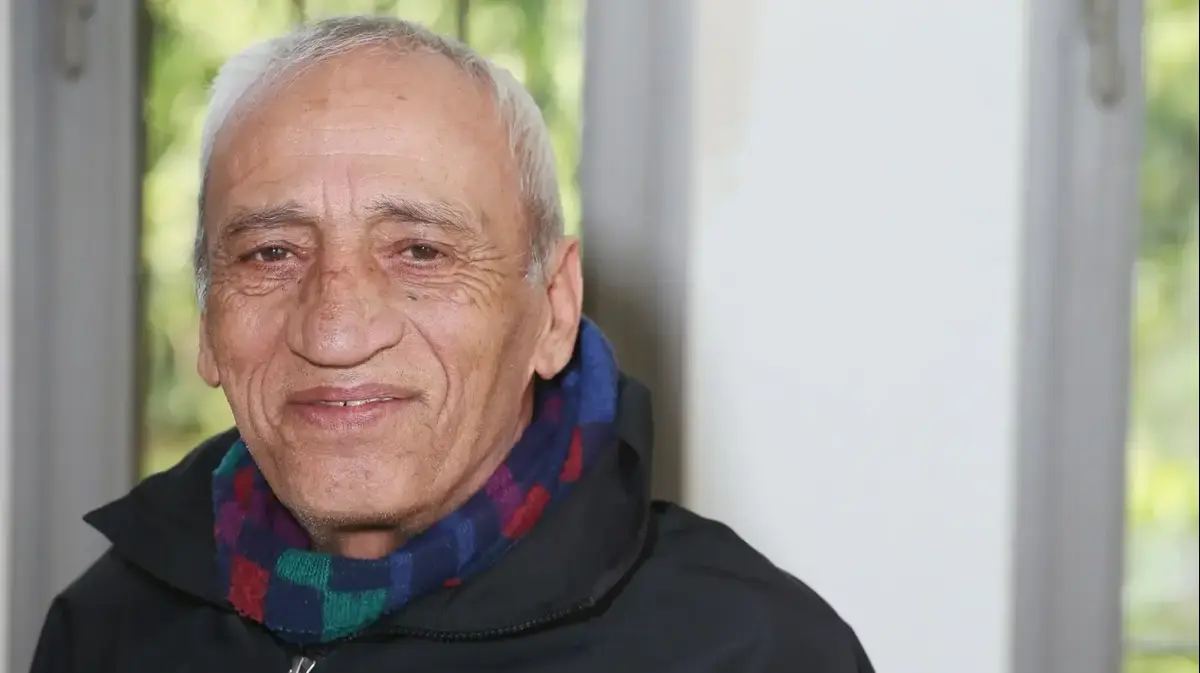

The explanation for the gap is mainly in the increase in the sale of penthouse apartments and premium apartments, "explains Roni Mizrahi, who heads the company.

Avnei Derech reports a record 69% increase in the group's sales to about 499 units compared to 300 units compared to 2019. The company's revenues doubled from NIS 280 million in 2019 to NIS 580 million in 2020. The increase was reflected in all areas of activity. Of the company: projects for the free market, urban renewal and price per occupant.

From the beginning of the first days of closure until today, the group has launched four new projects, among them: in Beit Shemesh 154 units, in Alfei Menashe 160 units, in Yokneam 208 units and in Lod 323 units.

Yair Cohen, CEO of the Milestones Group: "The Corona crisis, which caused sharp volatility in the various investment channels, has sharpened the recognition that investing in residential real estate is a solid and safer investment alternative. As part of the company's business development, we continue to increase our land. Expanding the scope of activities, such as acquiring new projects and entering into partnerships. "

In the rain company Holdings reports a huge jump.

In 2019, 391 apartments were sold, and this year 873. The volume of sales last year was NIS 444 million, and this year NIS 1.3 billion.

The data refer to new sales made in 2020 versus sales in 2019.

"In 2020, we opened five new projects," says Batya Mizrahi, VP of Marketing and Sales at Rain Holdings.

She said the year was challenging and unpredictable.

'All the trends we envisioned went through a dizzying upheaval, and everything that was planned did not necessarily come to fruition.

At the same time, when calculating the results in relation to the targets, we met the annual targets and in addition there were significant increases in prices and demand.

We ended the year with 2% revenue above forecasts. '

Coral Company sold 230 units worth NIS 288 million, similar to the corresponding period last year. As of the end of 2020, purchase requests amounting to NIS 26 million were signed. - 60 units, Coral Or Yam - 253 units, Corals Netanya - 256 units and Herzliya Rubina - 48 units.

Michal Gur, CEO of Coral: "Coral, which was issued and became a public company about a year ago, sums up an excellent year of activity, which is reflected in all the parameters.

The large number of contracts signed during the year is strong evidence that the solutions we have proposed have indeed met the need for a safety net appropriate to the challenges. "

Want to stay up to date all the time?

Sign up now for the Real Estate Newsletter today

Talk real estate with Ofer Petersburg. Listen to the new podcast >>

There were also turning points in the field of yields: during 2020, Ayala Agam marketed more than 70% of the office space in the Ayala Towers project, in the first of the first two office towers to be built in the new residential and employment complex in Tzrifin.

In the first quarter of 2020, when the first closure also began, Ayala Agam sold about 15% of the project.

In the two following quarters, sales slowed down, due to the general paralysis in the economy, during which an additional 15% was marketed.

The big leap was in the last quarter, when the company marketed another 40% of the project, after people internalized that the Corona would stay with us for another period and that we had to look at the long term and prepare for the day after.

Osnat Levy, Marketing Manager at Ayala Agam: "We adapted the sales process to the challenges of the period, in a way that included zoom meetings and meetings on the project site, when possible. Starting in October and at the end of the second closure, ".

Produced by the Department of Special Supplements