The billionaire's tweets managed to excite surfers to buy shares of the "gamestop" video store chain • The result: those who gambled against it on the stock exchange paid a heavy price

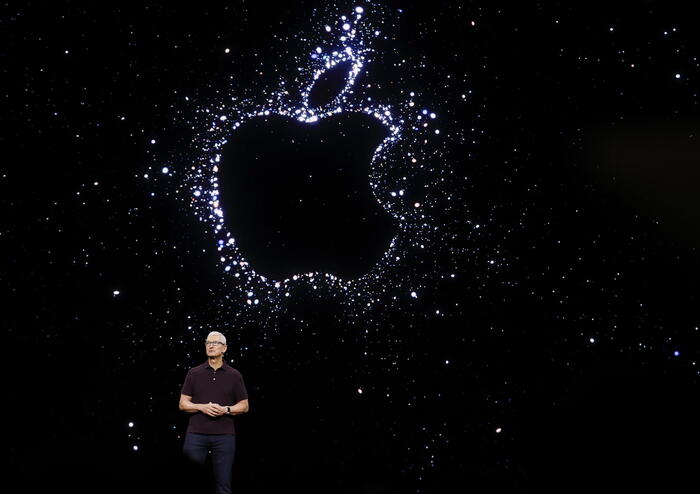

Elon Musk and Tesla on Wall Street // Photo: Reuters

The gaming store chain "gamestop" found itself today (Wednesday) at the center of an unprecedented battle between independent and small investors, led by the bizarre billionaire Elon Musk, and some of Wall Street's largest hedge funds.

The chain of stores, which announced earlier this year the closure of dozens of its branches, has become a popular target for short selling, also known as "shorting", which means a commitment to sell a share back at an agreed time, assuming the stock value is lower than the initial share price.

It is a profit-making method that is often used as a kind of "self-fulfilling prophecy" for companies that are at a problematic point and traded on the stock exchange.

The one who was previously hurt by the short sale was Elon Musk, at a time when it was assumed that his flagship company, Tesla, was in trouble.

Musk is now heading for a tsunami to buy shares in the gamestop chain, which has jumped its stock value by no less than 92% in less than a week.

The stock's value jumped from three dollars to more than 148.

It is important to note that not only Musk is behind the mass onslaught on the shares, but a larger movement of surfers, especially on the Reddit site, who have been outraged at the conduct of the financial sector for various reasons.

This is a particularly expensive loss for hedge funds that bought a short of the gaming network, because in the case of buying a short of a stock whose value did not fall but rose, the buyer must make up the price increase gap, and therefore it is a much larger loss than the initial investment amount.

According to media outlets in the United States, hedge fund investors have lost a total of more than $ 6.12 billion in gambling against gamestop shares, of which $ 2 billion just last Monday.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/BTHDUOM6GSCJU5BVV7CBEATLYQ.jpg)