weekly

Written by: Cheng Xue

2021-01-28 16:50

Last update date: 2021-01-28 16:50

It has been a year since the COVID-19 epidemic has continued, and Hong Kong’s economy is deteriorating, and all walks of life are inevitably affected.

Among them, the construction, tourism, retail, accommodation and catering industries are more like entering a long winter and ushering in a wave of closure.

The Census and Statistics Department recently recorded a seasonally adjusted unemployment rate of 6.6%, with an unemployed population of 245,800.

Workers who have suffered layoffs are not only unable to obtain targeted unemployment assistance from the government, but because of the MPF hedging arrangements, they have to "pay money to scramble themselves". The original timetable stipulates that the proposal to cancel the MPF will be submitted last year. The hedging arrangement may be postponed to the next Legislative Council.

Three years and three years, how long will the wage earners have to wait to cancel the MPF hedging?

To continue the above:

wage earners actually "post money to scramble themselves" and cancel the MPF hedging, no more waiting

The Liberal Party leader and legislator Zhong Guobin emphasized that the epidemic has lasted for a year, and Hong Kong's industries are dying, with a wave of closures and layoffs. At this time, if the government insists on forcibly canceling the MPF hedge, it will undoubtedly undermine the confidence of the business community.

Zhou Xiaosong held a different view, believing that the new plan will only be implemented in 2024 even if it is advanced according to the original schedule, and the economic situation at that time may not be unsatisfactory.

Compared with the current economic situation, he is even more worried that once the current government’s legislation is hopeless and procrastinated, it will leave hidden dangers for Hong Kong society.

Zhong Guobin, leader of the Liberal Party and member of the Legislative Council, emphasized that if the government insists on forcibly abolishing the MPF hedge, it will undoubtedly undermine the confidence of the business community.

(Photo by Gao Zhongming)

"In terms of short-term impact, the government's postponement of the bill is sending a bad signal to the business community." Zhou Xiaosong explained that after the news of the postponement of the bill recently came out, many employers said that the current economic situation in Hong Kong In other words, it is not the best time to promote the elimination of MPF hedging, which will create additional pressure on employers.

"Then, will the government's action create variables when the bill really goes to the Legislative Council? Will it cause stronger backlash from the business sector? This is something to consider."

From a long-term perspective, as an important part of labor retirement protection, if the MPF cannot cancel the hedging, the current pension problems facing Hong Kong will only worsen.

According to government information, more than 3 billion employers’ accrued benefits of MPF contributions are used as hedges each year. As of June 2020, the total amount of claims used to offset severance payments and long service payments is approximately 49 billion yuan.

In 2018 alone, there were 48,100 employees whose MPF accounts were used for hedging, involving as much as 4.395 billion yuan, and the average MPF accrued benefits of each "hedged" employee decreased by about 91,300 yuan, accounting for an average of the relevant employee accounts 50% of the balance accounted for 89% of the employer’s contributions in the relevant employee account.

"It means that the employer's contributions in the employee's account will basically be hedged within the limit of 390,000 yuan." Zhou Xiaosong calculated it, according to the figures of the MPFA, the account that was hedged in the employee's account Up to 90%, of which 90% of the employer’s contribution was washed away.

Only when they are dismissed at the age of 60 and stop working after receiving a long-term service payment is the equivalent of receiving the pension saved in the MPF after retirement.

In other cases, most of the employer's contributions in the employee's account will be flushed out-after all, the average employee's cumulative hedging limit is less than 390,000 yuan.

"In addition to the high administrative costs and other issues, how can you expect to provide retirement protection to the public through the MPF under such circumstances?" he asked.

In 2005, the World Bank published the report "Support for Elderly Income in the 21st Century—An International Perspective on the Pension System and Reform", proposing the five-pillar theory, namely, providing economic protection for the elderly through five different types of support.

These include: Zero Pillar-a basic pension plan that does not require contributions, funded by the state, and aims to provide the elderly with the lowest level of protection, such as the CSSA, fruit grant, and elderly allowance established in Hong Kong; the first pillar-and Income-linked mandatory public pension plan, which is absent in Hong Kong; the second pillar—income-linked mandatory occupational or private pension plan, that is, the current MPF; the third pillar—for occupational or private retirement The fund plan makes voluntary contributions, such as voluntary savings, voluntary MPF contributions, etc.; the fourth pillar-non-financial support, including available informal support (such as family support), other formal social security plans (such as medical care And houses), and other individual financial and non-financial assets.

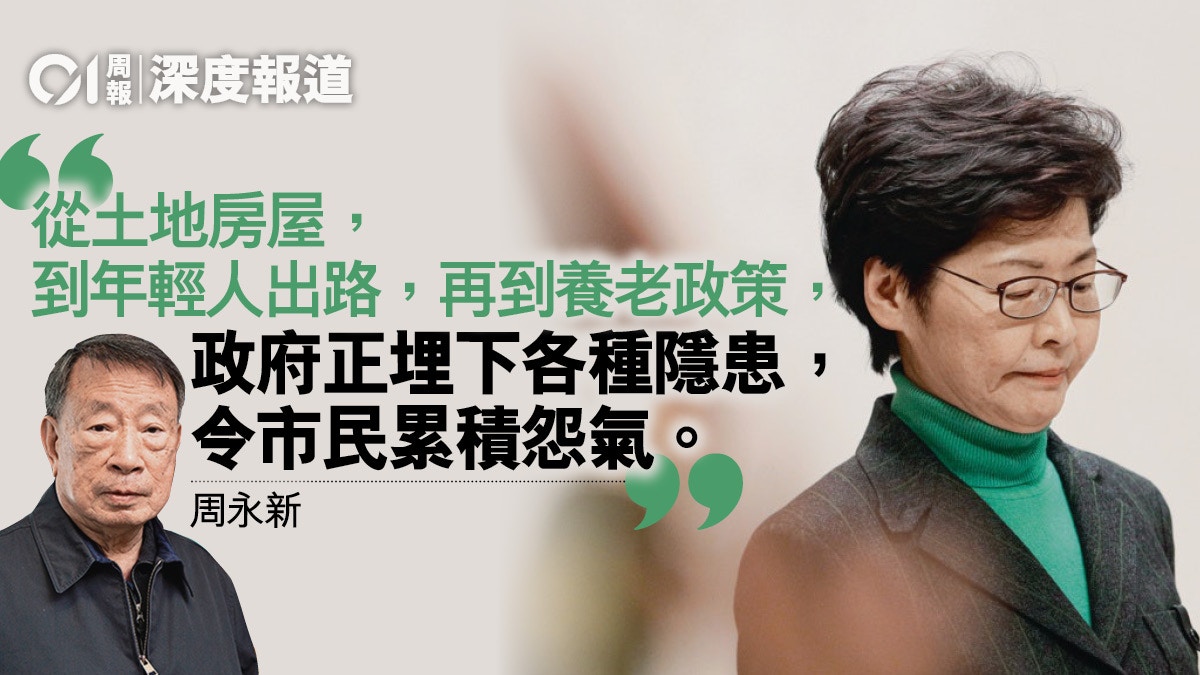

Zhou Yongxin believes that the government is planting all kinds of hidden dangers, from land and housing to the way out for young people, and to the pension policy, causing the citizens to accumulate resentment.

(Profile picture/Photo by Zheng Zifeng)

The research report "Future Development of Hong Kong Retirement Protection" led by Zhou Yongxin pointed out that using the Five Pillar Theory of the World Bank to evaluate the soundness of Hong Kong’s retirement protection system has the following problems: the zero pillar provides insufficient protection and lacks the first pillar ; And as the second pillar of the MPF replacement rate is too low, management fees are too high, and lump-sum payment, so retirees have to bear the risk of longer life expectancy and pension investment mistakes, which cannot be effectively protected Retirement life; and the aging population and the weakening of traditional filial piety will also impact the supporting role of the fourth pillar.

It can be seen that the old-age security system in Hong Kong is lame, and the hedging arrangement of the MPF has made the old-age risks of Hong Kong people more serious.

"If this situation cannot be effectively reversed, the end result will be that most people in Hong Kong will have their retirement life turned into a government guarantee to pay the bill." Zhou Yongxin said, "When you retire, everyone has limited money. Wait until June or July. What if I don’t have money at the age of ten? I can only ask the government for help!"

According to the Hong Kong Poverty Situation Report 2019, there are a total of 1,352,100 elderly people in Hong Kong, of which the number of poor elderly and the poverty rate are 391,200 and 32% respectively.

Currently, 41.6% of the elderly in Hong Kong apply for Old Age Living Allowance, 19.7% apply for Old Age Allowance, and 9.9% apply for CSSA.

Zhou Yongxin pointed out that if the retirement protection system is not perfected, the government’s responsibility for the elderly will only become heavier. At the same time, the situation of Hong Kong people who cannot enjoy their old age and still have to go out to work after retirement will not be improved.

"From land and housing, to the way out for young people, to the pension policy, the government is planting various hidden dangers and accumulating grievances among the citizens." Zhou Yongxin said with emotion: "Why are so many young people participating in social movements in 2019? The fundamental reason is that the bomb has always Buried here. If you don't complete the universal surrender (plan), the hedge cannot be cancelled. The retirement protection of Hong Kong people can be said to be on the verge of collapse. When the problems accumulate, when will society become stable?" He asked.

Zhou Xiaosong, secretary-general of the Hong Kong and Kowloon Federation of Labor Associations, pointed out that trade unions are weak and do not have the legal protection of equal negotiations with employers.

(Photo by Ou Jiale)

Insufficient labor protection, the government should reflect early

"In Hong Kong, labor and management have been unequal for a long time. Therefore, the government should be more active in protecting labor rights," said Zhou Xiaosong.

He took the collective bargaining system in Europe and the United States as an example, and pointed out that when workers collectively negotiate wages and various benefits with their employers, they can better protect their rights.

"However, in Hong Kong, trade unions are weak and there is no legal guarantee for equal negotiation with employers. When you let workers and employers negotiate wages, employers often say, don’t do it if you are dissatisfied, and no one will force you. I am dissatisfied with the treatment, and when I do not want to accept it, the price is to give up a job. This is inequality.” He explained.

Zhou Xiaosong took the minimum wage guarantee as an example: "Although the minimum wage is still very low, it has been the biggest improvement in the past two to thirty years. Even if it freezes this year, even if the economy is poor, McDonald's will cost 37.5 yuan per hour. If there is no minimum wage, McDonald’s may only cost 15 yuan to hire people.” He pointed out that when the labor force is weak, the government must intervene to promote social justice.

However, the Hong Kong government has so far been confined to the "small government, big market" governance thinking. It must call "effective capitalism" and pursue a "free market", but it is actually shirking its responsibility to protect labor rights.

Under the epidemic, wage earners actively strive to cancel the MPF hedging, and are unwilling to "sell themselves with money" when they are unemployed.

(Information Picture/Photographed by Li Zetong)

"Is the capitalist system effective? We need to reflect." Zhou Yongxin analyzed, and now there are many problems in capitalism all over the world, including Hong Kong.

"One is business affairs, which may lead to decision-making divorced from the masses. The second is that the government has limited commitment. I participated in the Basic Law Preparatory Committee and the SAR Government Preparatory Committee. At that time, I discussed that government expenditure should not exceed 20% of GDP. This has caused the government to bind hands and feet and dare not do anything. The third is the inequality in income and opportunities."

"It's not that we have to abandon the capitalist system, but that we have to change!" Zhou Yongxin pointed out.

As for how the government is acting in terms of labor rights, both he and Zhou Xiaosong believe that the role that the government must play is not to blindly inject capital and make concessions, but to promote social reforms with more active steps.

"For example, the government pays for the 14-week maternity leave," Zhou Xiaosong said. "Is it true that all costs for improving labor rights will be borne by the government? This is a bad trend." He recalled discussing the issue with the LAB. , Employer representatives said bluntly that "just the government gives money."

"If such a habit is formed, the management will not give in and always ask the government to pay-where does the government's money come from? Isn't it also taxpayer money? We don't want to use taxpayer money to subsidize employers."

Returning to the cancellation of the MPF hedging, he further emphasized that the MPF system, severance payment and long-term service payment protect the rights and interests of workers at different levels. After all, it is the employer's responsibility to cancel the hedge.

What the government should do is not to help employers share the responsibilities, but to put forward labor protection measures more proactively and actively promote them.

"However, the government itself has been relatively weak in recent years. I don't know if it can't convince employers or is unwilling to do it, which has caused the improvement of labor laws to stagnate." Zhou Xiaosong grumbled.

The above excerpt was recorded in the 250th issue of the "Hong Kong 01" Weekly Report (January 25, 2021) "Wage earners actually "post money to scramble themselves" and cancel the MPF hedging can no longer wait." If you want to read the full text, please

click here to

sample the weekly newsletter and browse more in-depth reports.

Highlights of the 250 issue of "Hong Kong 01" Weekly News:

[Cover Report] Saying goodbye to Trump Biden's new deal to fight the epidemic and seek unity, and political reform should not be forgotten

Sino-U.S. relations have entered a new pattern, "international line" fantasy should wake up

Distributing money can’t solve the fundamental problem. Economic governance needs a good government.

Workers actually "post money to scramble themselves" and cancel the MPF hedging

The key to the BNO dispute from changing naturalization conditions from travel documents

Is the theme park becoming a recreational area? Is the ocean park facing a dead end or a way out?

This is how the "epidemic area" must be sealed

Half a century, the relationship between China and Australia has fallen to a freezing point.

The tragic conclusion of the Irish Mother and Child Home sets the final chapter in the decadent Catholic history?

[Hong Kong Re-Planning] When will the "New Territories Bull" push?

Look at Hung Shui Bridge

01 Weekly report in-depth report on MPF MPF hedging retirement protection population ageing retirement life retirement system retired elderly poverty