Financial News

Written by: Hong Kong 01

2021-02-01 20:11

The last update date: 2021-02-01 20:12

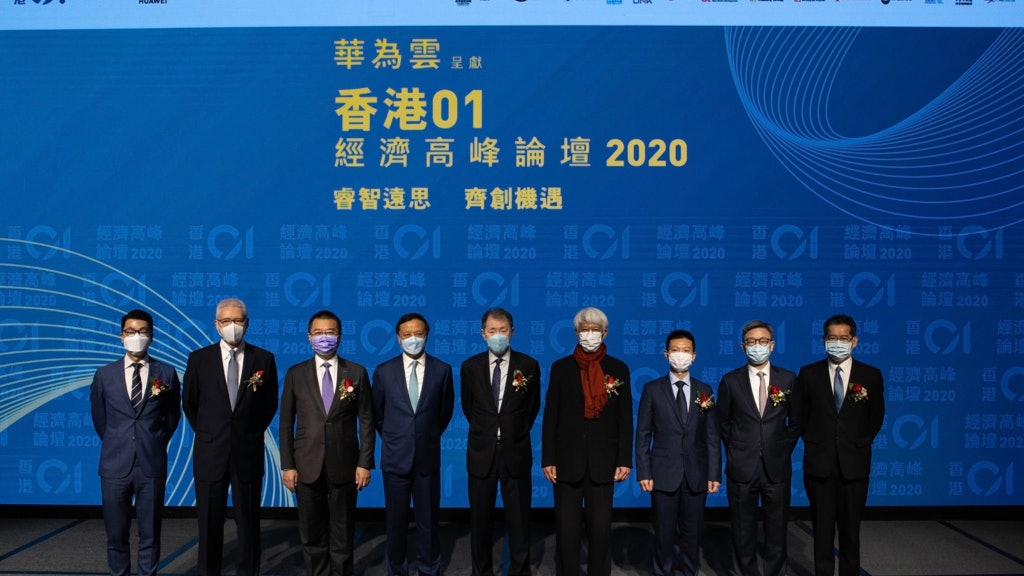

The second "Economic Summit Forum" hosted by "Hong Kong 01" came to a successful conclusion today (1st), and the event attracted more than 100 leaders from China and Hong Kong in politics and business circles.

A group of heavyweight political and economic leaders, experts and scholars in China and Hong Kong on the stage shared topics such as changes in the international political and economic landscape, changes in industrial structure, the development of the Guangdong-Hong Kong-Macao Greater Bay Area, and new development opportunities in Hong Kong, hoping to pool their wisdom and help companies accurately grasp the situation and grasp , Explore room for growth.

The second "Economic Summit Forum" hosted by "Hong Kong 01" came to a successful conclusion, attracting more than one hundred leaders from China and Hong Kong in politics and business circles to attend.

(Photo by Yu Junliang)

Yu Pinhai, the founder of "Hong Kong 01", said in his opening speech for the forum that China is the leader of the world without major changes in a century. It is also the political and economic transformation of the world and the new world, as well as the driving force of a new round of globalization.

Hong Kong once played an important role in China's reform and opening up, but at that time it passively participated and earned some wealth.

Today, Hong Kong can no longer participate passively. The first step in active participation is not to become a burden to the country, let alone an obstacle to the country's participation. It should comprehensively promote reforms to become a forward of the Chinese team to position itself.

In his speech, Hong Kong Chief Executive Carrie Lam said that Hong Kong is an export-oriented economy, backed by the motherland and facing the world, and the United States is one of our main trading partners.

The relationship between China and the United States will undoubtedly have a profound impact on Hong Kong.

When talking about the Guangdong-Hong Kong-Macao Greater Bay Area, it is pointed out that participating in the construction of the Greater Bay Area is the best entry point for Hong Kong to integrate into the overall development of the country and will bring unlimited opportunities for Hong Kong's economic development.

This forum is divided into two parts, subdivided into three topics.

The first shot is the "Hong Kong-Shenzhen dual-engine development in the Bay Area."

This part is divided into two parts. The focus of the first part is "Financial Interconnection", hosted by Yu Pinhai, the founder of "Hong Kong 01". Guest speakers include Ren Zhigang, member of the Executive Council of the Hong Kong Special Administrative Region and former CEO of the Hong Kong Stock Exchange Group Li Xiaojia.

Ren Zhigang: The internationalization of RMB should be pushed to a new level

Ren Zhigang said that under the current difficulties in Sino-US relations, especially when the US has weaponized finances and does not allow investors and fund raisers to enter the market, he believes that the internationalization of the renminbi should be pushed to a new level and promoted to the capital market.

He suggested that the use of the Greater Bay Area as a pilot can be explored to test capital circulation.

Li Xiaojia: Hong Kong acts as an intermediary to invest funds in Chinese SMEs

Li Xiaojia believes that interconnection should be expanded on a large scale, and Hong Kong should be used as an intermediary to invest funds in the development of Chinese SMEs, so that more foreign-funded enterprises can get more returns.

He took Saudi Aramco’s listing in Hong Kong as an example. If the Shanghai-Shenzhen-Hong Kong Stock Connect can seize the opportunity, for example, through the "New Stock Connect", Chinese investors can use RMB to invest in Saudi Aramco and profit from it, while allowing foreign holders to hold RMB assets.

This is called "Swap over the century".

In the second session "Innovation and Technology Cooperation", the host is the Chief Executive Officer of the Hong Kong Financial Development Council, Au Jinglin, and the guest speakers include MTR Chairman Ouyang Boquan, WebLab Bank Board Chairman Chen Jiaqiang and Qianhai Authority Hong Kong Affairs Chief Liaison Official Hong Weimin.

Ouyang Boquan: Develop APP to give passengers more information

Ouyang Boquan believes that technology is driving the development of MTR.

He cited the MTR Mobile App currently launched by MTR in hopes of giving passengers more information.

I believe that the current stage is only the initial stage. Based on technological advancements such as technology and artificial intelligence, I will think about how to help passengers depart from home to their destination, including Hong Kong and the Greater Bay Area.

He also mentioned that MTR recently officially launched the two-dimensional ticket code for rides. Passengers can use Alipay Hong Kong’s easy-to-ride code to enter the gate. This is the first step to bring the two places closer, and Octopus has expressed its intention to participate in the Mainland’s "One Card Pass". ".

Chen Jiaqiang: Fintech forces the transformation of traditional banks

Chen Jiaqiang pointed out that financial technology is a hot topic, not a very magical new thing, but the integration of traditional financial technology with new economic activities.

He also mentioned the industry of virtual banks, saying that the Hong Kong Monetary Authority launched virtual banks two or three years ago. "At that time, Hong Kong was the first in Asia to go out." There were many participants in the technology innovation companies in the Mainland.

Chen Jiaqiang also believes that by allowing service providers to enter the Hong Kong market, thereby driving interaction between the two places, it can force the transformation of local traditional banks.

He said frankly that if the virtual bank experiment is successful, fintech can really land in Hong Kong, and this model can be applied to different regions.

Hong Weimin: Happy to see colleges and universities returning to the Greater Bay Area for "industry-university-research"

Hong Weimin believes that it is now very happy to see different higher education institutions in Hong Kong return to the Greater Bay Area for "industry-university-research" cooperation.

However, it is believed that the "industry-university-research" cooperation between China and Hong Kong still lags behind the international community. Hong Weimin pointed out that one of the reasons for this situation is that Hong Kong's management of university professors is too "bureaucratic" and restricts university professors too much. Many, I think we should focus on research and processing in the future.

He also believes that the epidemic not only affects the logistics and capital flows between China and Hong Kong, but also adversely affects the development of talent exchange.

Hong bluntly said that if Hong Kong fails to resolve the issue of customs clearance between the two places, Hong Kong will have a chance to be marginalized by the Greater Bay Area.

"Because the Greater Bay Area continues to develop even under the epidemic."

In the second part of the forum, with the topic "China and the United States set a new chapter in Hong Kong crisis and opportunity", it discussed the challenges Hong Kong has encountered in the "big change unseen in a century" in the comprehensive strategic game between China and the United States, and how Hong Kong should continue Give play to its unique identity as an international financial center, shipping hub and cultural intersection.

The moderator was Su Jinliang, the former Director of the Bureau of Commerce and Economic Development of the Hong Kong Special Administrative Region Government. Guest speakers included Lin Yifu, Dean of the Institute of New Structural Economics of Peking University, Huang Keqiang, Chief Executive Officer of Hong Kong Science and Technology Park, and Deng Xiwei, Deputy Director, China and Global Development Research Department, The University of Hong Kong .

Before the topic discussion, the Financial Secretary Chen Maobo delivered a speech on the topic, saying that the United States is uneasy about China’s peaceful rise and challenging its leading position in the world. It has been a long-standing thing to try all means to contain China. Therefore, even if the US government changes. It is expected that the differences between the two countries will still be difficult to resolve.

He believes that Hong Kong must grasp its own advantages and integrate into the overall situation of national development in order to achieve substantial economic development in the face of major changes.

Before the topic discussion, the Financial Secretary Chen Maobo delivered a speech on the topic. He believed that Hong Kong must grasp its own advantages and integrate into the overall situation of national development in order to achieve substantial economic development.

(01 screenshot)

Lin Yifu: China's economy will surpass the US

Lin Yifu, dean of the Institute of New Structural Economics at Peking University, believes that China is doing a better job in responding to the new coronavirus epidemic.

According to the estimates of the National Foundation (IMF), the annual economic growth was 2.3%, while the US fell by 4.9%. The gap between the two countries is 7.2 percentage points.

In comparison, the US GDP grew by 2.2% in 2019; China reached 6.1%; the gap between the two was only 3.9%, reflecting that the epidemic has widened the economic growth gap between the two countries.

Lin Yifu believes that the time for China's economy to surpass that of the United States is more likely to advance to 2028 in 2030.

At the same time, he also expressed confidence in China’s development and emphasized that we must do our own thing and play a dual cycle. It is estimated that by 2049, China’s per capita GDP will reach half of that of the United States based on market exchange rates, but considering that China’s population is the United States. 4 times that means that China’s economy is twice that of the United States.

Huang Keqiang: Hong Kong needs to develop technology and re-industrialization in the future

In addition, Huang Keqiang, chief executive of the Hong Kong Science and Technology Park, pointed out that Hong Kong needs to develop technology and re-industrialize in the future.

He believes that the development of technology and re-industrialization is what Hong Kong must do. With China and the United States competing, Hong Kong needs to strengthen itself.

He said that the Science and Technology Park hopes to help the company use Hong Kong as its base to do core research in Hong Kong, develop the Greater Bay Area, the "One Belt One Road" and Southeast Asian markets, and achieve "going out and bringing in", and emphasizes the need to develop local technology economy " We must rely on ourselves," and we must retain core scientific research in Hong Kong in the long run.

In terms of re-industrialization, he pointed out that industry only accounts for 1% of GDP. If we want to develop a diversified economy, we must think about what different types of economies will be driven in the future.

He said that if re-industrialization is developed, it must not be the type of labor in the past. In the future, blue-collar factories may have programming and monitoring technology.

Deng Xiwei: Hong Kong can bring foreign technology into China in the next step

Deng Xiwei, deputy director of the China and Global Development Research Department of the University of Hong Kong, said bluntly that Hong Kong has missed many opportunities for economic transformation in the past years. In the past years, Hong Kong has only focused on financial development, leaving talents in other industries lacking upward opportunities.

However, under the current background of de-globalization, it is a good thing for Hong Kong.

Hong Kong should encourage start-up development and devote more resources to industry-university-research work.

Hong Kong has always acted as a "super middleman" between the world and China, pushing Chinese companies to "go global," but he admitted frankly that Hong Kong rarely brings foreign technology and technology into China.

He believes that Hong Kong is close to the Southeast Asian industrial chain, and the next step can be to bring foreign technology into China, expand the industrial chain, enrich the domestic dual cycle, and act as a "super middleman."

2020 Economic Summit Forum

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/3I74UEXLYRBBRPGPSGWNN6WXH4.jpg)