Almost a year after the stock market crash of March 2020 at the start of the global Covid-19 pandemic, it is the prospects of recovery that this time, paradoxically, sows nervousness on the financial markets.

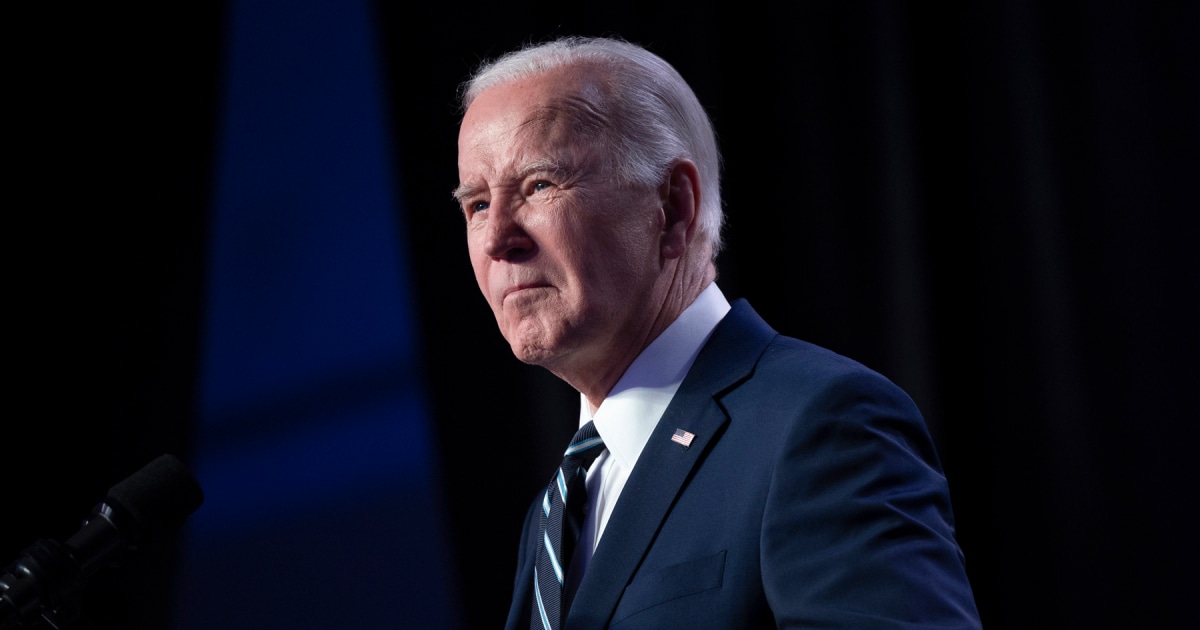

Joe Biden's $ 1.9 trillion stimulus package, due to be voted on in the House of Representatives on Friday, has ignited the powder.

A sudden surge in government bond interest rates sent stocks tumbling in major global markets at the end of the week.

Successive statements from central bankers calmed things down a bit on Friday.

Read also: Six economic challenges for the 46th President of the United States

The 10-year US bond rate rose above 1.61% on Thursday, up from 0.50% last summer.

That of French 10-year OATs returned to positive territory for the first time since June 2020. Mechanically, when bond rates rise, stocks, which have been overvalued lately, become less attractive to investors, who have started selling massively.

The

This article is for subscribers only.

You have 82% left to discover.

Subscribe: 1 € the first month

Can be canceled at any time

I ENJOY IT

Already subscribed?

Log in