Enlarge image

Will you follow Erdoğan's call again?

In mid-August 2018, business people with US dollars in their hands crowd in front of an exchange office.

Following a call from the Turkish president, they demonstratively want to sell dollar and euro savings to support the Turkish lira.

Photo: REUTERS

After the Turkish lira crashed, President

Recep Tayyip Erdoğan

(67) called on his compatriots to invest their accumulated foreign exchange or gold holdings to stimulate the economy.

His appeal is directed at citizens "who keep foreign currency and gold at home just to feel safe".

At the party congress of his Islamic conservative ruling party AKP, Erdogan said on Wednesday in Ankara:

"From these, my citizens, I would like them to invest the foreign exchange and the gold in their homes, which are our national assets, in various financial resources and thus bring them to the economy and production."

He also called on investors to trust Turkey.

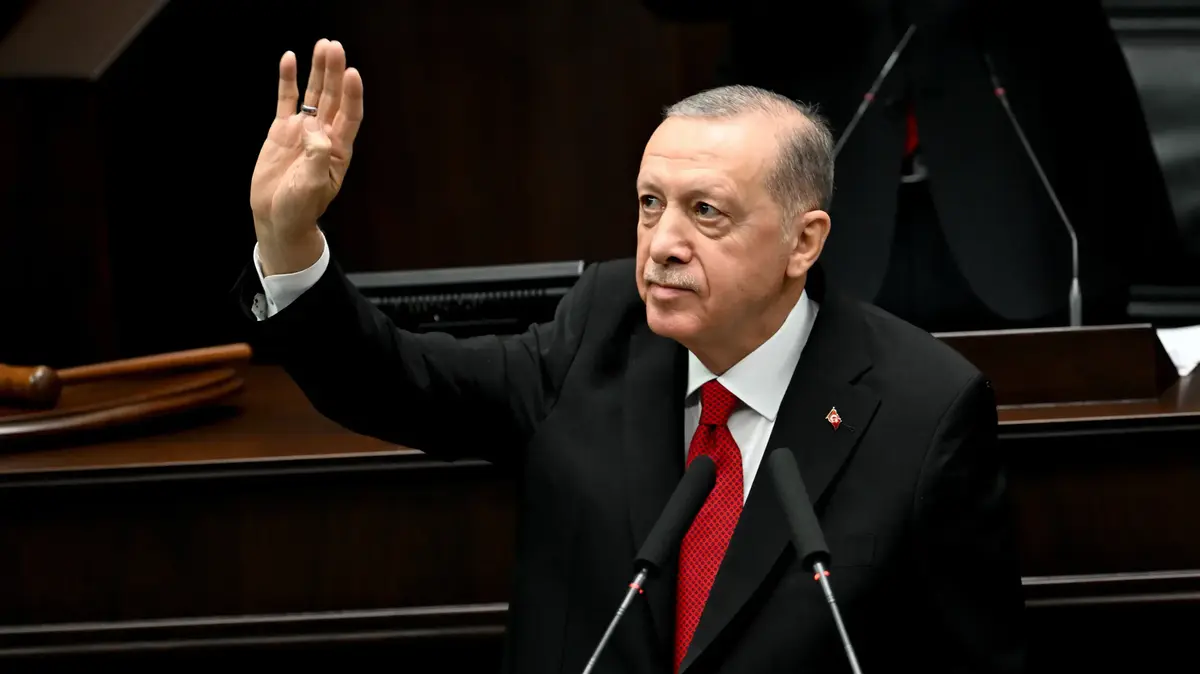

Enlarge image

"From these, my citizens, I would like ..."

: Turkish President

Recep Tayyip Erdoğan

greets his supporters on March 24 before the start of the AK party congress

Photo: MURAT CETINMUHURDAR / PPO / REUTERS

Locals hoard billions in foreign currencies

Background: Due to concerns about negative real interest rates, high inflation and exhausted central bank reserves, many locals have been investing part of their money in foreign currencies and gold for years.

At the end of last year, there were around 260 billion US dollars in foreign currencies in Turkish banks' accounts.

That's around $ 3,200 per person.

The Turkish government temporarily tried to counter this escape from its own currency with higher fees for such transactions and higher capital requirements for banks for bank balances in foreign currencies.

Apparently, the intervention attempts are not showing much effect.

The mistrust in their own currency is too great, the Turks have to find out every day how prices gallop away and numerous goods are barely affordable for them.

The Turkish national currency, the lira, and the stock exchange prices in Istanbul had plummeted on Monday.

While the Istanbul stock exchange stopped its deep fall on Tuesday, the Turkish lira continued to depreciate slightly against the dollar and the euro.

The prices of Turkish government bonds were also under pressure again: Conversely, the yield for ten-year lira-denominated paper rose to around 19 percent, the highest level in almost two years.

more on the subject

Lira slump brings debt problem: "Turkey is a candidate for default"

The trigger for the market

turmoil

was the dismissal of central bank chief

Naci Ağbal

(53) by Erdoğan over the weekend.

During his short term in office, Agbal had regained confidence in Turkey's fickle monetary policy.

By raising interest rates, he had stabilized the lira, which had previously fallen sharply, even though President Erdoğan is an opponent of high interest rates.

The latter is likely to have become Agbal's undoing.

The new central bank

governor Şahap Kavcıoğlu

(53) is a former MP for Erdogan's AKP and the fourth occupation in two years.

Before his political career, Kavcıoğlu had worked as a banker for 25 years, most recently until 2015 as Deputy Managing Director of the state-run Halkbank.

rei / dpa-afx