The dividend calendar of Spanish listed companies begins to have fewer gaps as the year progresses and companies begin to emerge from the crisis caused by the pandemic and which, during the past year, reduced payments on the Spanish Stock Exchange.

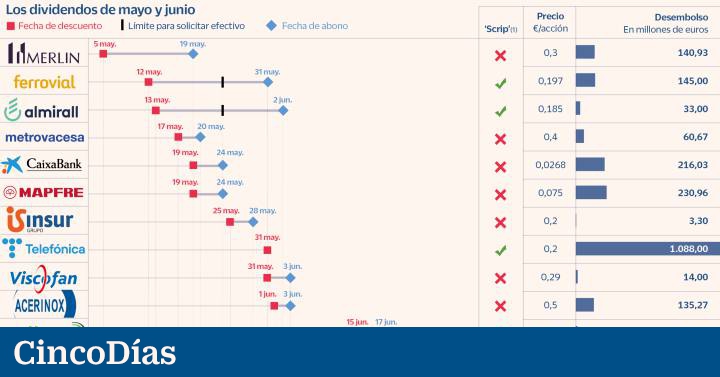

The deliveries pick up speed and in the remainder of May and during the month of June around a dozen companies will pay slightly more than 2,100 million euros in coupons together.

The largest disbursement in the coming weeks will be made by Telefónica, whose scrip dividend starts on May 31. The company chaired by José María Álvarez-Pallete will distribute 1,088 million as long as 100% of the shareholders opt for the option of receiving the coupon in cash. The timing of this payment is still unknown in detail. Precisely, last Wednesday, during the presentation of results for the first quarter of the year, the company gave more details of the shareholder remuneration policy for the following months.

And is that after the June payment, the operator plans to distribute a dividend of 0.30 euros per share.

This payment would be made in two tranches, the first payable in December 2021 and the second in June 2022. Both will be 0.15 euros, through the voluntary flexible dividend modality.

For the purposes of this second tranche, the adoption of the corporate resolutions will be proposed to the general meeting of shareholders in order to carry it out.

Behind Telefónica, the Spanish listed companies that will make the largest disbursement in the coming weeks will be Mapfre and CaixaBank.

The Spanish insurer will reward the loyalty of its investors on May 24 and to be eligible for this coupon of 0.075 euros gross per security, you must be a shareholder of the company on May 19.

Mapfre will disburse 231 million euros with this payment.

MORE INFORMATION

Eight Ibex securities pay a dividend yield of more than 5%

Telefónica confirms the dividend for 2021

Do you want to collect the Ferrovial dividend?

For its part, CaixaBank will deliver 216 million euros in what is its first dividend after its integration with Bankia and after the ECB allowed the banks to return to pay back their shareholders, although with the limitation of 15% of the profit.

As for the election dividends, in addition to Telefónica, there are two in progress. Ferrovial once again uses this formula of remunerating shareholders, which is already common in the company. Since May 13, Ferrovial's rights have been listed on the market. The shareholders of the company who prefer to collect the dividend in cash have until May 24 to notify their entity. In case of not doing so, they will receive the shares. The amount of the Ferrovial dividend is 0.197 euros gross per share and will be effective on May 31.

The other scrip dividend on the calendar for the coming weeks is Almirall's.

The Catalan pharmaceutical company will pay a dividend to whoever wants it in cash on June 2 and to be able to collect it, shareholders have until May 24 to request it.

The coupon amounts to 0.185 euros.

In the real estate sector, two payments stand out in the days to come.

Metrovacesa will distribute 0.40 gross euros per share next Thursday and today is the last day to acquire shares and be able to receive this coupon.

For its part, Merlin Properties will pay 141 million euros on Wednesday, May 19, which represents 0.3 euros for each share of the real estate company.

Viscofan and Acerinox, on June 3;

Cellnex, on June 17, and Euskaltel, probably that same day, in the absence of confirmation from the shareholders' meeting, and Ebro Foods, on June 30, complete the calendar of listed companies that pay in the coming weeks.

The Ibex Top Dividend rises 15% in the year

At highs.

The Ibex Top Dividend index accumulates a return of 15% so far this year and on Monday of last week it reached its highest since February 2020. It is made up of the 25 companies with the best dividend yield on the Spanish Stock Exchange