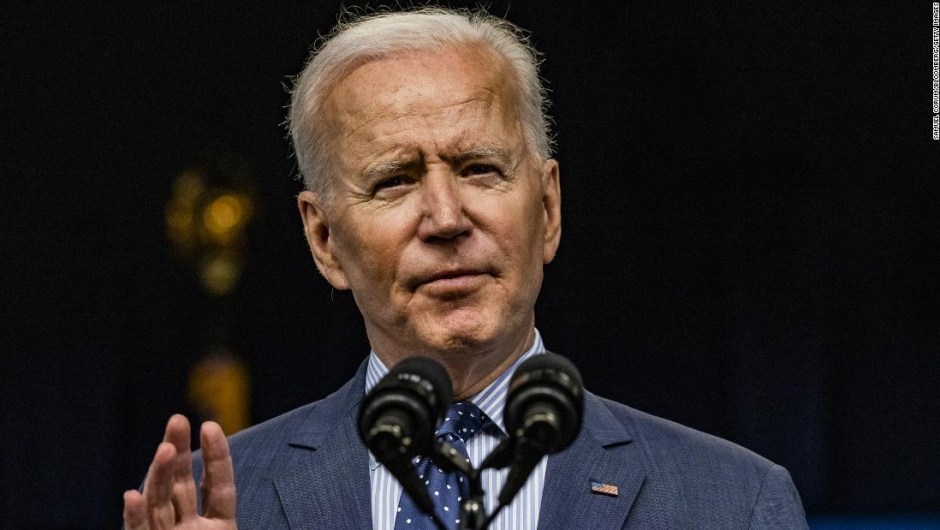

Biden proposes a global tax reform and seeks the support of G7 leaders.

London (CNN Business) -

The Biden administration's ambitious plan to reform the global tax system will face a crucial test soon, with US Treasury Secretary Janet Yellen meeting with finance ministers from the Group of Seven (G7) in London this Friday and Saturday, seeking the support of many of the world's major economies, an important step in the administration's efforts to rewrite international tax rules and dissuade US companies from taxing their profits abroad. .

Apple wins appeal over million-dollar tax debt owed to Ireland

G7 finance ministers are expected to back the US plan during the summit, according to a Reuters report citing a US Treasury official. Washington's proposal is likely to gain full backing when leaders of the G7, including President Joe Biden, will meet in the UK next week, the news agency reported.

Last month, the US Treasury proposed a global minimum tax of at least 15%, with the aim of tackling an inflexible and loopholed international system.

Setting a minimum rate could help deter companies from shifting their profits to countries where they would pay less taxes.

Biden has a "fundamental conviction" to raise taxes on corporations and the wealthy.

It could cost you

“With the global corporate minimum tax set to practically zero today, there has been a race to the bottom in corporate income tax, undermining the ability of the United States and other countries to raise the income needed to make investments fundamentals, ”the US Treasury said in a statement on May 20.

Yellen is likely to find willing negotiating partners this week.

This Friday, the finance ministers of France, Germany, Italy and Spain wrote in a letter to The Guardian newspaper that the US proposal was a "promising start."

“Therefore, we are committed to defining a common position on a new international tax system at the G7 finance ministers meeting in London today.

We are confident that this will create the necessary momentum to reach a global agreement at the G20 in Venice in July.

It is within our reach.

Let us make sure that it is, ”they wrote.

advertising

Although some of the major European economies have indicated that they agree to the plan, the UK has resisted.

UK Finance Minister Rishi Sunak told Reuters on Thursday that the US proposal could work, but details still need to be worked out.

The European Union puts Panama back on its black list of tax havens

The G7's backing could help speed up parallel fiscal negotiations among the roughly 140 countries led by the Organization for Economic Cooperation and Development (OECD).

Ireland, which has been successful in attracting companies from around the world, including large US tech companies, by offering a corporate tax of just 12.5%, is one of the countries that has expressed significant reservations about the proposal. of Biden.

Biden's plan to shell out at least $ 1.4 billion in new infrastructure spending depends largely on his ability to win support for a corporate global minimum tax that increases payments to the Treasury.

Tax reform