It's the big day for the Paris stock market listing of Believe.

An “almost historic” moment according to Cédric O, the Secretary of State for Digital.

Like many French Tech players, he is betting on the start of a “long series”, which would see French start-ups betting on the Parisian market rather than on the American Nasdaq.

This operation is certainly modest compared to the tens of billions raised by the Americans, but it symbolizes a certain revival.

Believe, valued at 2 billion euros, raises 300 million euros.

A sum intended to finance the growth of the company over the next three years.

Le Figaro - How do you interpret the arrival of Believe on the Paris Stock Exchange?

Cédric O -

We must not minimize the importance of what is going to happen.

There have been few IPOs of tech companies.

It is an almost historic moment, which opens a new era.

This year, French Tech should once again break its own fundraising records.

Paris has the means to establish itself as the technological center of Europe.

Is that an analysis that you share?

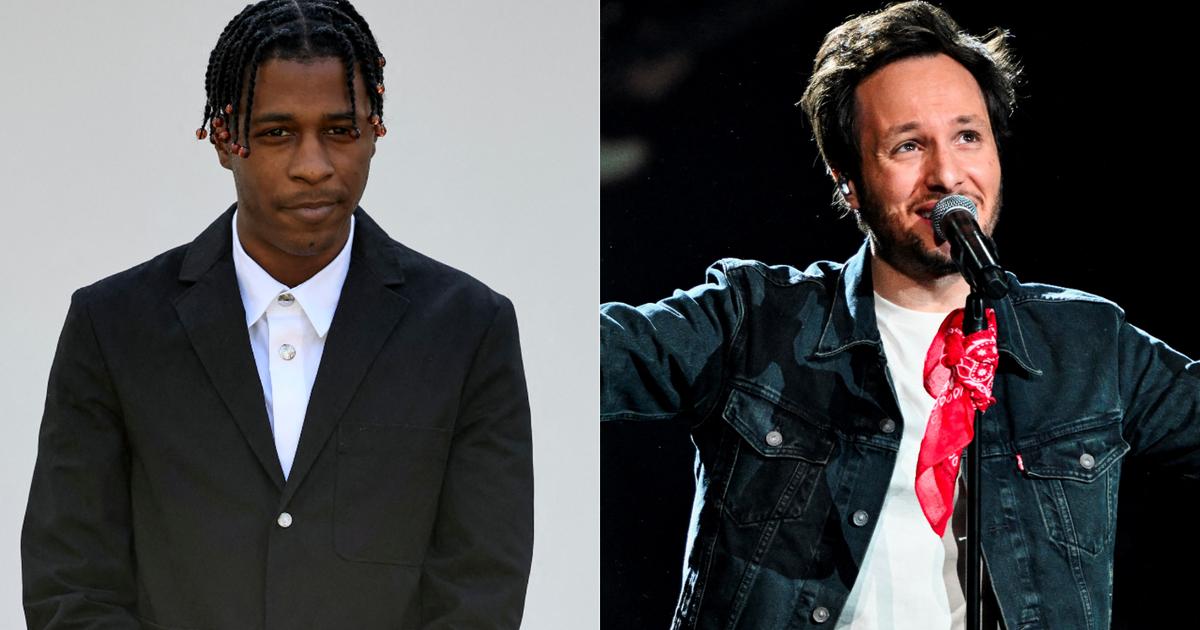

Denis Ladegaillerie, CEO of Believe-.

Yes quite.

The choice of Paris was logical.

Believe's head office is in Paris, our technical and operational capacities are in France.

France and Europe are important areas for our activity.

Listing in Paris is more logical, especially since we have the support of the place.

We certainly had strong pressure from an American investor to favor Wall Street, but I think that today, there is a pool of interesting investors in Paris.

I prefer a value visible in Paris rather than a small company in the United States, whose business is not focused on the United States.

Does Paris have sufficient financial resources to absorb a new wave of IPOs?

Denis Ladegaillerie -.

We wiped out the plaster, with our first fundraisers more important than the others. We have seen the evolution and structuring of the ecosystem, with investors who have integrated the mode of growth of companies such as ours. We must have companies listed in France with significant shareholders who can capture the creation of value and that American, Asian or Chinese funds are not the only ones to benefit from it! Our goal is to become the world leader in our sector. We are present in 50 countries, achieve 35% growth per year. We will help create a new state of mind to support more companies like ours.

Cedric O -.

This is the first major post-establishment operation of the Tibi funds.

Somehow it's a good test for us.

I know this will pave the way for other start-ups who are actively preparing for it.

Do you think a virtuous circle has started?

Cedric O -.

We are opening a new page.

OVHCloud has announced its intention to list in Paris.

Other companies should follow soon.

If we want the next very large French companies to be in the CAC 40 and not in the flagship index of a foreign stock exchange, now is the time!

Denis Ladegaillerie -.

This operation has several objectives: to finance us, to gain visibility, but also to involve employees in the growth of the company, with employee shareholding plans. We will also be able to better embed the management of the companies that we will buy. We would like to have a very strong and French shareholder base, which corresponds to our activity, even if Technology Crossover Venture remains our biggest investor. It is very satisfying to see that several investor profiles are interested in Believe, from those with more traditional profiles, to tech specialists and individual shareholders.When you distribute ultra-popular artists it is very satisfying to see individual shareholders investing.

Cedric O

-. This IPO contributes to the meeting between individual shareholders and French Tech. There is a beginning of demand to move towards these technological stocks. We hope this will inspire middlemen to create the retail products that meet them.

Denis Ladegaillerie -.

We help create the tools to identify an ecosystem, help it grow and provide it with solutions. The next step is to keep the companies in France and develop the investor base. The IPO is just the beginning, not the end in itself. We will demonstrate our ability to increase our profitability over time, our ability to use data, artificial intelligence to help artists develop. And the more companies there are, the more powerful this ecosystem will be.