Commissions have become the Holy Grail of the banking business and the great headache of its clients, especially if they do not have a sufficient degree of connection with their entity to be free of charges for financial services. The persistent zero interest rate environment that has been in force in the euro area for years and for which the end is not in sight in the medium term has forced banks to squeeze out commission income as much as possible. It is the formula with which to compensate for the weakness of the margin of the traditional business, of the profit that was obtained by the banking activity of a lifetime, that of raising money and lending it at interest rates that are no longer what they were.

The new playing field set by low interest rates has established a new strategy in the relationship of banks with their clients and in the commissions they charge.

The priority is the most profitable clientele, the one that generates business and not only gets into debt with the bank but also contracts investment products.

Thus, for example, it is a really complicated mission to open an account in a bank without maintenance costs unless the payroll is entered, receipts are domiciled or you also have a credit card.

click on the photo

The month of June is the time for a quarterly or semi-annual review of bank commission rates and some entities will give a twist to the prices for services that apply to less connected clients.

As Marta Alberni, Afi banking expert, explains, in addition to the growing prominence in recent years of net commissions in the banking business, "in recent months there has been a trend of change in the policy of charging commissions from entities as a way to offset the lower financial income and the cost of excess liquidity as a result of the evolution of the reference rates ".

More information

Free transfers, but only if they are made online or at ATMs

Charges for cards and use of ATMs

These are the deposits and accounts that still pay for savings

The bank generalizes in June the commission for maintaining an account

In any case, the intensification of bank fee income has been going on for a long time and its contribution to the basic margin of the sector has gone from 26% in 2012 to 35% at the end of 2020, also increasing its contribution to the gross margin of the sector.

In this strategic increase in income from commissions, in addition to the fees for basic financial services, such as checking accounts or cards, commissions from investment funds and pension plans have a crucial weight, which only last year reported almost 3,000 million euros to large banks.

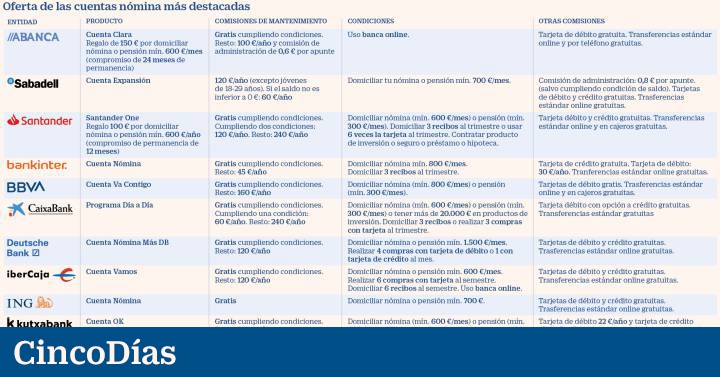

From the 240 euros a year from CaixaBank and Santander to the 45 from Bankinter

Banks have modified their linking policies in recent years, tightening the exemption from the cost of maintaining accounts.

Those clients who have not adapted to the new requirements will have to render accounts in June, since the payment of commissions is usually made quarterly or semi-annually and only in some cases monthly.

In addition, some changes also take effect this month.

As of Tuesday, BBVA will apply the new conditions of its Va Contigo account, which imply an increase in commissions to 160 euros per year, compared to 100 today, if the requirements of directing a payroll of at least 800 euros are not met or a pension of a minimum of 600 euros.

More demanding are the conditions of the accounts of the two banks with the highest maintenance fees: CaixaBank and Banco Santander, which cost up to 240 euros per year. The Day-to-Day program of the former establishes two criteria to meet: direct payroll (minimum 600 euros) or pension (minimum 300) or have more than 20,000 euros in investment products and direct three receipts or make three card purchases per quarter. In the case of Ana Botín's bank, the condition of direct debit payroll or pension is added the direct debit of three receipts or six uses of the card and the contracting of an investment product, insurance or loan with the entity. However, if the client meets only two of the assumptions, the commission drops to 120 euros per year.

Sabadell, Deutsche Bank, Ibercaja, Kutxabank, Liberbank or Unicaja set the cost of maintaining their accounts for unrelated clients at 120 euros. The case of Sabadell is somewhat different because the Expansión Account is not exempt from expenses –except for young people between 18 and 29 years old–, nor by direct debiting the payroll. It also establishes an administration fee of 80 cents per entry. However, if the account is not left with a negative balance, the maintenance fee drops to 60 euros per year and the cost per entry disappears.

The expenses associated with the Abanca and Bankinter accounts are lower. The Clear Account of the first one only establishes a 100% online operation as a condition. If not, the commission is 100 euros per year plus 60 cents per entry. If the client does not want a digital account, they can join their Zero Commission Program, but the requirements for those over 30 years of age are more numerous. It is necessary to direct a payroll or pension or have a balance of at least 500 euros in savings products and meet one of the following assumptions: make purchases with a credit card for at least 2,000 euros per year; make purchases with a credit card for 1,200 euros a year and take out insurance; have an average monthly balance in savings products of at least 30,000 euros; have a balance in investment products of a minimum of 8,000 euros,or take out two insurances with Abanca.

For their part, customers of the Bankinter Payroll Account who do not meet the requirements (direct debit of a payroll of at least 800 euros and three receipts per quarter) have to face only a rate of 45 euros per year, the cheapest among the large traditional banks.

For banks, hiring a payroll account is the first step to link a client, for that reason, although they have tightened the requirements to make them free, they are also launching promotions to attract them.

Abanca, Santander, Liberbank and Unicaja offer gifts of between 100 and 150 euros for direct debit of the payroll, as long as they are new clients and they commit to a permanence of between one and two years.