The central bank of the United States has hardly revealed its intention to initiate a lifting of exceptional measures within a few months which are flooding the markets with liquidity.

The silence of the Federal Reserve in this regard in the statement of its monetary committee which ended Wednesday afternoon in Washington, initially disappointed the equity markets.

Read also: The rebound in activity and prices calls for a signal from the Fed

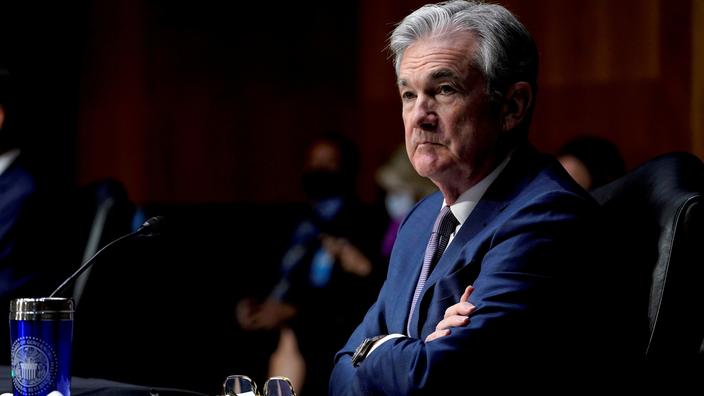

During the press conference that followed, Jay Powell, the head of the Fed, still made it clear that the central bank was ready to adjust its policy if inflation proved to be more persistent.

He also hinted that the discussion of a possible future plan to gradually reduce public debt buybacks by the Fed would be held in the near future.

The schedule sets the next meeting of the committee on July 27-28.

A hike in the key rate planned for next year

We note, however, that a greater number of members of the Fed's monetary committee are now considering a first hike in the central bank's key rate next year, which has been set at zero for fifteen months. Seven out of eighteen members believe that moment will come next year. They were only four to think so last March. In addition, thirteen out of eighteen are considering it before the end of 2023. They were seven to anticipate it at the end of March. An advancement in time which benefits the dollar but causes the euro to fall.

These expectations, the predictive value of which is deemed doubtful by Jay Powell, are published quarterly by the Monetary Committee, but anonymously. The Federal Reserve judges that

"economic activity and employment have improved amid progress in vaccinations against covid-19"

. It is also revising its growth forecast for the year 2021 from 6.5% to 7%. However, as expected Jay Powell and his colleagues, unanimously maintain at zero the rate of "fed funds" to which the banks lend themselves. very short-term liquidity.

They also confirm the continuation of monthly repurchases of 80 billion dollars of public debt and 40 billion dollars of bonds secured on real estate claims.

Wall Street would have liked the Federal Reserve to at least recognize that a debate had already started on the question of a very gradual reduction, perhaps from the fall or the winter, of its debt buybacks .

A scenario that turns out to be more complex than expected

The Federal Reserve is in a delicate situation: the scenario it envisaged last winter for the end of the pandemic is proving to be more complex than expected. Under the effect of several massive stimulus plans on the one hand, and thanks to the liberating effects of vaccinations, activity is rapidly resuming. The justification for its hyper-stimulating monetary policy is therefore diminished, or even called into question.

At the same time, dysfunctional supply chains and the reluctance of millions of Americans to return to the workforce are triggering sharp price and wage increases. Year-over-year wholesale price inflation rose to 6.6%. At the level of consumer prices, it reaches 5, 8%. We are therefore already well beyond the 2% target that it has moreover allowed itself to exceed for some time. The Fed remains calm, convinced that we are partly witnessing a catching-up compared to the months of confinement. She considers that supply chains will normalize within a few months, which will calm prices.

Moreover, the most unexpected is that despite the marked rebound in activity, 7.6 million jobs are still missing, compared to the situation prior to the pandemic.

“In one to two years we will see that the job market will be very, very solid,”

says Jay Powell. The strength for the moment less marked than expected in hiring encourages him to delay as much as possible before even talking about a future lifting of the ultra-stimulating measures he took at the start of confinement in 2020.