Retailers ask Biden to decongest ports 0:54

(CNN Business) -

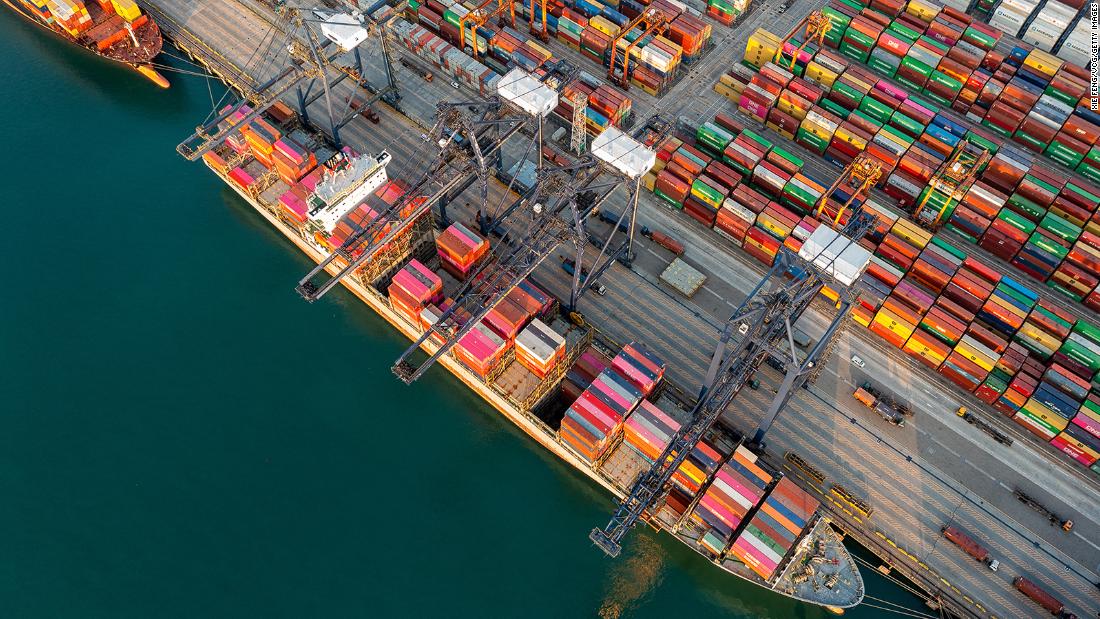

A coronavirus outbreak in southern China has clogged ports critical for global trade, causing a backlog of shipments that could take months to clear and lead to shortages during the year-end Christmas shopping season.

The chaos began to unfold last month when authorities in southern China's Guangdong Province - home to some of the world's busiest container ports - canceled flights, blocked communities and suspended trade along its cost to control a rapid rise in covid-19 cases.

The infection rate has improved since then and many operations have been restarted.

But the damage is already done.

Boats jam in the Suez canal by a huge container ship

advertising

Yantian, a port about 80 km north of Hong Kong, handles goods that would fill 36,000 6-meter containers every day.

The port closed for nearly a week at the end of last month after infections were found among dock workers.

While the port has reopened, it is still operating below capacity, creating a large backlog of containers waiting to leave and ships waiting to dock.

The congestion at Yantian has spread to other container ports in Guangdong, including Shekou, Chiwan and Nansha.

They are all located in Shenzhen or Guangzhou, the world's fourth and fifth largest comprehensive container ports, respectively.

The domino effect is creating a big problem for the global shipping industry.

The accumulation of merchandise is worrying

Yantian's backlog "adds additional disruption to an already stressed global supply chain, including the important stretch of shipping," said Peter Sand, chief shipping analyst at Bimco, a shipping association.

People "may not find everything they are looking for on the shelves when they buy Christmas presents at the end of the year," he added.

As of Thursday, more than 50 container ships were waiting to dock in Guangdong's Pearl River Delta, according to Refinitiv data.

That's the largest backlog of orders since 2019.

The downside to Yantian-only operations is worrisome.

The port has been unable to handle some 357,000 6-meter container loads since the end of May, according to a recent estimate by Lars Jensen, chief executive of Danish consultancy Vespucci Maritime.

That's more than the total cargo volume affected by the six-day closure of the Suez Canal in March.

Yantian Port operations have recovered to approximately 70% of normal levels.

But it does not expect to return to full capacity until the end of June.

Chaos in the Suez Canal could disrupt the supply of goods in the coming months

Covid-19: partial closure of Guangzhou due to new outbreak 0:56

Increased shipping costs

Congestion in southern China has prompted major shipping companies to warn customers about delays, changes in ship routes and destinations, and spikes in rates.

Maersk, the world's largest container shipping line and ship operator, told customers last week that ships could be delayed at Yantian for at least 16 days.

While the company said it would divert some carriers to alternative ports, that won't necessarily solve the problem.

Maersk warned that waiting times at places like other ports in Shenzhen, Guangzhou and Hong Kong could increase as more ships arrive.

Shipping giants Hapag-Lloyd, MSC and Cosco Shipping, meanwhile, all have increased freight rates for cargo between Asia and North America or Europe.

MSC, for example, said this month it would increase shipping rates from Asia to North America by as much as $ 3,798 per 13-meter container.

It is a worldwide trend.

Fares for eight major East-West routes have increased since the same period a year ago, according to London-based Drewry Shipping.

The biggest price jump occurred along the route from Shanghai to Rotterdam in the Netherlands, which soared 534% from the previous year to more than US $ 11,000 for a 13-meter container.

Meanwhile, average container shipping rates from China to Europe recently reached $ 11,352, the highest level since at least 2017, according to Refinitiv.

Continuous interruptions

The crisis in Guangdong exacerbates tension in an already saturated global industry.

In the United States, for example, major ports along the California coast are already jammed with container ships, compounding the bottleneck at the country's largest commercial gateway to Asia.

The US National Retail Federation asked President Joe Biden earlier this week to address the traffic jam at US ports.

In a letter to Biden, the organization warned that the problems "have not only added days and weeks to our supply chains, but have caused inventory shortages, affecting our ability to serve our customers."

The shipping industry also continues to witness the knock-on effects of the disruption to the Suez Canal in March, when the Ever Given got stuck and blocked one of the world's most important trade routes for nearly a week, said Parash Jain. , HSBC's Head of Shipping, Ports and Asia Transportation.

"In any case, the resolution of the accumulation initiated after the congestion at the Yantian terminal could take months, as the start of the high season will mean that demand will only increase further," he said.

A delicate balance

The crisis in Guangdong shows how fragile the global supply chain is, according to Pawan Joshi, executive vice president of E2open, a Texas-based supply chain software provider.

"There is no room for errors or unexpected events, everything is squeezed," he said.

"This means that you cannot afford a single error because there is no longer a buffer."

The pandemic wreaked havoc last year as closures temporarily shut down factories and disrupted the normal flow of trade.

As economies come back to life, suppliers have been hit by a rebound in manufacturing and additional consumer demand.

But that increase in demand is colliding with almost unchanged capacity in container shipping.

The reduction in global air cargo capacity due to the collapse of long-range aviation has made things worse.

"With sustained strong demand for ocean freight around the world, we will continue to see limited ocean freight with higher-than-normal rates and more cargo rollovers than usual," Joshi said, referring to shipments that need to be booked in the future. trip because they cannot be loaded onto the original ship.

Demand is likely to change a bit as countries relax restrictions on covid-19 and people start spending less on appliances and other products and more on outdoor experiences again.

But the constraints in the global supply chain are unlikely to disappear anytime soon.

"More recently, we have seen widespread global supply chain fatigue adding to existing challenges," Bimco's Sand noted, adding that tensions are likely to continue to be felt "for up to a year."

China Global trade

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/UPJFL32VLUYXGXRE7MRLZ6X3W4.jpg)