See if you qualify for a check for having children 1:04

(CNN) -

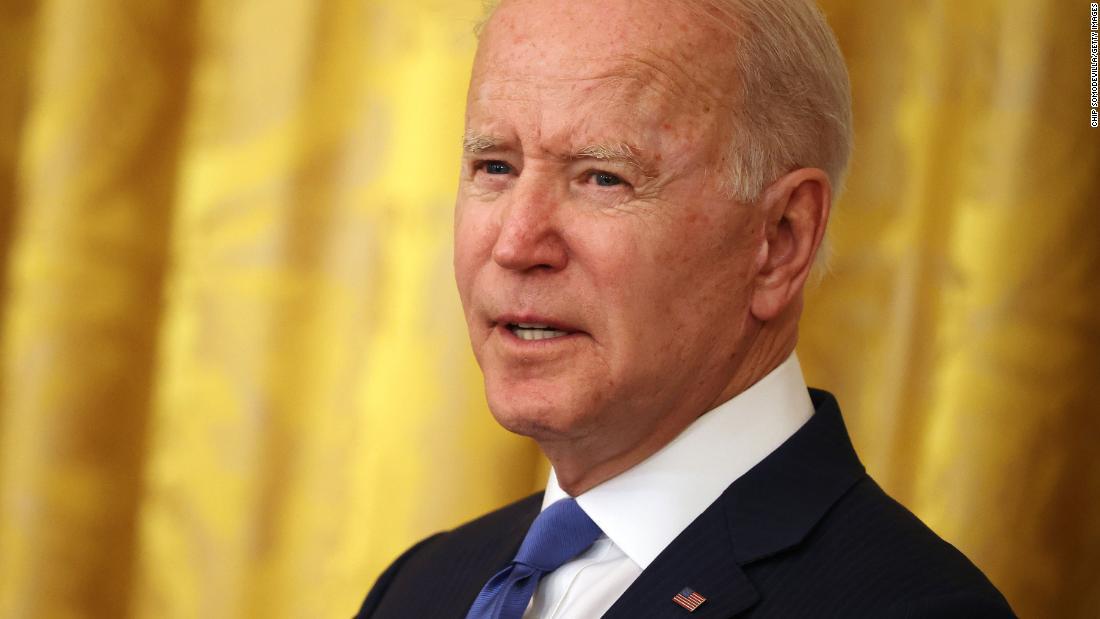

President Joe Biden will deliver a speech this Thursday in which he will promote the expansion of the child tax credit (CTC), a provision of his Government's covid-19 aid package, aimed at to reduce child poverty. Biden "will explain in plain language how the child tax credit works," according to a White House official. "For each child under the age of 6, families will receive US $ 3,600, and for each child from 6 to 17 years old, families will receive US $ 3,000."

"The president will provide an overview of how some families can use this money, from the basics, such as food and housing, to new school supplies or extracurricular activities," the official told CNN in an exclusive preview Wednesday. night.

The first child tax credit payments were sent.

This is what you should know

Starting Thursday, according to the White House, American families will be able to receive payments on the 15th of each month, which will provide them with additional funds, until the end of 2021, with a reduction in taxes when they file their returns next year. The vast majority of families, approximately 39 million households, representing 88% of minors, will automatically receive the credit because they presented their 2019 or 2020 returns requesting the credit. Families filing taxes electronically should see payments in their accounts on Thursday that say "CHILD CTC," while families filing by mail should expect checks in "several days," according to the administration.

The White House expects the payments to be "transformative" for families, leading to "the largest decline in child poverty in a year in US history," the official said.

Families who have not recently filed tax returns or who used the no-filing tool last year to obtain their stimulus checks can use an IRS portal to enroll and receive the expanded child tax credit.

The enrollment tool allows users to provide the necessary information about their households and, if they wish, their bank accounts so that the agency can directly deposit funds.

In his credit presentation speech this Thursday, Biden "will highlight the adjustments that were made to the CTC so that the families that most need help get the full amount of this tax credit, as well as the return on investment it provides to children. of our nation. "

advertising

"For the first time in our nation's history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor visits, school supplies and groceries," said Treasury Secretary Janet Yellen, in a statement, Wednesday night.

"This major tax benefit for the middle class and the step to reduce child poverty is a remarkable economic victory for the United States, and also a moral victory."

The full and enhanced credit will be available to heads of households earning up to $ 112,500 per year and joint filers earning up to $ 150,000 per year, then the credit gradually begins to decline.

For many families, the credit stabilizes at $ 2,000 per child and begins to decline for single parents who earn more than $ 200,000 per year or married couples with incomes greater than $ 400,000 per year.

More low-income parents will be able to take advantage of this child tax credit, as the relief package makes it fully refundable.

So far it was partially repaid, leaving more than 26 million children unable to get full credit because their families' incomes were too low, according to estimates by the US Department of the Treasury.

Biden Administration Says States May Restart Pandemic Unemployment Benefits As Lawsuits Increase

The first payment comes as Biden's broad social agenda clears a crucial hurdle.

Senate Democrats on the Budget Committee announced Tuesday that they reached an agreement on a $ 3.5 trillion budget resolution, which includes spending for Biden's social proposals.

The president will also use part of his speech Thursday to "underscore the importance of passing the American Families Plan as part of his comprehensive Build Back Better program to ensure this tax grant continues for working families for years to come," he said. the official to CNN on Wednesday.

Credit