How do you explain that prices are falling so much in Paris while they are increasing overall in Île-de-France?

Thomas Lefebvre.

Prices in Paris have fallen 2.2% over the past year, 0.3% in June alone.

The price difference with the Paris region continues to widen, it is a new phenomenon.

Usually, Parisian prices set the tone for the whole of the postponement market that is the suburbs, which is no longer the case since the start of the pandemic.

On the contrary, prices in the suburbs continue to rise, driven by the seasonal effect of spring.

It is a period when many families move to be within their walls at the start of the school year.

The prospect for these families of finding, for the same budget, a larger property and above all with an exterior in the inner suburbs outweighs the desire to live within the city walls.

Read alsoReal estate in Île-de-France: the house with garden makes you dream more than ever

Should we expect prices to continue to climb in Île-de-France?

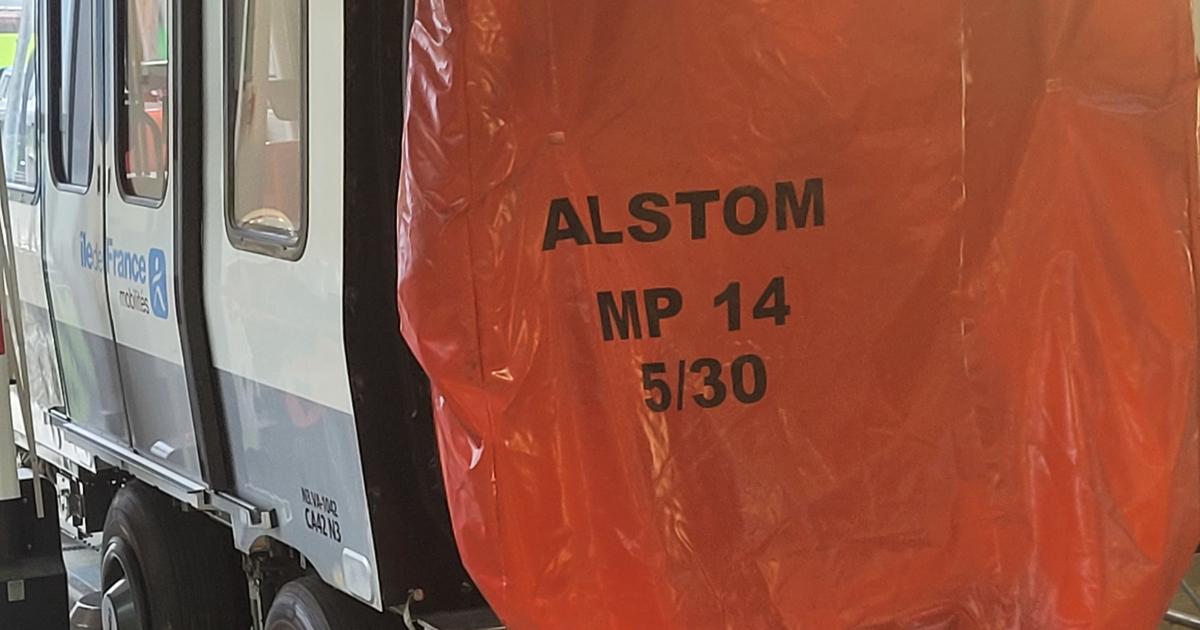

The Paris region is experiencing a catching-up in prices that has nothing to do with a real estate bubble. And this is explained. Ile-de-France businesses are moving towards a two-day-a-week teleworking rate, which does not make it possible to go and live in Marseille or Bordeaux but to accept longer transport time to live in the inner or outer suburbs. If we add to this a modernization of public transport, the Grand Paris Express, cycle paths, renovations of neighborhoods linked to the Olympic Games… The suburbs - and more generally the outlying areas of large urban centers - should do well. game. I am thinking of cities close to Greater Paris such as Villejuif, Gennevilliers, Saint-Denis which are undergoing rapid change and should be the big winners in the coming years.

This summer, the rules for granting loans will become restrictive for the banks, which will no longer be able to be as fluid ... Could this seize the machine, slow down demand and lower prices?

In themselves, the criteria made mandatory this summer are not that restrictive. This involves capping the debt ratio at 35% of income, including borrower insurance, and limiting the duration of loans to a maximum of 25 years - 27 years in new buildings with a two-year grace period - with flexibility granted. to banks on 20% of their files. In fact, French credit production rests on sound foundations and banks have adopted these methods for years but making them binding raises many questions:how to measure this 20%? How will the bank know it has exceeded this ratio? What will be the procedures so as not to stick out? And what penalties in this case? Will the fear of these sanctions push the banks to be more severe? The start of the school year promises to be very uncertain on this point. With prices falling in Paris, these are the two areas of concern to watch in September.