How much will families receive in child credit?

2:27

(CNN) -

Many millions of Americans are beginning to receive monthly government checks to help care for their children.

Looking for a similar government program with the power to affect poverty in America, I came up with three: Social Security, Medicare, and the Affordable Care Act.

With Social Security, the government makes sure that older Americans don't fall into poverty.

With Medicare, you make sure they have health insurance.

With the Affordable Care Act, you help others in need buy health insurance.

Now he is trying to make sure that American children receive money every month.

This is a very big thing.

But it's a one-year experiment for now, unless Democrats can figure out how to force him back through the Senate and make the vastly expanded credit permanent.

Most parents qualify.

Unlike food stamps, now called the Supplemental Nutrition Assistance Program, or SNAP, benefits, or other welfare programs intended only for the poor, this new credit is much larger.

More than just parents in dire need received up to $ 300 per child deposited into their bank accounts Thursday.

This program, an expansion of an existing tax credit, will help the middle class and even people who earn hundreds of thousands of dollars.

advertising

The first child tax credit payments were sent.

This is what you should know

Part of the tax credit will be claimed next year at tax time, but the big change is that part of the benefit is paid directly to the parents in advance, offering a monthly increase.

The Internal Revenue Service (IRS) has been desperately trying to reach low-income Americans, through churches and other community groups, who may not have needed to file tax returns, but should now do it because it would qualify them for this credit.

Otherwise, up to 5 million children could be left out, according to a CNN report.

The United States has been creeping toward this type of social benefit for years, in increments, and on a bipartisan basis, though not in a bipartisan manner.

Republicans doubled the child tax credit to $ 2,000 per child with their huge tax cuts bill in 2017, but they rejected this new expansion, which Democrats included in the covid assistance bill they passed in 2021. .

But the idea of giving money every month to American parents - unheard of in equally wealthy European countries - clearly has some bipartisan support and could help keep American children out of poverty and improve the quality of life for parents.

It shares some similarities with a proposal pushed earlier this year by Republican Sen. Mitt Romney of Utah (also possibly the godfather of Obamacare, the other major Democratic social spending achievement of recent years).

Democrats rejected his plan because it was paid for with cuts to other programs they like.

Democrats were able to turn this year-long experiment into law in part because they didn't have to find cuts to pass the covid aid package.

Now Democrats are calling for it to be consolidated into American law.

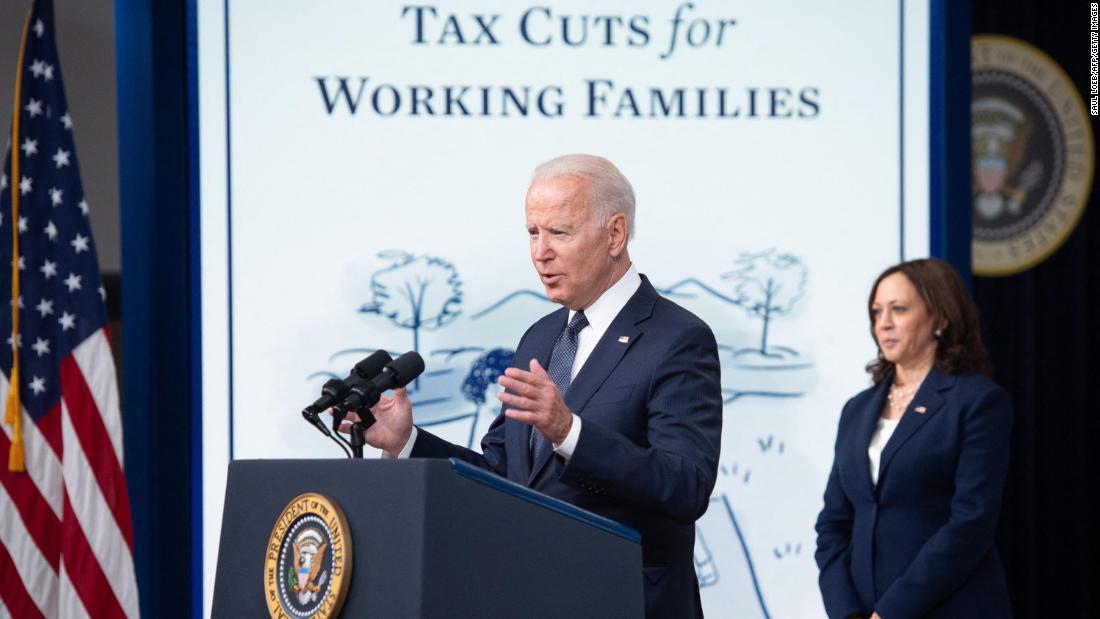

"Let's celebrate this day, Thursday, July 15, 2021, as the day the American family grew much stronger," Vice President Kamala Harris said during remarks with President Joe Biden in Washington.

"It's a good day, America."

She took some credit for insisting that the credit be paid monthly, helping needy parents cover expenses throughout the year.

He also argued that the benefit will help minors after they grow up, by improving their health and quality of life now.

"The payments may be monthly, but the impact of this child tax credit will certainly be generational," he said.

A Brookings review of research on similar programs on smaller scales argued that the benefits of such payments follow children into adulthood.

He also cites that researchers at Columbia's Center for Poverty and Social Policy have argued that the checks will help reduce poverty particularly among black, Hispanic and Native American minors.

Is this a tax credit or a welfare program?

Democrats are careful to refer to these payments as a "tax cut," as Harris did on Thursday.

Republicans, like Sen. Marco Rubio of Florida, call it "welfare."

I asked CNN's Tami Luhby, who covers health care and public assistance programs, for her take on this:

LUHBY

:

Both parties are right here. The child tax credit has been around for years and won the support of both parties, including Rubio, who lobbied to increase it as part of the 2017 GOP tax cuts. But that's largely because it was available primarily to working families: it was necessary to have some income to be able to claim it.

The American Rescue Plan made a fundamental change to the credit, making it fully refundable by 2021. That allows many more families, including lower-income Americans who are out of work, to claim it. More than 26 million children in need will now be eligible for the full credit thanks to this change, a key tool in the Democrats' push to reduce child poverty.

About 1 in 7 children were in poverty in 2019, according to the latest census data. Changes to credit, including increasing the amount, are expected to cut child poverty by almost half this year.

But it has also caused a stir among Republicans, who call it welfare.

Removing the income requirements makes it more like a government assistance program, although it is also open to most middle- and upper-middle-class American families. However, many advocates of the extended child tax credit liken it to a child allowance or universal basic income program that supports most families in the US.

How much does this cost taxpayers (many of whom are parents now receiving cash!)?

The cost of permanently expanding the tax credit would be nearly $ 1.6 trillion in 10 years, according to the Tax Foundation, or between $ 100 billion and $ 110 billion in each of those 10 years, including 2022.

By way of comparison, the Pentagon asked for $ 715 billion for its 2022 budget. Therefore, this expansion is worth about one-seventh of the Pentagon's budget in 2022.

For another comparison, the US spends much more than it takes in.

The budget deficit in 2021 is projected to be $ 3 trillion and in 2022 $ 1.2 trillion, many times the cost of this credit.

However, this has an implication for some families: Getting the credit in increments up front could have consequences if they expect a tax refund, the

Wall Street Journal

warns

.

The first checks.

If I was surprised to see a check on my bank account this morning from "IRS TREAS 310 CTC," I'm sure millions of other Americans were, too.

The first check was not issued as the IRS has banking information for many people and the agency just pushed a few buttons.

Biden To Highlight "Historic" Effort To End Child Poverty In His Speech On Expanding The Child Tax Credit

This was not the case after Social Security was signed into law in 1935. The first checks didn't come out until 1940, after people had contributed to the program for a few years.

We know exactly who received the first check.

It was Ida May Fuller, a legal secretary in Ludlow, Vermont.

According to the Social Security Administration, she "worked for three years under the Social Security program. The taxes accrued on her wages during those three years totaled $ 24.75. Her initial monthly check was $ 22. 54. During his life he received a total of US $ 22,888.92 in Social Security benefits. "

Inflation!

That $ 24.75 is equivalent to about $ 480.32 today, according to an inflation calculator, an inflation rate of 1,840.7%.

A dollar went much further back then.

A random thought about government intrusion.

One part of the country is extremely nervous that someone who works for the government knocks on their door to encourage them to get vaccinated.

I legitimately wonder how parents will react against government intrusion when they see new monthly government payments appear in their bank accounts without asking.

I bet they more than agree with that.

But we'll see.

Credit

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/VOQEHFVTC5OSYTU5YOO5SYQ5DU.jpg)