Enlarge image

Arrived on the New York Stock Exchange:

With its luxury electric limousine Air, Lucid Air is clearly following Tesla's business model - the IPO has now been successful

Photo: ANDREW KELLY / REUTERS

Around 800 kilometers range and 1080 hp in the top version, a huge panoramic glass roof and plenty of space inside: No question about it, the first model from Lucid Motors, which costs up to 170,000 dollars and is called "Air", looks great both inside and out.

The former chief engineer of Tesla's Model S,

Peter Rawlinson,

is responsible for the Air

.

Born in Britain, he fell out with Tesla boss Elon Musk, was hired as head of technology at Lucid's predecessor Atieva in 2013 and was promoted to Lucid Motors CEO in 2019.

Enlarge image

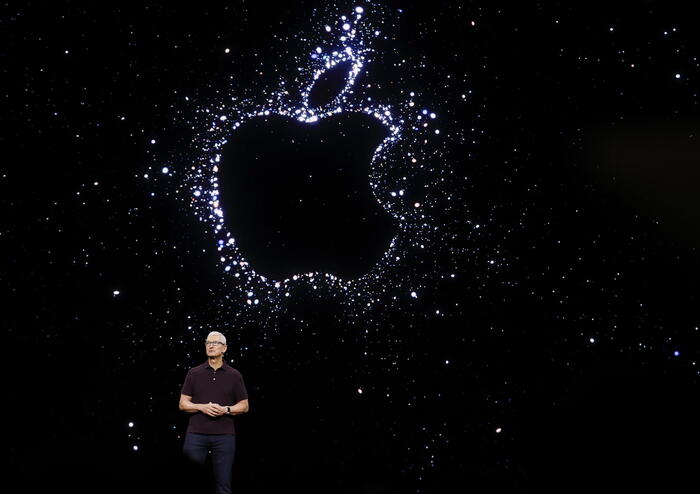

Billions raised:

Lucid Air CEO Peter Rawlinson rang the bell on the Nasdaq for the IPO of his company

Photo: ANDREW KELLY / REUTERS

Rawlinson has been working on getting his old employer into the parade for eight years. Lucid adheres exactly to the Tesla model in many ways, starting with an expensive luxury vehicle and a particularly high-speed drive. Still, it was not easy for the Californians to make the transition from concept car to production vehicle. Lucid struggled several times with financial problems, which is why he had great trouble buying and setting up his factory, and had to postpone the market launch of the Air several times. It only got easier for Lucid when the Saudi Arabian state fund invested a billion dollars in the Californian start-up.

The Air is still only available as a concept vehicle, the first series vehicles are to be delivered in the second half of 2021.

Lucid now has a lot of capital available to expand its production: Since Monday, the car maker has been trading as the Lucid Group on the Nasdaq New York Stock Exchange.

Lucid announced that the IPO would bring in $ 4.4 billion.

Right at the start of the stock market, the Lucid share price rose by almost 7 percent.

Swarm investors made Lucid IPO difficult

The IPO took place through the merger with the stock market shell Churchill Capital Corp IV. It is another sign of how much the race for the future of the car is shifting to Wall Street. According to a press release, they already have over 11,000 paid reservations for the Lucid Air - including an "excellent management team". In addition to Rawlinson, the former Mercedes CFO Frank Lindenberg (58) is also represented on Lucid's board of directors.

So big names for a big serve.

However, the Spac IPO did not go smoothly.

Last Thursday, the shareholders of the stock market vehicle Churchill should actually wave through the merger with Lucid.

In the first attempt this failed: There were too few votes, so Lucid extended the deadline to Friday and postponed the IPO to Monday.

According to media reports, it was not due to the lack of support from the voting shareholders - but rather to the fact that too few shareholders cast votes.

In the run-up, numerous private investors who are close to the Wallstreetbets and Reddit crowd movement had acquired Churchill shares.

Rawlinson and the head of Churchill, Wall Street investor

Michael Klein

, had to beg for votes in a call on Thursday. In the end, they managed to get the necessary majority of the shareholders' votes together. But the whole thing was pretty close. That showed "stumbling blocks for Spacs", which attract a large number of amateur investors, meant the "Financial Times" smugly.

After all, Lucid is the potential Tesla adversary listed via Spac, whose series production is actually imminent, judges the "Wall Street Journal".

With the Air, Lucid wants to bring the currently most efficient electric drive train onto the market: Lucid's electric motors should consume almost 20 percent fewer kilowatt hours per 100 kilometers than Tesla's current technology.

Lucid's big competitor comes from Stuttgart

For the time being, Lucid no longer has any major financial problems - but the Tesla blueprint also has a few warnings for Lucid.

It took Tesla years to be recognized as a serious automaker.

When Tesla's Model 3 was launched, there were massive start-up and quality problems.

So Lucid still has a lot to do before it can rightly be called a Tesla competitor.

After all, Lucid has the German under contract who was supposed to save Tesla's Model 3 from the "production

hell

": the former Audi man

Peter Hochholdinger

(59), who is now helping to build Lucid's plant in the Arizona desert.

Photo gallery

Mercedes EQS - the electric guiding star in pictures

Photo: Daimler

Rawlinson gets a tough competitor from the traditional auto industry right at the start of the Air market: At the end of 2021, Daimler's electric sedan Mercedes EQS will also be launched in the USA.

The most striking feature of the Swabian luxury glider, in addition to the opulence of the interior, is its particularly efficient drive - which enables a standard range of 770 kilometers.

So it's not just Lucid that is sawing one of the most important Tesla promises, namely the most efficient drive on the market.

wed