Lin Xingzhi, the founder of The Hong Kong Economic Journal, announced today (29th) that he has stopped writing and ended his "Hong Kong Economic Journal" column.

In his column, he pointed out that he had worked in different positions for the Hong Kong Economic Journal for 48 years and 27 days.

He described saying

goodbye to readers as "healthy conditions are acceptable, and there is still a free choice under the general environment."

He said, nearly. For half a century, he has been straightforward and free to speak. He is spiritually satisfied, has substantial gains, and is physically and mentally happy. I hope he can live comfortably in the future. He also thanked the "Computer Room" of the Hong Kong Economic Journal and his colleagues in the editorial department.

Lin: The Hong Kong stock market is "lost" with the Western system, and the government intervenes in the operation with a visible hand

Lin Xingzhi published a column in the Hong Kong Economic Journal today entitled "Different systems, strict observance of Hong Kong stocks in different ways, and the immortality of Hong Kong stocks." He mentioned that the stock market should tilt upwards "in the long run". However, the world situation has changed and the Hong Kong stock market is following this trend. The possibility of decoupling has gradually emerged. The main reason for the "disconnection" with Western systems is that the government's tangible hands indirectly intervene in market operations.

He said that Beijing fears that the mainland's "big data" will fall into the hands of people with ulterior motives overseas, and orders relevant companies to stop or withdraw their listings overseas, ordering the newly lucrative "tutorial industry" to become non-profit and "cannot be listed for financing," and even strictly regulated. The operation of the "fast-cargo circulation" in the market depends on the Hong Kong stock market. In particular, the stock price movements of some listed companies that have been directly affected by this policy in recent days can be said to have fallen astonishingly.

However, he pointed out that blaming the Hong Kong stocks' decline on Beijing’s policy intervention does not fully reflect the facts, because it has recently coincided with the escalation of Sino-US exchanges of language to a situation where the "lost connection" between the two sides has become impossible, and the Indo-Pacific region is full of clouds. The tensions in China seem to have a greater impact on the stock market. At a time when the Sino-US antagonism is becoming stronger, the possibility of capital "escape" into the free market, which will inevitably rise in the long run, is more than anything else. This is completely reflected in Hong Kong and the Mainland. The stock market is showing signs of weakness, and Wall Street stocks are not only unaffected but also reverse upward.

Lin Xing continued to say that in the current and foreseeable future political environment, the Hong Kong stock market is unavoidably affected by mainland policies. However, if the "Securities" institutions can operate professionally without political interference, the future stock market will be able to achieve steady, long-term and healthy development. With the vitality of the Chinese economy and the successful operation of the "digital renminbi", it is entirely possible that the Hong Kong stock market will stand out from the free system and shine.

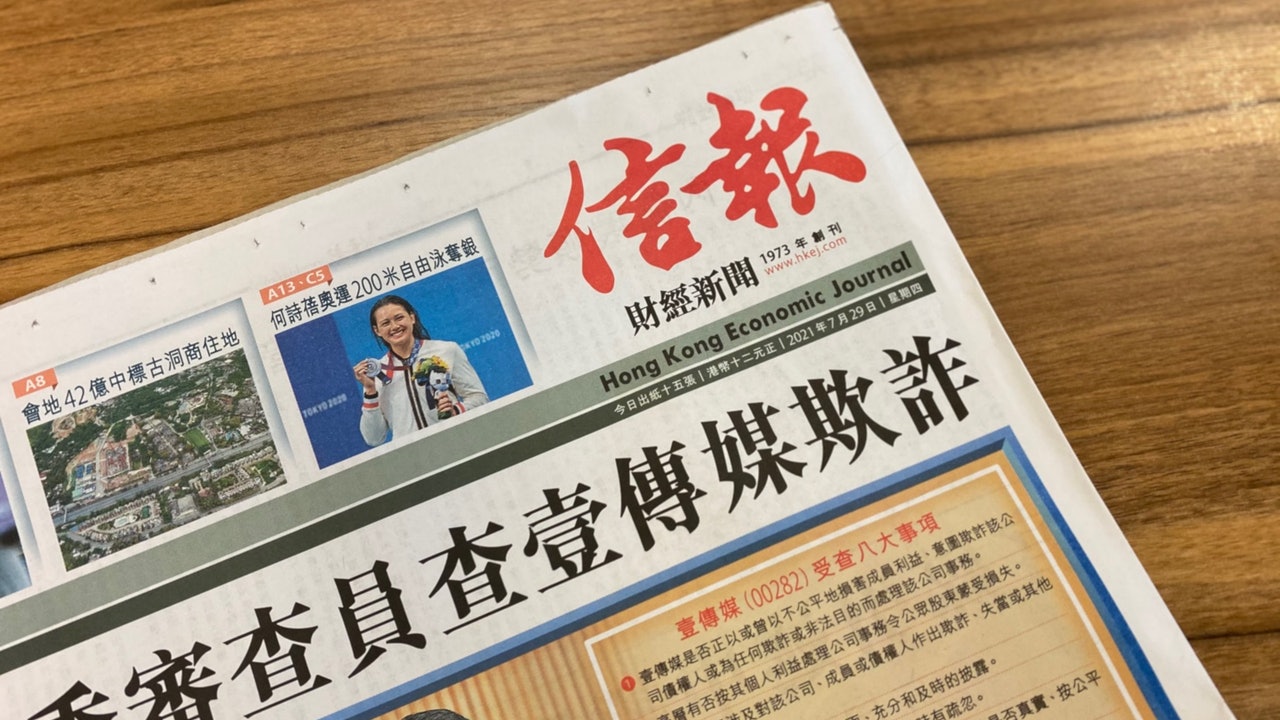

Founded the "Hong Kong Economic Journal" in the 1970s and wrote a column for more than 20 years

Lin Xingzhi, who is over eighty years old, founded "The Hong Kong Economic Journal" in 1973 with his wife Luo Youmei and media person Luo Zhiping. From 1973 to 1996, he wrote an editorial "Political and Economic Review" in the "Hong Kong Economic Journal", analyzing and commenting on the political and economic situation of Hong Kong and the world. , Hailed as "Hong Kong's No. 1 Healthy Pen".

Since 1997, Lin Xingzhi transferred the "Lin Xingzhi Column", and later transferred the management of the "Hong Kong Economic Journal" to his daughter Lin Zaishan, but he continued to write the column.

In August 2006, PCCW Chairman Li Zekai purchased 50% of the shares of The Economic Journal for US$35 million. In September 2014, he purchased the entire equity of the Economic Journal.

Cai Ziqiang Ming Pao’s column puts aside pen: writing political commentary has nothing to change and still serves as a lecturer at CUHK

01News

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/3I74UEXLYRBBRPGPSGWNN6WXH4.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KMEYMJKESBAZBE4MRBAM4TGHIQ.jpg)