Enlarge image

Third attempt:

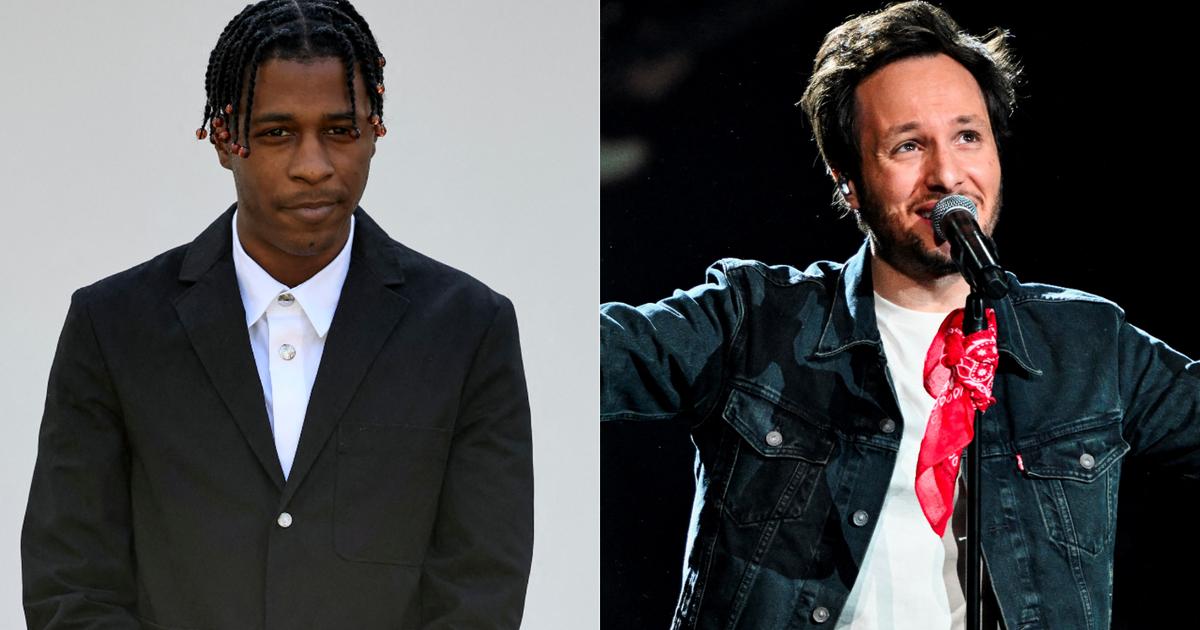

Vonovia boss

Rolf Buch

does not give up at Deutsche Wohnen

Photo:

Jakob Hoff / imago images

The boss of the market leader Vonovia,

Rolf Buch

(56), announced an improved offer for the takeover of the competitor Deutsche Wohnen - just one week after the majority of the shareholders of Deutsche Wohnen gave him the cold shoulder.

According to information from manager magazin, the planned merger failed at the second attempt because Vonovia boss

Rolf Buch

(56) and CFO

Helene von Roeder

(51) had gone too carelessly with the purchase of Deutsche Wohnen, and the advisory banks also failed.

In the third round in the takeover struggle, Buch is now pushing the pace.

He would like to get the biggest deal in the German housing industry to date before the federal election in September if possible.

Germany's largest landlord wants to pay the owners of Deutsche Wohnen 53 euros per share, one euro more than last offered. This means that Deutsche Wohnen would be worth a total of 19 billion euros. Buch is firmly convinced that this time he will be able to convince the majority of the competitor's shareholders. "It won't go wrong," he said on Monday. Vonovia had "calculated generously," he said today.

Vonovia had previously secured almost 30 percent of the shares in the competitor.

Together, the two groups would be the largest rental company in Europe with more than 500,000 apartments.

Deutsche Wohnen boss

Michael Zahn

(58) and his fellow board members are still on board: He got the impression that many shareholders regretted the failure.

"We don't want to withhold the opportunity to agree to the merger on better terms."

The further process now depends on the approval of the financial supervisory authority Bafin, which has to give the green light for a new offer, said Buch.

"If it goes very quickly, we can know a few days before the general election whether we have reached the acceptance threshold this time."

In attempt number three "the bar is significantly lower"

Nevertheless: For Buch, under which Vonovia has grown rapidly, the Deutsche Wohnen takeover threatens to become a never-ending story.

He had already ridden his first attack on the competitor in 2016, at the time against his will and without success.

At the second attempt this year, he was able to get the competitor's board of directors and supervisory board on board, but not all of the hedge funds involved in Deutsche Wohnen.

Their speculation on a higher price made Buch responsible for its failure also in the second attempt.

Too few shares were offered.

So now try number three.

Vonovia is starting from a different level this time, said Buch.

"Before we had to jump from a standing start to 50 percent, now we just have to jump from 30 to 50 percent."

Vonovia has already secured almost 30 percent of Deutsche Wohnen's capital.

"The bar is significantly lower," emphasized Buch.

He was sure to be able to convince hesitant shareholders.

Union Investment criticizes the takeover price to be too low

Marc Tüngler, General Manager of the German Association for Protection of Securities Holdings (DSW), sees it similarly. "The offer is not made in the blind flight," he told the dpa. Vonovia obviously did what should have happened before the first offer: talk to the hedge funds and the bulky shareholders. "The 53 euros are already a sip more. But it's not so much more that Vonovia's point of view no longer pays off the deal," analyzed the sales representative.

Union Investment Manager Michael Muders was still not satisfied with the "Financial Times".

The NAV, a common indicator of company value in the real estate industry, is 56 euros per share, he said.

Vonovia and Deutsche Wohnen did not initially react to the statements on the stock market.

Tüngler sees Buch under time pressure.

"The takeover has to take place before the general election. Then the cards will be reshuffled."

This uncertainty would have been too great.

"That's why the iron has to be forged right now."

After the election, there could be more government intervention in the housing market.

For example, the Greens are calling for a federal law to open up the possibility of setting upper rent limits.

Vonovia wants to arm itself against renewed speculation about a higher price. This time, it should be expressly stated in the offer that Vonovia will not conclude a domination and profit and loss transfer agreement for three years. In such a contract, minority shareholders could get a higher price for their paper than in a takeover bid. In the real estate market, takeovers without such a contract are "quite common," emphasized Buch. "Since this may not have been known to everyone, we have now clearly communicated it."

What if the book should fail again?

"If that doesn't work out now, things will get tighter for Mr. Buch too," assumes shareholder representative Tüngler.

The Vonovia boss points out that the new takeover attempt is not going it alone.

"All committees, both from Vonovia and Deutsche Wohnen, said: This is the right way to go."

Vonovia already has a plan to refinance the transaction: Of the 20 billion euros that it has secured as a loan for the takeover, eight billion should be redeemed through a capital increase.

wed, rei / Reuters, DPA