5 hard-to-find products now 1:44

London (CNN Business) -

The vast network of ports, container ships and trucking companies that move goods around the world is in crisis and the cost of shipping is skyrocketing.

That's worrying news for retailers and shoppers, especially around Christmas time.

More than 18 months after the pandemic, the disruption of global supply chains is getting worse, fueling shortages of consumer products and making it more expensive for companies to ship goods where they are needed.

Unresolved issues and the emergence of new issues, including the delta variant of coronavirus, mean that shoppers are likely to face higher prices and fewer options this holiday season.

Companies like Adidas, Crocs and Hasbro are already warning of disruptions as they prepare for the crucial year-end period.

"The pressures on global supply chains have not abated and we do not expect them to do so anytime soon," said Bob Biesterfeld, CEO of CH Robinson, one of the world's largest logistics firms.

A long delay at China's ports could interfere with your Christmas shopping this year

Delay in Chinese ports could impact your purchases 1:05

The closure of ports in China, a big problem in distribution

The latest hurdle is in China, where a terminal in the Ningbo-Zhoushan port south of Shanghai has been closed since Aug. 11 after a dock worker tested positive for COVID-19.

Major international shipping lines, including Maersk, Hapag-Lloyd and CMA CGM, have adjusted schedules to avoid the port and warned customers that there may be delays.

advertising

The partial closure of the world's third-busiest container port is disrupting the operations of other ports in China, putting further pressure on supply chains already suffering from recent problems at Yantian port, ongoing container shortages, closure of factories related to the coronavirus in Vietnam and the lingering effects of the blockade of the Suez Canal in March.

Shipping companies expect the global transportation crisis to continue.

That greatly increases the cost of moving cargo and could put upward pressure on consumer prices.

"We currently expect the market situation to ease only in the first quarter of 2022 at the earliest," Hapag-Lloyd CEO Rolf Habben Jansen said in a recent statement.

Climate crisis could worsen due to lack of metals 0:58

How does the shipping crisis affect the world market?

The cost of shipping goods from China to North America and Europe has continued to rise in recent months, following an increase earlier in the year, according to data from London-based Drewry Shipping.

The company's World Container Index shows that the composite cost of shipping a 12-meter container on eight major East-West routes reached US $ 9,613 in the week through August 19, 360% more than a year ago.

The biggest price jump came on the route from Shanghai to Rotterdam in the Netherlands, with the cost of a 12-meter container skyrocketing 659% to $ 13,698.

Container shipping prices on routes from Shanghai to Los Angeles and New York have also skyrocketed.

"The historically high current freight rates are due to the fact that there is unmet demand," said Soren Skou, chief executive of container shipping giant Maersk, on an earnings conference call this month.

"There just isn't enough capacity," he added.

China suspended some international flights to the country if five people on board a plane tested positive for coronavirus upon arrival at its airports

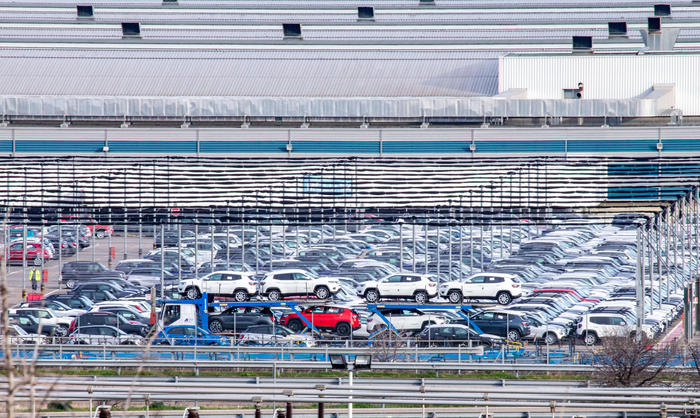

Photo of Ningbo-Zhoushan port on Aug 15, 2021 in China's Zhejiang province. (Credit: Suo Xianglu / VCG via Getty Images)

Port congestion

The closure of the Ningbo terminal will add to bottlenecks stemming from the June closure of Yantian, a port about 80 kilometers north of Hong Kong, after coronavirus infections were detected among dock workers.

While a partial reopening of the Yantian port took just a few days, returning to normal services took nearly a month, according to S&P Global Market Intelligence Panjiva, as congestion spread to other ports.

That spells trouble for retailers and consumer goods companies trying to replenish inventories ahead of the crucial year-end holiday shopping season.

"The Ningbo closure is now particularly delicate as it may delay exports for the peak season for deliveries to the United States and Europe, which generally arrive from September to November," S&P Global Panjiva said in an investigation note on August 12. .

Drewry Shipping said on Friday that congestion in nearby ports of Shanghai and Hong Kong is "increasing" and spreading in other parts of Asia, as well as Europe and North America, "particularly on the west coast" of the United States.

About 36 container ships are anchored off the adjacent ports of Los Angeles and Long Beach, according to a report Thursday from the Marine Exchange of Southern California.

That's the highest number since February, when 40 container ships were waiting to enter.

Typically, there would be only one or zero container ships at anchor, according to the Marine Exchange.

Congestion in California is beginning to spread to "virtually every port in [the United States]," according to CH Robinson's Biesterfeld.

"The chances of your boat arriving on time are around 40%, up from 80% by this time last year," he told CNN Business.

US Retail Sales Down From Stimulus-Driven Peak

Domino effect

The backlog at ports will have a ripple effect on clogged warehouses and road and rail capacity already under pressure.

Logistics networks have been operating at full capacity for months, thanks to stimulus-driven demand led by US consumers and a rebound in manufacturing.

Truck driver shortages in the United States and the United Kingdom have only exacerbated supply disruptions.

US imports in March and May exceeded levels seen in October 2020, generally the peak of the shipping season, said Eric Oak, supply chain research analyst at S&P Global Panjiva.

"This means that logistics facilities have been running out for most of the summer," he added.

It's not just the ports that are under pressure.

Air terminals receive increasing amounts of cargo as companies turn to alternative methods to transport their goods.

At some of the largest airports in the United States, such as Chicago, there are delays of up to two weeks to claim cargo, according to Biesterfeld.

Efforts to contain the covid-19 outbreaks have recently disrupted traffic at the Shanghai Pudong and Nanjing airports in China.

Retailers ask Biden to decongest ports 0:54

Retailers brace for shock

"Name just about anything and it seems like there is a shortage somewhere," added Biesterfeld.

"Retailers are struggling to replenish inventory as fast as they are selling, and trying to prepare for the holiday demand."

Supply chains were debated in nearly two-thirds of the 7,000 company earnings calls globally in July, up from 59% the same month last year, according to an analysis by S&P Global Panjiva.

Producers of consumer goods are taking drastic measures to meet demand, such as changing where products are made and moving them by plane instead of boat, but companies like shoe company Steve Madden say sales are already being lost. because they just don't have enough assets.

The company has moved half of the production of its women's range to Mexico and Brazil from China in an attempt to shorten delivery times.

"In terms of the supply chain ... we could talk about this all day. There are challenges around the world," Chief Executive Officer Edward Rosenfeld said on an earnings call last month.

"There is congestion in ports, both in the United States and in China. There are covid outbreaks in factories. There are problems getting containers. We could go on and on."

This is one of the major clothing brands affected by the closure of factories in Vietnam during the last month.

Data from S&P Global Panjiva shows that nearly 40% of the volume of goods imported into the United States by sea during the 12 months through July came from the Southeast Asian country.

This is what some companies and brands say

Adidas CEO Kasper Rorsted said the sportswear company will not be able to fully meet "strong demand" for its products in the second half of the year due to closures, despite shifting production to other regions.

The supply chain difficulties have "caused [a] significant delays and additional logistics costs, in particular as we have been making more use of air cargo," he said in a recent earnings call.

Crocs CEO Andrew Rees said transit times from Asia to most of the company's leading markets are about double what they were historically.

"That has been the case for some time, and we hope [to live] with that," he told investors last month.

To ensure product availability during the holiday season, Hasbro, which makes Monopoly and My Little Pony, said it is increasing the number of ocean carriers it works with, using more ports to expedite deliveries, and purchasing more products ahead of time from multiple countries. .

For consumers, the contraction of the supply chain is likely to mean higher prices.

Hasbro, for example, is raising prices to offset rising freight and commodity costs.

The company projects that its shipping expenses will be on average 4 four times higher this year than last year, according to CFO Deborah Thomas.

Buyers should also prepare for longer than normal delivery times and may need to have several different gift ideas up their sleeves.

"As we've been forecasting for months, shoppers will see some empty shelves during the end of the year holidays," Biesterfeld said.

"And if you buy most of your gifts online, do it early. Delivery time can be four to six weeks."

Transportation crisis