Enlarge image

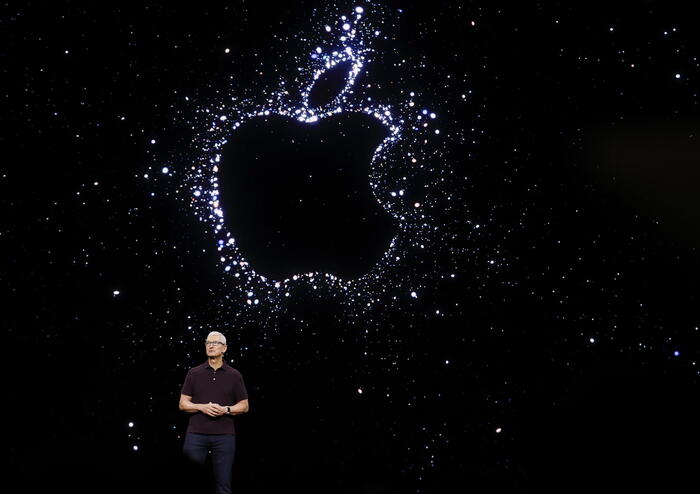

Heavy equipment:

Rivian founder

RJ Scaringe

with a prototype of his R1T electric pickup at the Los Angeles 2018 auto show

Photo: Mike Blake / REUTERS

The electric vehicle manufacturer Rivian has submitted documents for an IPO by its own account.

The US company said the papers handed over to the regulatory authorities are still confidential.

This sets the stage for multi-billion dollar revenue by the end of the year as Rivian hits a hot market for new stocks in the US.

Rivian, with big investors like Amazon, Soros Fund Management and Blackrock in the back, will aim for a valuation of around 70 to 80 billion dollars, the Reuters news agency learned on Friday from two sources familiar with the matter. At this level, Rivian would surpass General Motors, the largest auto company in the United States. But it would only be a fraction of the nearly $ 700 billion market capitalization of Tesla, which is currently planning a pickup ("cybertruck") that would compete with Rivian's own variant.

Rivian's IPO should top the list of IPO candidates by the end of the year. In the course of the year, according to the financial data provider Dealogic, the record amount of more than 225 billion dollars has been brought in. Some top-class players such as the Chinese transport giant Didi, the South Korean e-commerce group Coupang or the Coinbase crypto exchange have already taken advantage of the record-breaking activity on the capital market this year and listed their shares on US stock exchanges. Several other big names are expected for the last quarter, including the chip manufacturer Globalfoundries, which also produces in Dresden, the restaurant software provider Toast and the private equity firm TPG.

Rivian did not provide any further details on his IPO plans on Friday.

A first public look at the company's finances is expected in the coming weeks.

The company is one of the most heavily capitalized startups in the United States.

Rivian has raised around $ 10.5 billion since early 2019, with $ 2.5 billion in a funding round led by Amazon and Ford in July alone.

Order for 100,000 delivery vans from Amazon

Founded in

2009 by

RJ Scaringe

(38) under the name Mainstream Motors, the company changed its name to Rivian in 2011.

The name is derived from the Indian River in Florida, a lagoon where Scaringe often rowed in his youth.

Production of an electrically powered pickup and an SUV is slated to begin this year.

The IPO is marked by a race by car manufacturers for electrification, as China, Europe and other countries and regions require lower CO2 emissions from vehicles. In the US, traditional manufacturers such as GM and Ford have switched factories to produce electric cars, while Tesla, Taiwanese contract manufacturer Foxconn and several start-ups are building new plants or expanding old ones. Earlier this month, Reuters reported that Rivian was in talks to invest at least $ 5 billion in a new vehicle plant in Fort Wort, Texas.

Rivian is currently pursuing a two-pronged strategy: building electric delivery vans for Amazon and at the same time developing a brand for electric pickups and SUVs aimed at wealthy private customers. Amazon has ordered 100,000 vans from Rivian as part of the retail giant's efforts to reduce its carbon footprint. However, the current year was not without its challenges for Rivian. In July, CEO Scaringe had to tell customers that the market launch of his vehicles had been delayed due to the pandemic.

Apart from Rivian, a number of electric car startups have seized the opportunity of the boom in the capital markets over the past 12 months.

In particular, the rise of the listed company shells (Spacs) helped many.

Both Lucid Motors, Nikola, Fisker and Lordstown have slipped into such covers - blank checks from investors who do not know in advance what kind of business they are investing in - in order to go public without cumbersome registration and disclosure requirements.

ak / Reuters