Jacques Bichot is an economist, former professor at the University Jean-Moulin-Lyon-III, he is the author in particular of La Retraite en liberté (Le Recherches-Midi).

Gérard Lafay is an economist and professor at the Panthéon-Assas University and author of numerous books on economics, the most recent of which is 12 keys to getting out of the crisis (the Harmattan).

Our objective is to reform social protection in order to transform what is currently a drag that we are dragging into an engine for the economy. France devotes enormous resources to its social protection, but design errors, dysfunctions and abuses waste a significant part of this effort. Our country can do better without spending more, provided it is governed intelligently.

The French are fed up with compulsory deductions without compensation. On the other hand, they have an intact appetite for social protection services: it would not shock them that the welfare state absorbs almost a third of the GDP, as is currently the case in France, if the effectiveness of security social and health care system was up to the budget available to these organizations through contributions and taxes paid by citizens. We must do better without spending more as a proportion of GDP.

The so-called "

employer

" contributions are quite simply a part of the workers' remuneration, part dedicated to the financing of the

Social Security

.

Social contributions have historically been divided into two parts, employee and employer, to support parity, to understand the collaboration between "

social partners

".

As this is now firmly anchored in institutions and in people's minds, it is now possible to have the main employers' social contributions absorbed by employee contributions.

So that the cost of the Social Security is well understood by the employee, it would be desirable that his account be credited with the totality of his remuneration.

Jacques Bichot and Gérard Lafay

Apart from the occupational accident and disease insurance, taken out by the employer to be covered in the event of a "

glitch

" for which, in its capacity, it bears the responsibility, any contribution intended for the social protection of employees would be salary-related. Thus it would become obvious that the worker pays in full for his health insurance, whether he is an employee or on his own account. For old-age insurance, it is also necessary to make clear what the current legislation conceals: by paying old-age contributions, the worker does not prepare for his own retirement, but pays what he owes to his elders, who previously raised him. and trained.

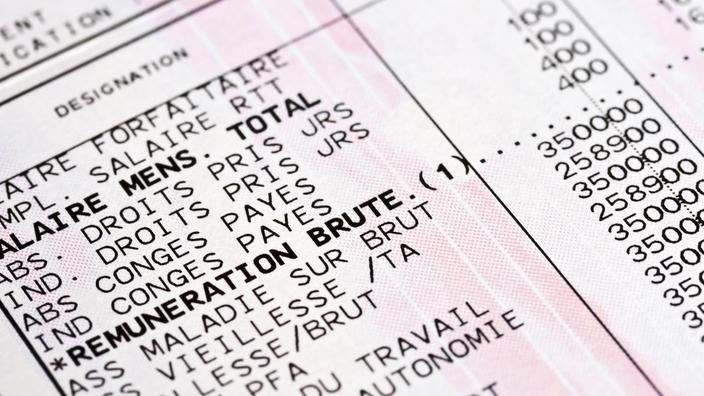

For example, consider a gross salary of € 3,000, including in current legislation € 600 in employee contributions, to which are added € 1,200 in employer contributions, or € 4,200 disbursed by the employer.

What do the good s

ens

tell us

?

If the net salary is € 2,400 (€ 3,000 - € 600), the remuneration for work amounts to € 4,200, on which the Social Security (in the broad sense) takes € 1,800.

It is imperative that the payslip starts from these € 4,200, real work remuneration for the employee and real labor cost for the employer.

The total remuneration of the employee is € 4,200, of which € 1,800 will be used to pay for his social protection and what he owes to his elders.

Read also France still the champion of direct debits

So that the cost of the Social Security is well understood by the employee, it would be desirable that his account be credited with all of his remuneration, € 4,200 in our example, and that the € 1,800 intended for social organizations be taken from this account by said organizations, as do water, electricity, gas and telematic service providers. So everyone will realize what social security really costs.

At the same time, social contributions must be clearly explained, clearly distinguishing: those which settle a debt to the elderly, and therefore are not intended to open up rights (the current old age contributions);

those which finance the health insurance of contributors, and therefore give rise to the right to healthcare coverage;

and those which finance the preparation of future workers, and therefore should open up pension rights.

Thus, for example, educational expenditure is intended to be financed rather than by taxes by a contribution which generates pension rights.

It would be the end of this humiliating and fundamentally inaccurate view of the assisted family, a conception that undermines our societal functioning.

Jacques Bichot and Gérard Lafay

The law provides that the allocation of “

contributory

”

pension rights

is made on the basis of contributions which, in reality, immediately returned to retirees, do not serve in any way to prepare the pensions promised to contributors. The term “

contributory rights

” is therefore inappropriate. Social security must be brought back into line with economic reality, namely an exchange between successive generations: generation A brings up generation B, investing in the human capital it represents, then living on the dividend drawn from this investment - a fraction professional earnings of members of Generation B when they became active.

Pension rights should be allocated in proportion to the investments made in the human capital in training represented by the youth. They will thus use two distinct channels: a parental contribution in kind (maintenance, education) and a financial contribution (taxes and contributions financing initial training, family benefits, health insurance for children and young people in training).

Imagine what the effect on fertility might be of a very concrete recognition of the family as the country's main investor. An investor who does not need to be subsidized, but only to be respected in his natural right to obtain a fair share of the proceeds of the investment in which he participates. It would be the end of this humiliating and fundamentally inaccurate view of the assisted family, a conception that undermines our societal functioning.