Price rises eat away at spending power

, but they also make savings lose purchasing power.

Like termites, which little by little eat away at the inside of the wood,

inflation erodes the value of financial assets without us noticing

.

20 years ago,

bank deposits

were an attractive alternative for most households who wanted to put their money aside without having to take practically any risk.

Thus, it was also possible to combat inflation.

Now, it is no longer possible.

Even less in view of the rise in prices registered in August, of 3.3% year-on-year.

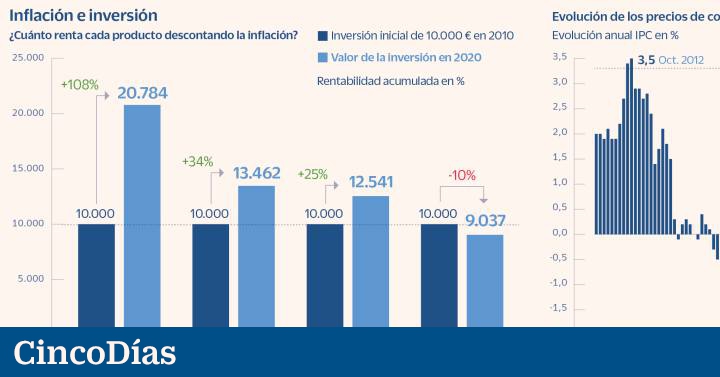

The European association of investment fund managers (Efama) prepared a study a few weeks ago to analyze the extent to which price increases were reducing our capital.

According to the aforementioned Efama report,

10,000 euros invested in 2010 that would have been put into bank deposits would have become 9,037 euros in 2020, once price increases have been discounted

.

With the zero-rate monetary policy promoted by the European Central Bank (ECB), people with debt benefit, having to pay less for their mortgage or credit.

Instead, savers can no longer expect any return on bank deposits.

If we add to that that prices do continue to rise, that is when the devaluation of savings appears.

Inflation-linked bonds

One way to avoid this inflation risk is to buy what is known as inflation-linked bonds (or real bonds).

There are bonds issued by governments that not only return the nominal, but also give an extra based on inflation.

The investor who buys the bond at the time of issue ensures a return that adds up to the coupon of the bond, plus the observed inflation.

However, inflation-linked bonds also react to the inflation outlook, so they may have some unexpected effect.

In 2021, for now, this type of category has achieved a return of 1% after discounting the rise in prices.

Although the price increase in the last decade has been lower than in previous periods, in aggregate terms it has been 10%

.

It may seem like little, but it means that those 10,000 euros from 2010 left in the bank now have a purchasing power equivalent to 9,000 euros.

In other words, with the same money you can buy less things.

The wormwood of inflation is best appreciated in terms of opportunity cost.

A European investor who had allocated those 10,000 euros to a stock market investment fund would have achieved 20,784 euros at the end of the period, already discounting the effect of inflation.

If instead of contracting a variable income fund, which inevitably undergoes strong fluctuations, you had put your money in a more conservative fund, which only had bonds in its portfolio, you would have ended the period with an equity of 12,541 euros, 3,500 euros more than putting money in deposits.

The Efama report highlights that "these results highlight the

opportunity cost and financial losses incurred by European households that continue to keep their savings mostly in deposits

."

In Spain, this trend is very marked. Household bank deposits have been rising for 11 months, to exceed 942,000 million euros, setting record after record. And that, despite the fact that the interest rate offered in new 12-month deposit operations has been stagnant at 0.01% for more than a year (a decade ago it was close to 3%).

During the past decade, the loss of purchasing power was less, since the consumer price index (CPI) has remained almost every year below 2%.

However, the situation today is much worse.

The rise in electricity prices, fuel prices, together with the breakdown of supply chains for some products - such as microchips, which have made some electronic items more expensive - has caused inflation to set a year-on-year figure in August 3.3%, a level not seen in more than a decade.

In the academic world there is an interesting debate about whether this rise in inflation is specific (due to the various economic disorders generated by the pandemic) or whether it is structural.

Of course, while the value of the money saved in the bank continues to depreciate.

"

One of the best formulas to reduce inflation risk as much as possible is to have the portfolio invested in real assets, mainly stocks

, since the companies in which we invest are increasing their prices to adapt to the new environment," says Unai Ansejo, director delegate of Indexa Capital.