Enlarge image

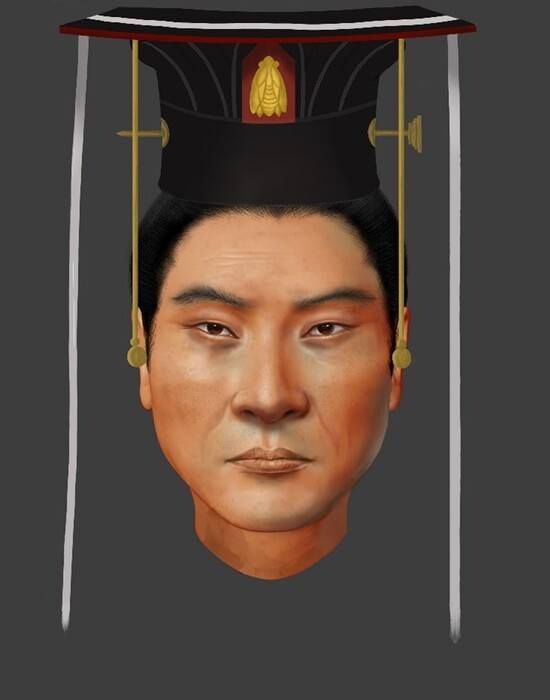

Sincerity, seriousness, stubbornness:

Evergrande founder

Hui Ka Yan

comes from a humble background

Photo: Bobby Yip / REUTERS

The man who brought China to the brink of collapse lost his mother when he was just eight months old.

She died of blood poisoning, and this loss,

Hui Ka Yan is

said to have once said in private, shaped his personality.

His independence and stubbornness, the Chinese media quote the now 62-year-old real estate billionaire, could be related to the lack of maternal love.

Righteousness, righteousness, sincerity - if there are any qualities Hui inherited from his father, it is these.

At least that's what a close relative puts it. The senior was an old revolutionary, in the army since he was 16 years old, tried and tested in war operations as a company commander against Japan in the 1930s and 1940s.

Hui Ka Yan was raised by his grandmother in the simple circumstances of rural China. He studied at Wuhan Iron and Steel University, now the Wuhan University of Science and Technology (WUST), and started his career in the steel industry in the early 1980s. After just a few years, Hui had achieved the rank of director, but in the early 1990s he decided to quit his steel job and move to the economically thriving province of Guangdong in southeast China. A little later he took the step that would determine his future life: Hui founded the real estate company Evergrande.

Two decades of growth and success followed - at least superficially.

The Evergrande Group was instrumental in driving the Chinese real estate boom and pulling up a series of residential projects in the prosperous cities of the People's Republic.

Although - keyword paternal righteousness - when procuring building land, according to the media, not everything was always in accordance with the law.

Evergrande at the heart of the Chinese economy

For many years, the company made a significant contribution to the upswing in China, which is largely based on this hype on the house and apartment market. Three quarters of private wealth in China is linked to property ownership, writes the New York Times. Evergrande operates in the heart of one of the fastest growing economies in the world. And company founder Hui Ka Yan, who still holds around 70 percent of the company's shares, made a lot of money.

At the height of the boom in 2017, the US magazine "Forbes" estimated Hui's fortune at 45 billion dollars - and crowned the Evergrande maker as the richest man in Asia.

His group grew beyond the real estate market, acquired the most successful soccer club in China, Guangzhou FC, and opened up new areas of business.

According to media reports, Evergrande also briefly ran pig farms.

Football clubs, pig farms - and electric cars

Significantly more attention was paid to the commitment in the automotive sector: The China Evergrande New Energy Vehicle Group is supposed to build electric cars and is already listed on the stock exchange. In the spring of this year, according to the "Wall Street Journal", founder Hui advertised

the company that would overtake the US manufacturer Tesla and become the largest electric car manufacturer in the world by 2025

at a private meal by Alibaba founder

Jack Ma

. The market value of Evergrande's auto subsidiary skyrocketed towards 90 billion US dollars at that time - although the company has not yet brought a mass-market car onto the market.

In the meantime, Evergrande's auto shares have come back down to earth (market value most recently around 54 billion Hong Kong dollars, or just under seven billion US dollars).

And the stocks and bonds of the Evergrande real estate group have also been on the downside for months: Investors are fleeing because the mountain of debt that it has built up over the past few years and decades threatens to become doomed.

A mountain of debt of around $ 300 billion, the construction sites have come to a standstill

The entire real estate boom in China is largely based on loan financing - and probably no other real estate company is as heavily indebted as Evergrande. According to media reports, the group's debts add up to $ 300 billion. The group had problems with outstanding debts even before the pandemic. The corona crisis has now exacerbated these problems again.

That means: Evergrande is in a deep mess.

The media report on hundreds of construction sites of the group across China that are currently not progressing.

Suppliers are waiting for money - and so are creditors.

China authorities recently called on those in charge of the group to resolve the debt problem.

But that doesn't seem so easy: The real estate business in the People's Republic is no longer as smooth as it was a few years ago.

Concerns about China's financial system

Most recently, Evergrande himself warned that loan defaults could occur if construction work did not start again, parts of the business were to be sold and loans were to be extended. The flight of investors has only accelerated it. Rating agencies such as Fitch or Moody's have meanwhile downgraded the Group's creditworthiness. In short: Evergrande is on the verge of collapse - and should it occur, it should have an impact far beyond the company's boundaries.

Observers anticipate shock waves that could ripple through the entire Chinese banking and financial system. "Its huge balance sheet will have a real ripple effect on China,"

Lu Ting

, an economist with Nomura investment house, is quoted in the media. "When financial institutions lose money, they will cut back on lending to other companies and sectors."

A failure of Evergrande could result in a credit crunch for the entire Chinese economy, says

Chen Zhiwu

, finance professor at Hong Kong University

, according to the New York Times

. That would be "not good news for the financial system and the economy," he says. According to the Financial Times, the effects of such a collapse would be felt on international markets even outside of China.

The big question is whether those in charge of Beijing's politics and authorities would allow such a failure.

The large amount of money that investors from all over the world have put into the company over the years flowed in the belief that Beijing would prevent possible losses in case of doubt.

One reason for this hope lay in the person of Evergrande founder Hui Ka Yan, who is considered to be politically well connected.

Hui is well connected - and was a speaker at the national congress

Hui is said to have had a sponsor in

Zeng Qinghong

, a resigned politician from China who made it to the highest offices in the 2000s. According to the New York Times, Hui is also a member of the Chinese People's Political Consultative Conference, an elite group of politically well-wired advisors. In 2018, Hui spoke at the 13th National Congress of the Chinese Communist Party.

On the one hand. On the other hand, Beijing has obviously recently changed its attitude towards the country's business elite, which has amassed enormous wealth over the years, not least in private. The regulation, which the tech industry in particular has experienced in recent months, points in this direction. In addition, the high debt in the real estate sector is now seen by some as a structural problem in the Chinese economy that should be resolved - Beijing may therefore prefer an end with horror to horror without end.

Last but not least, Evergrande founder Hui has a self-interest in saving his company.

According to Forbes, his private wealth has shrunk to 12.2 billion US dollars in the wake of the decline in recent years.

On the other hand, he is

facing a decision-maker,

President

Xi Jinping

, who is hoping for another term of office at the end of next year, at the Communist Party congress, and who should therefore be interested in stability in the country, at least until then.

For Evergrande investors, that could be cause for hope.

cr