Enlarge image

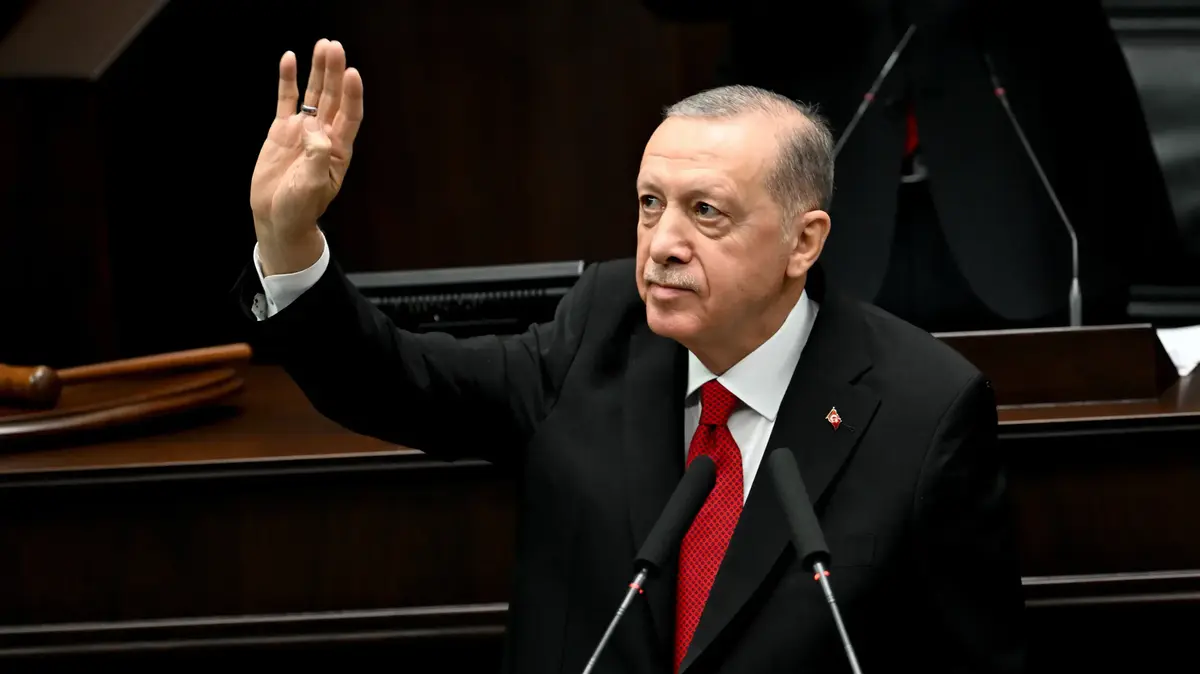

Interest rates down, lira at record low: President Erdogan continues to put pressure on the Turkish central bank

Photo: Adem Altan / AFP

Experts and investors were caught completely on the wrong foot by the rate cut by the Turkish central bank.

Hardly any analyst had expected a decrease at all, especially not at this level.

The Turkish lira came under considerable pressure after the decision and fell to a record low against the US dollar.

As a result of the interest rate cut, the key interest rate is again well below the inflation rate of 19.25 percent.

As a result, the real interest rate, i.e. the base rate minus inflation, is negative.

Investments in Turkish assets are therefore less favorable for foreign investors.

That weighs on the national currency, which has been under devaluation pressure for a long time anyway.

One reason is the unclear course of the central bank.

Concession from the central bank to President Erdogan

The interest rate hike did not come as a complete surprise, however: A few weeks ago, central bank governor Sahap Kavcioglu announced that he would be placing more emphasis on core inflation without energy and food prices.

This is below headline inflation.

Analysts had interpreted the change in monetary policy as a concession to President Recep Tayyip Erdogan, who rejects high interest rates as economically damaging.

Kavcioglu is now the fourth central bank governor since 2019. His predecessors were ultimately all out of favor because they did not support Erdogan's preferred course of loose monetary policy.

Since his appointment a few months ago, Kavcioglu had kept key rates stable.

This had raised hopes in the markets that at least it would not switch to rate cuts.

The central bank said the recent rise in inflation was unsustainable.

This essentially corresponds to the arguments of other central banks such as the US Federal Reserve or the European Central Bank (ECB).

However, inflation in

Turkey is

much higher than in the USA or the euro area.

Nevertheless, the Turkish central bank took the promise to keep the key interest rate above the inflation rate.

Rather, she highlighted the importance of supply-side shocks and developments in core inflation.

la / dpa-afx