The world order of the last decades has had as main protagonists multinational companies that, thanks to their power of cross-border influence, have managed to influence world geopolitics. However, the pandemic has been a setback for globalization, exposing the weaknesses of the value chain and forcing the recovery of state interventionism more typical of the last century. In the new world order established after the health crisis, multinationals - especially US and Chinese ones - will continue to play an important role in the global economy and politics, but they will have to adapt to new rules of the game. In the case of large Spanish companies, their strategy should be based, according to the experts consulted, on the search for emerging markets,without disappearing from those in which they began their global expansion three decades ago, such as the Latin American market.

More information

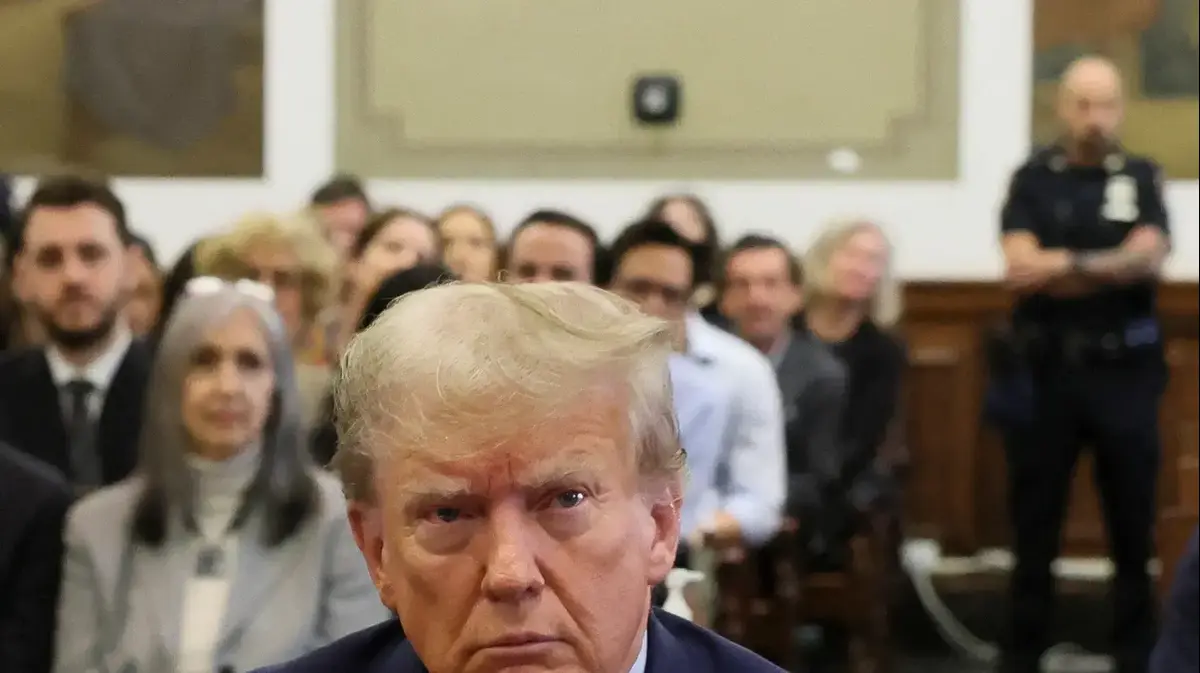

Trump "orders" companies to stop manufacturing in China and raises tariffs again

China and the US announce an agreement to phase out tariffs

USA vs China: scenarios of the new cold war

The covid-19 pandemic is a clear example of globalization, the process that connected markets, societies and cultures around the planet after World War II and that accelerated from the 1980s with advances in technology. and transportation. But this health crisis also invites reflection on this economic model. The liberalization of trade, promoted by private companies that requested the elimination of tariffs and the signing of trade agreements between countries, gave way to a financial scenario of relocation and production dependent on third countries, as explained by Marc Ibáñez, collaborator of the Research Center of International Relations of Barcelona (CIDOB). “With this crisis this model has been called into question,mainly due to the lack of vision on national security around value chains ”, Ibáñez points out, adding that“ it is necessary to rethink how to minimize this dependence on third parties with new market alliances, for example, applying near sharing policies ” .

GAFA vs. BATX

For the CIDOB collaborator, this will not translate into a complete loss of power for the multinationals, but it will translate into a new scenario and new rules of the game that will modify their way of acting and influencing the world economy.

The government of the United States, without going any further, intends to cut the power of its large technology companies (Google, Amazon, Facebook and Apple, known by the acronym GAFA) through six bills that were admitted to the Congress.

A measure that could weaken the hegemony of GAFA in the information technology sector and the global economy, compared to its Chinese competitors, the BATX (acronym for Baidu, Alibaba, Tencent and Xiaomi).

"Protect the competition of its domestic market, while trying to ensure a robust business structure capable of competing globally," explains Federico Steinberg, principal investigator at the Elcano Royal Institute, on the dichotomy facing the Government of Joe Biden. "Instead, the EU should take advantage of its intermediate position between the United States and China, to negotiate with both," he adds. "The most important thing is that Europe is capable of modifying the rules of the game in its market to favor competition and protect European companies."

As Lourdes Casanova, professor and director of the Emerging Markets Institute at the Samuel Curtis Johnson Business School, explains, Spanish multinationals have to react to this new economic context, “looking for new investment markets, but without withdrawing from those in which they achieved its global expansion ”. Casanova refers to the Latin American market that was the boom of large Spanish companies in the nineties of the last century.

The serious economic and political crisis that Latin America has suffered in recent years has forced Spanish multinationals to reorganize, losing their presence in this market. Although Spanish direct investment in Latin America currently represents 42% of the total, the expert warns about the rise of Chinese companies in the region and the danger that dropping this market would pose for the Spanish economy.

Spain continues to belong to the exclusive club of 32 countries that have companies in the Fortune magazine ranking, those with the most power of influence due to their investments abroad (Santander, Telefónica, ACS, Iberdrola, BBVA, Repsol and Mapfre). However, the closure of markets due to the commitment of the States to their own business infrastructures will force Spanish multinationals to make new decisions. “The United Kingdom aimed to be a primary partner for the United States, good news for Spanish multinationals with a presence in the British country; but we are already seeing that the Biden Administration follows the path of the previous Donald Trump administration of putting its internal market first, ”says Casanova. "In this situation,It is necessary for Spanish companies and the Spanish Government to explore and negotiate other ways of internationalization ”, he concludes.

The agreement between China and the EU, at a standstill

It took more than seven years of negotiations and, although it was announced in December 2020, it has yet to go live.

Diplomatic disputes are holding back the Comprehensive Trade Agreement between China and the European Union (CAI, for its acronym in English), the most ambitious that the Asian country has signed with a third State or group of States and which introduces rules against technology transfer, new rules of the game for Chinese public companies in the European market with greater transparency in public subsidies and commitments for the first time for the sustainable development of their businesses - in environmental and labor matters.

The deal is still frozen more than half a year later.

Europe distrusts the Asian giant and fears that it will take advantage of its position to buy European firms at bargain prices and thus enter the single market.

China currently has 25 bilateral agreements with EU member states, however, as Lourdes Casanova, co-author of the book The Era of Chinese Multinationals, explains, Europe's strength lies in its union.

"It is important to establish a unified legal framework, only in this way can the growth of European companies in foreign markets be promoted, and that of China is key," he points out.