The veteran Chinese-owned real estate company Huaren Land (0127) officially announced today (6th) privatization at a price of 4 yuan per share. If the privatization is approved, China Land will delist and end its listing career.

Looking back at the history of Chinese Land, the former chairman and major shareholder Liu Luanxiong (Liu) is actually not the founder of the group.

Looking at the information, the group was founded in 1922 and was originally controlled by Feng Pingshan and Li Guanchun.

However, in the mid-1980s, the two big families had a bad relationship, and a battle for assets broke out. Liu had the opportunity to successfully obtain control of Huazhi as a "sniper", which caused a sensation.

Huazhi was founded in 1922 and controlled by Feng Pingshan and Li Guanchun.

(Profile picture)

In 1986, the chairman of Chinese Land was Feng Bingfen of the Feng family, and the chairman of China Entertainment, a subsidiary of China Land, was Li Fushu of the Lee family.

Looking through the information, the Feng and Li families were at odds, and the Li family was not united.

The first is that Li Fuzhao, a member of the Li family, sold the shares of Chinese Real Estate to the well-known "corporate doctor" Wei Li, and Wei Li joined forces with Feng Bingfen to hold Li's owner as a major shareholder holding close to 35% of the equity. Kicked out of the board of directors of China Land.

But there is a big loophole in this operation, that is, the total equity in Wei Li and Feng Bingfen's hands has not reached the 35% trigger point of the full-scale acquisition at that time.

After the Lee family was kicked out, they sought foreign aid. Together with Feng Yongxiang, the second son of the Feng Jingxi family of Sun Hung Kai Securities, they proposed a full purchase of China Real Estate for 1.6 billion yuan. The consortium holds 28.5% of the shares and has 2.8% shareholder support, hoping to recapture China Real Estate. .

Detailed report:

[True.

Company doctor] Legendary Wei Liling and remembered to come back to life and compete with Liu for home

China Land announced its privatization.

(Network tribute picture)

Liu Luanxiong's high price to "Dominate the World"

At this moment, Emico, a subsidiary of "Da Liu", suddenly took a shot, scavenging the market, and proposed to acquire Chinese Land for 16.5 yuan, and later raised the purchase price to 18 yuan.

The temptation of acquisitions at sky-high prices caused the Li family to sell all the stocks. Even Feng Bingfen's younger brother also sold the goods. Liu Luanxiong suddenly got 42.8% of the shares.

Checking the official website of Huazhi, Liu Luanxiong acquired 43% of the issued shares of Huaren Property through AMG, and held a 10.7% stake in China Entertainment Property, a listed company of Zhonghuan Entertainment.

Feng Bingfen appeared "stretched" in the equity battle. Unable to contend, he could only sell his shares to Wei Li and increase his shareholding to 29.5%. From a chaos to a situation of "two dragons grabbing beads", he wanted to "cope" "Liu Luanxiong's "task" kicked to Wei Li.

However, Liu Luanxiong already holds nearly half of the shares and has sufficient advantages. Wei Li does not want the two heroes to fight, and cooperates with both parties to manage China Land. Wei Li is the chairman of the board of directors, while the major shareholder Liu Luanxiong is only the managing director.

But how can one mountain hide the two tigers. As a major shareholder, Liu used rights issues to raise funds for multiple acquisitions, including seeing Wei Li's tight cash flow, and taking advantage of the acquisition of Grand Hotel (0045) as the grounds of rights issue.

The two sides fought for several rounds and almost ended in a tie.

Until the eve of the 1987 stock market disaster, in September of that year, China Land announced that it would acquire Causeway Bay Royal Building, Wan Chai Harcourt Building, and Navy Building from Land for 2.378 billion yuan (later renamed Amigao Building and MassMutual Building, and finally sold for 12.5 billion yuan). For China Evergrande, to become the center of China Evergrande), it needs to raise 3 billion yuan.

Wei Li could not afford the sudden and large expenses, so he sold his holdings and resigned as chairman of the board of directors.

By 1993, in order to streamline the structure, China Land merged with its controlling shareholder, AMG International, and AMG became a wholly-owned subsidiary of China Land.

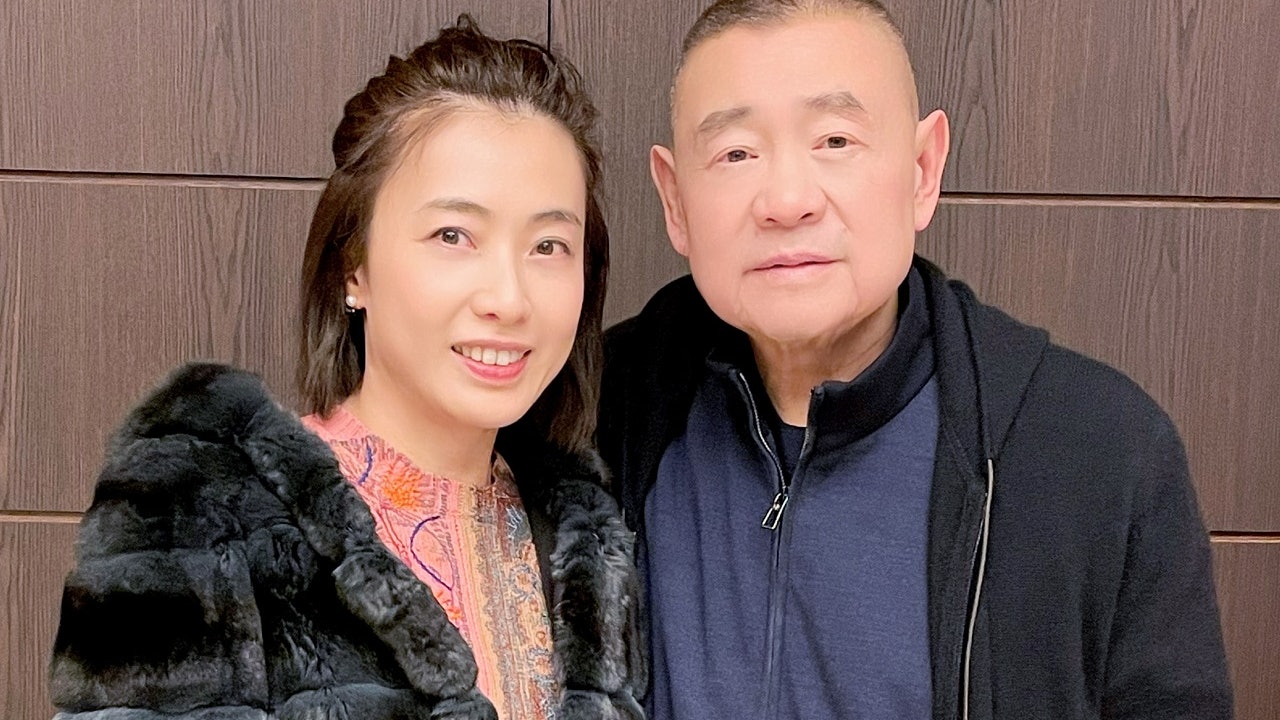

In 2014, Liu resigned as executive director, chairman and chief executive officer and handed it over to Liu Mingwei and his wife Chen Kaiyun (Gambier).

Investing in Evergrande may lose more than tens of billions of hands

In recent years, China Real Estate has rarely developed real estate projects, and invested more in mainland real estate stocks and high-yield bonds. Among them, China Evergrande (3333) is the most promising.

However, the mainland authorities tightened the level of domestic housing financing, which plunged Evergrande into a bond crisis, and the prices of stocks and bonds were double-killed.

The group announced earlier that it would sell all of its shares in Evergrande.

These shares were purchased in 2017 and 2018 at a total cost of approximately 13.596 billion yuan, with an average of 15.8 Hong Kong dollars per share. Once they are sold, the accumulated book loss may exceed 10 billion yuan.

In danger, it is organic. Affected by the Evergrande crisis, Huazhi’s stock price has fallen to nearly 3 yuan. Seeing the stock price is down, Liu Luanxiong shot and announced the privatization of the company. The price per share is 4 yuan. At the end of June this year, the net asset value of about 12.99 yuan per share is still a 69.2% discount.

Huazhi privatized Gambie only spent 1.9 billion to "buy" the entire company Huazhi privatized Gambie 3 children become big winners and can jointly own more than tens of billions of assets | Wendona

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/RDP7XNGW75D75IA7EEZLKLBVJQ.jpg)