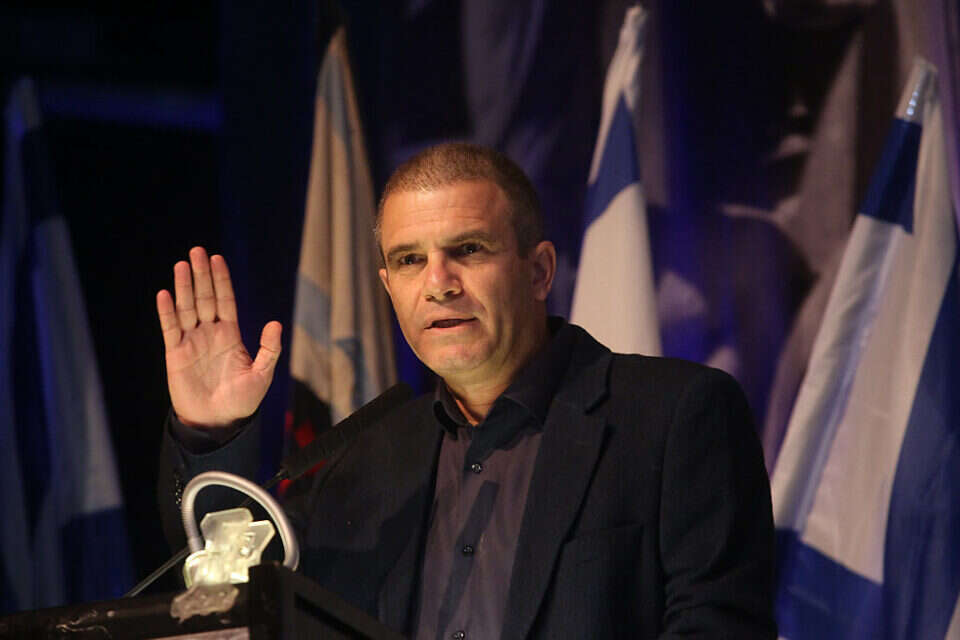

The Tax and Economics Prosecutor's Office filed an indictment today (Thursday) against Gal Hirsch, Oded Sheknai and Michael Binyamini for tax offenses, each defendant according to his share.

A separate indictment was also filed against Yaniv Adam for tax offenses as part of a plea bargain.

According to the indictment, between the years 2009-2007, Sheknai, Hirsch, Binyamini and Adam acted as partners in providing services to the Ministry of Defense in Georgia and elsewhere, within the framework of a set of companies under their control, each according to its share.

Among other things, the defendants operated within the framework of Defensive Shield Israel Ltd., which was established in Israel, companies established in Georgia and companies established in the British Virgin Islands.

During this time, the four worked with the Defense Ministry in Georgia in security consulting, military training and brokering deals for the sale of military equipment.

Sheknai and Hirsch jointly managed the activities in Georgia, including its professional management, planning and implementation, and were responsible for liaising with the Georgian Ministry of Defense and local officials.

Binyamini worked in Georgia to promote the professional activities and interests of the partnership.

Adam was responsible, among other things, for professional supervision, mentoring and accompaniment of the programs implemented as part of the activity.

According to the indictment, from the business activities of the partnership, the defendants generated cumulative income in the amount of millions of shekels, which flowed into the accounts of the companies mentioned above. The profits were divided among the defendants in transfers to their personal accounts and accounts of other foreign companies, which are controlled by foreign banks. The defendants also transferred funds between their personal accounts and the accounts of the companies under their control to themselves.

A complex and branched set of companies described in the indictment, as well as the many agreements and bank accounts used, is intended, among other things, to help the defendants receive the funds, divide them while disguising their enjoyment of them and help them hide their income.

Thus, according to the indictment, in the years 2009-2007 Oded Sheknai did not report in his reports personal income in the amount of not less than NIS 19.5 million.

In 2008 Gal Hirsch did not report in his personal reports personal income in the amount of not less than NIS 6.1 million, and in the years 2009-2008 Michael Binyamini did not report personal income in the amount of not less than NIS 13.4 million.

According to the indictment in the settlement filed against Yaniv Adam, in the years 2009-2007, Adam did not report income in the amount of NIS 3.6 million that grew for the company through which he operated abroad, without reasonable justice.

As part of the settlement with Adam, it was agreed that Adam would plead guilty to submitting a report and incorrect information without reasonable justice and the parties would petition for an agreed penalty of 6 months of service work and a fine of NIS 100,000, after settling the tax debt with the tax authority.

It will be recalled that, in addition to the suspicion of tax offenses, the investigation in the case initially also included suspicions of paying a bribe to a foreign public employee - suspicions in which no evidentiary basis was formed in the investigation phase.

The case was investigated by a joint team of the National Fraud Investigation Unit (JHA) at Blade 433 of the Israel Police and of the Tel Aviv Investigations Assessing Officer at the Tax Authority, and with the assistance of the Anti-Money Laundering Authority.