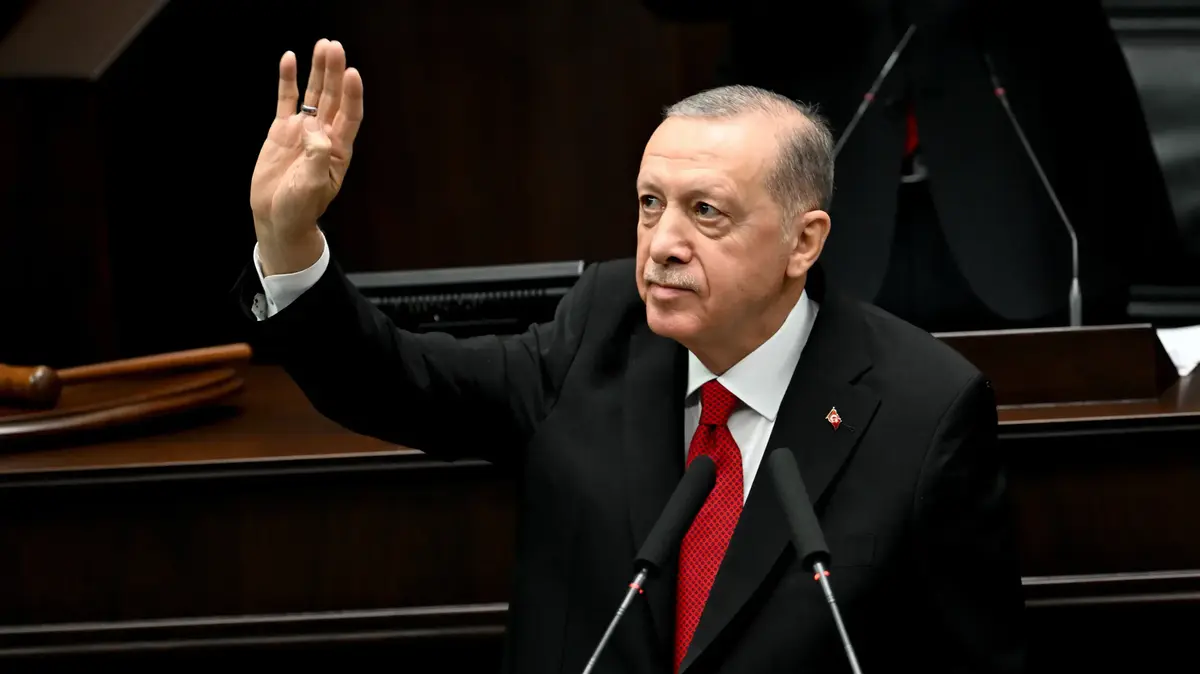

Turkish President Recep Tayyip Erdogan has just lowered the key interest rate.

Now he seeks confrontation with once important allies.

Investors are appalled.

Ankara - On Thursday the Turkish central bank cut the key interest rate by 2.0 percentage points to 16.0 percent.

Economists are appalled by this step.

According to experts, with inflation of over 19 percent, an interest rate hike would be necessary to strengthen the purchasing power of the lira.

Turkish President Recep Tayyip Erdogan, on the other hand, believes that a lower interest rate could stimulate the economy.

But only an increase in the key interest rate would help in the fight against high inflation.

Turkey: Export products are becoming cheaper and more competitive

Things have been looking bad for the Turkish lira since the rate cut.

It has lost 3.5 percent of its value against the euro.

Since the beginning of the year, the loss with the euro has been around 25 percent.

After Erdogan declared several ambassadors from Western countries to be undesirable persons on Sunday (October 24), the lira plummeted again, especially against the dollar.

Ascan Iredi, portfolio manager at DZ Privatbank SA,

told

ntv

: “The government is taking it

The decline in the value of the Turkish currency is accepted and accepted. ”This is good for export because Turkish products become cheaper and more competitive.

But the interest rate cut does not bring many more advantages.

In the long run, this even turns out to be a disadvantage for Turkey.

“It is not just the national wealth that is falling due to inflation,” explains Iredi.

As a result, the entire country is losing its international connection, which is particularly negative for companies.

Erdogan's financial policy will have an impact on the elections

In order to save the lira, the Turkish government would have to understand that higher interest rates are needed, Iredi makes clear.

"Otherwise you will not be able to stop the decline of the Turkish lira." Ultimately, Erdogan is only interested in votes in the next election.

But Iredi makes it clear that the president could scare away voters with his current tactics in the long run.

“Ultimately, it will cost jobs and then at the latest it will also have an impact on the next elections,” says the portfolio manager, summing up the precarious situation.

(ph)