Supply chain delays threaten Christmas 2:39

(CNN) -

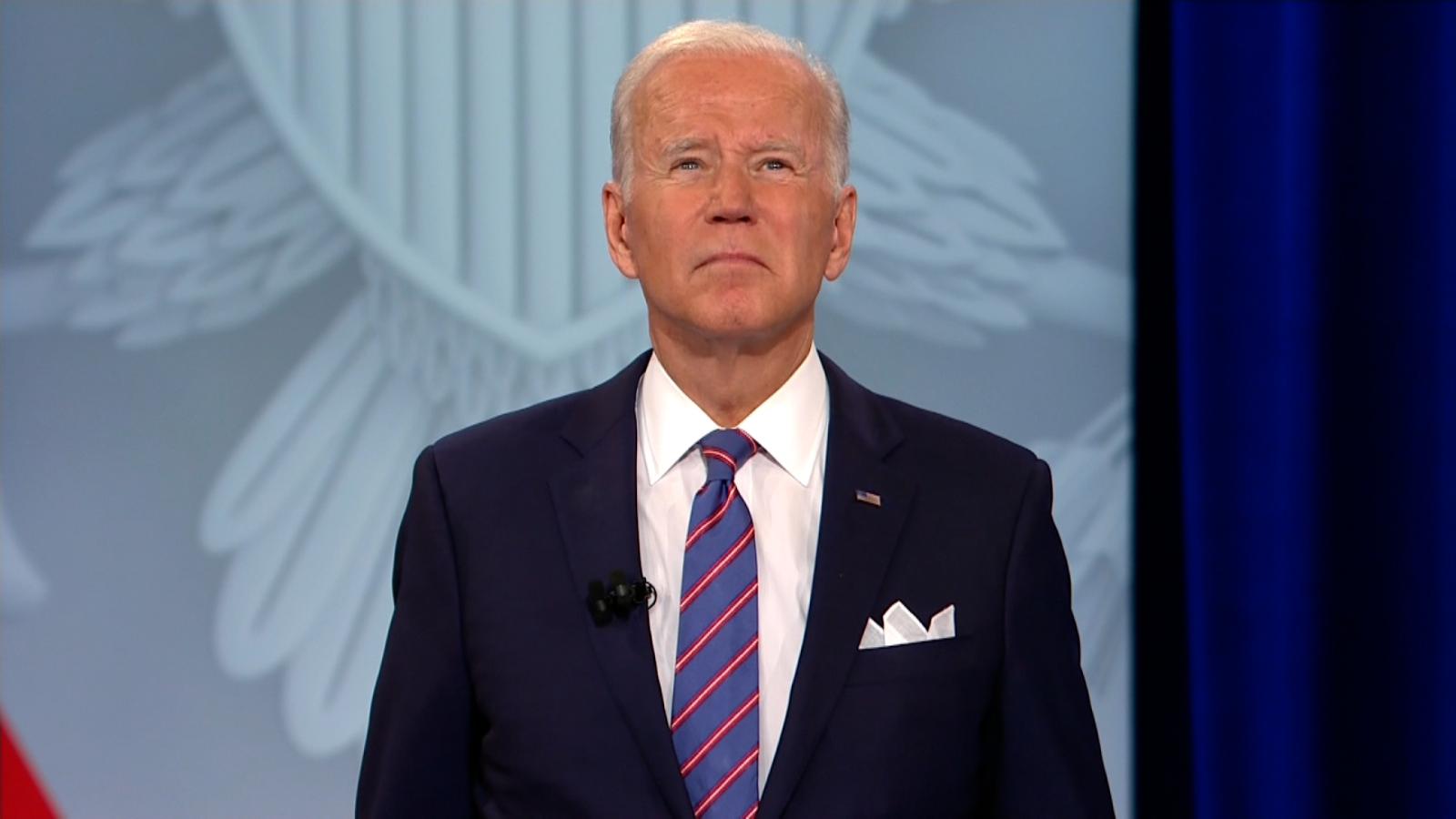

US President Joe Biden will unveil a significantly scaled-down version of his massive economic plan to expand the social safety net on Thursday, hours before leaving for his second major trip abroad as president.

The proposal, for US $ 1.75 trillion, focuses on providing care to families, addressing the climate crisis, expanding access to healthcare, reducing costs for the middle class, and tax reforms.

Reasons why Joe Biden's economy is going in the wrong direction

This Thursday morning, Biden headed to the Capitol to present his framework to the Democratic group in the House of Representatives, and will later make statements from the White House to make his case to the American people.

His program continues to raise doubts and he faces an uncertain fate in Congress.

Progressive House Democrats remain skeptical of the plan and want to see the full legislative text, threatening not to vote in favor of the bipartisan infrastructure package until the bill is released.

What does the growth of the US economy mean?

1:45

The new plan makes important concessions and does not include several key points that Biden had initially proposed, such as paid family and medical leave, prescription drug pricing provisions, free community college, and dental and vision coverage for Medicaid.

advertising

This is what the plan includes:

Measures for infancy and childcare

Introducing free, universal preschool for all 3- and 4-year-olds, the largest expansion of public education in 100 years, according to the White House.

It would include financing for six years.

Expand access to high-quality and affordable pediatric health care to some 20 million children a year, with funding for six years.

Permanently improve Medicaid coverage for home care services for the elderly and disabled, which would be the most transformative investment in home care access in 40 years, according to the White House.

Expand the enhanced child support tax credit included in the American Rescue Plan and provide more than 35 million households with up to $ 3,600 - or $ 300 a month - in tax cuts per child.

Do you predict high inflation in the US economy?

1:19

Fight the climate crisis

Most of the project focuses on climate and would include the largest legislative investment in fighting climate change in US history, according to the White House.

White House officials say the bill to be presented by Biden will put the US on the path of the Paris Agreement goal: a 50-52% reduction in greenhouse gas emissions below levels. from 2005 to the end of the decade.

$ 320 billion for clean energy tax credits.

This includes 10-year extended tax credits for utility and residential scale clean energy, as well as transmission and storage, clean passenger and commercial vehicles, and clean energy manufacturing.

US $ 105,000 million to face extreme weather events, pollution in communities and the creation of a Civil Climate Corps to conserve public lands and reinforce the resistance of communities.

$ 110 billion in investments and incentives for clean energy technology, manufacturing and supply chains.

US $ 20,000 million to incentivize the purchase of new generation technologies by the government, including non-polluting building materials.

Health care

Reduce premiums for 9 million Americans who purchase insurance through the Affordable Care Act.

Close the Medicaid coverage gap and offer health coverage through the Affordable Care Act premium tax credits to certain uninsured Americans.

Expand Medicare coverage to include hearing services.

Delta variant prevents US economy from recovering 0:54

Reduce costs for the middle class

$ 150 billion to expand access to affordable housing.

The plan would allow for the construction, rehabilitation and improvement of more than one million affordable homes.

Expand the Earned Income Tax Credit for some 17 million low-wage workers.

Increase the maximum Pell grant by US $ 550 for more than 5 million students enrolled in public and private non-profit universities and expand access to "dreamers."

Expand free school meals to 8.7 million children during the school year, as well as provide a benefit of US $ 65 per child per month to families of 29 million children to purchase food during the summer.

Tax reforms

The project will impose a minimum tax of 15% on the profits of companies that declare more than US $ 1 billion in profits to shareholders.

It also includes a 1% surcharge on company share buybacks.

The project will adopt a minimum tax of 15%, country by country, on the foreign profits of US companies.

It will apply a new surcharge on taxes to the income of billionaires and billionaires: a rate of 5% on top of income of $ 10 million and an additional surcharge of 3% on income greater than $ 25 million.

The White House stresses that no one earning $ 400,000 or less would have their taxes raised.

Hire tax agents trained in going after the wealthiest evaders, modernizing outdated tax technology and investing in taxpayer service.

IMF adjusts US and Mexico economic growth 2:33

After months of negotiations and concessions that reduced Biden's initial $ 3.5 trillion proposal by half, the White House expressed its confidence Thursday morning that this new framework would have sufficient support to be approved in both the House of Representatives and the Senate.

"This will mean the most transformative investment in children and health in generations, the largest effort to combat climate change in history, a historic tax cut for tens of millions of middle-class families, and the largest expansion of affordable health care in a decade, "a senior government official said Thursday.

The official added: "And it is paid entirely by rewarding work, not wealth, and by ensuring that the super-rich and corporations pay their fair share and cannot cheat all honest Americans on their tax bills."

With information from Betsy Klein and Kevin Liptak

Joe biden

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/VOQEHFVTC5OSYTU5YOO5SYQ5DU.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/VBVLA4RLPJBHZEVSYQCSXI5CX4.jpg)