It has been a long time that almost on a daily basis Turkey is surprising with data indicating a new economic downturn.

The Turkish lira is losing ground in the currency basket, already crossing the 9.5 pound mark, after only about £ 8 was needed in September to buy one US dollar - a scenario that until a few years ago, even a year ago, seemed completely unfounded.

In fact, in the last two years the crash has been pretty consistent.

From January to September last year, the Turkish lira lost more than 21% of its value - reaching 7,566 pounds to the dollar.

A month later, in October, she had already crossed the eight-pound mark to the dollar.

Even then, there was great doubt that a scenario of more than 9.5 pounds per dollar could occur this month.

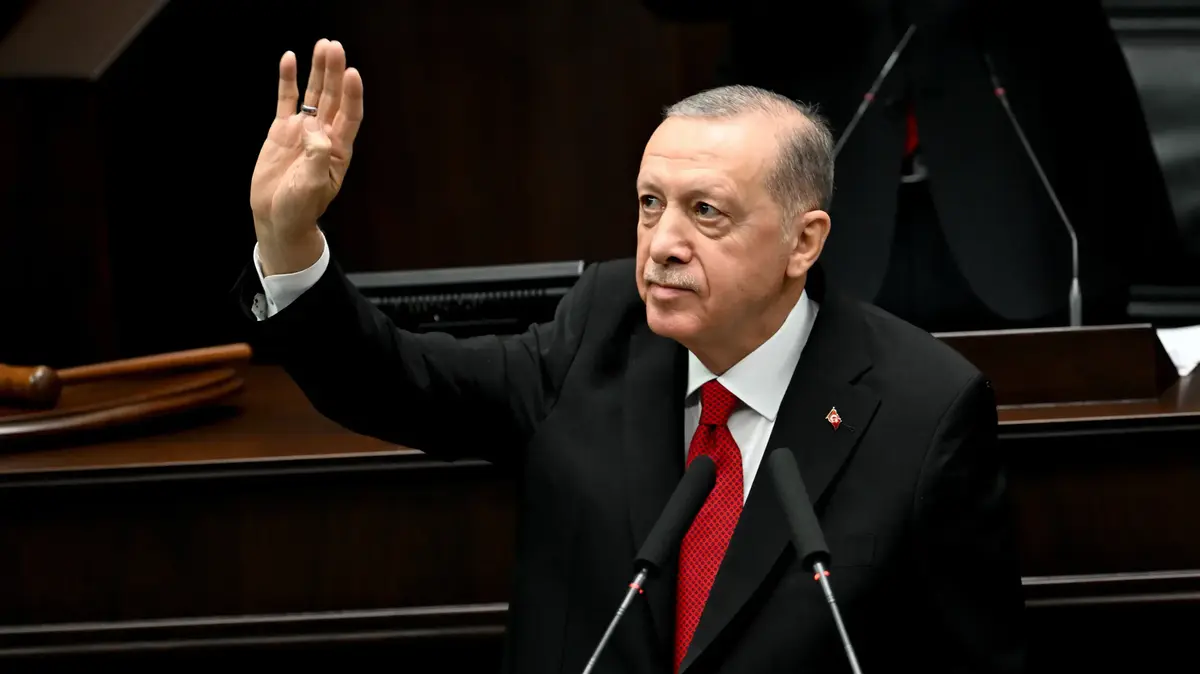

Turkish President Recep Tayyip Erdogan refuses to acknowledge this reality and take the necessary steps to stabilize the economy.

Erdogan justifies his refusal to adopt economic plans by saying that he should get on well with the common people - his voter base - especially before the upcoming mid-2023 elections. In the current situation, he prefers to fire central bank governors.

From the time he took office as Prime Minister on March 14, 2003, until July 5, 2019, four governors have served in the Central Bank.

However, from July 2019 until now, four more governors have served in this position.

This is due to a series of dismissals carried out by the President of Turkey, which indicates the sovereignty of the central bank there.

Governor, forecast and rating

What may explain the helplessness of the Turkish central bank today is the identity of the governor, Shah Hap Kajiolu.

Although he is a doctor from the Marmara University of Banking and Insurance, from November 2015 to June 2018 he served as a Member of Parliament for the Justice and Development Party (AKP) headed by Erdogan.

He also wrote articles for Yeni Shapak, a newspaper that is considered a sort of Erdogan magazine, in which he made sure to pardon the president for his economic policies - even though it has no grip on reality.

Data published by the Turkish central bank indicate in themselves the severity of Turkey's economic problem.

The Central Bank of Ankara announced on Thursday that the inflation forecast for this year has jumped from 14.1% to 18.4%.

Beyond that, the forecast for next year has risen from 7.8% to 11.8%.

The unemployment rate there is still higher than 12%, and when the world interest rate is at an all-time low - in Turkey it is 18%.

Rushing inflation in Turkey,

At the same time, Turkey's debt-to-GDP ratio continues to update upwards after reaching 28% in 2016, and by 2020 it had jumped to 36.77%.

It now stands at 37.11%.

This is a level of more than $ 260 billion.

According to current estimates, the debt will continue to soar until 2026 - when it is expected to reach more than 46%.

Turkey's credit rating has been declining since 2018 and is now among the lowest (BB) - lower than Egypt's, and similar to that of Paraguay.