Former President of the Monetary Authority and member of the Executive Council Ren Zhigang attended the "ForeSight 2022" forum hosted by the Hong Kong Productivity Council last Thursday (November 18). "Challenge" as the topic, sharing his insights on the "National Fourteenth Five-Year Plan".

The non-official member of the Executive Council of the Hong Kong Special Administrative Region and the former arbitrator of the Hong Kong Monetary Authority Ren Zhigang recently participated in the forum to share his feelings and views on reading the "14th Five-Year Plan".

(Profile picture)

New focus: integration into the overall situation of national development

"If I remember clearly, the "National Fourteenth Five-Year Plan" has 19 chapters, 65 chapters, 199 sections and 20 columns." Section. The first section is similar to the five-year plan in the past. It supports Hong Kong’s consolidation of its competitive advantages. The newer version is that Hong Kong will build the "Eight Centers." The overall picture is different from the previous "hope that Hong Kong and the mainland will deepen cooperation."

What is "the overall situation of national development"?

Ren Zhigang pointed out that the center of gravity is the "dual cycle pattern", that is, the domestic and international dual-cycle economic cycle is the mainstay of the domestic and international cycle. "It is the most important one (economic planning) since the country has planned, because the background is a century of change. "

On August 23, the SAR government held a national "Fourteenth Five-Year Plan Outline" presentation. Chief Executive Carrie Lam, Director of the Liaison Office Luo Huining, and Deputy Director of the Hong Kong and Macau Affairs Office of the State Council Huang Liuquan and others attended.

(Profile picture)

So, how should Hong Kong "integrate" into it?

Ren Zhigang said that he tried to find the word "Hong Kong" in the whole plan, but apart from Chapter 61, Hong Kong was not mentioned in other parts.

On the one hand, Ren Zhigang was "a little disappointed" because "I don't see how Hong Kong can participate in the domestic cycle. As for the international cycle, what is our role as an international center, especially an international financial center?" But on the other hand On the other hand, he also determined that if the country did not give instructions in the "plan", it would leave "imagination space" for Hong Kong.

Therefore, Ren Zhigang urged the guests to think about "how to integrate Hong Kong into the overall situation of national development", and emphasized that although the central government supports Hong Kong to build the "Eight Centers", the society also pays more attention to the "Eight Centers", but these are not the real focus, because the eight centers and The role played by Hong Kong's integration into the overall development is "not directly related."

New Imagination: RMB Internationalization and Free Flow of Capital

As the first president of the Hong Kong Monetary Authority, Ren Zhigang has gone through the trough of financial development with Hong Kong, and the offshore RMB business in Hong Kong, which is currently "the world's best", was promoted by Ren Zhigang during his tenure.

Sitting at the forum, he proudly said, "Where is the origin of RMB internationalization? It is Hong Kong."

In 2001, the Monetary Authority began to discuss with the People's Bank of China (hereinafter referred to as the "PBOC") the idea of developing personal RMB business in Hong Kong.

In 2003, the State Council approved the development of personal RMB business in Hong Kong and appointed Bank of China (Hong Kong) as the world's first RMB clearing bank. Since then, a complete payment system has been established.

In the past 20 years, the scope of RMB business has changed from individuals to enterprises, and the business types have also moved from deposits to trade settlement, financing, and securities.

Many financial scholars pointed out in an interview with "Hong Kong 01" earlier that the internationalization of the renminbi may start a new cycle with the "14th Five-Year Plan" and rise to a higher level.

【Related Reading】:

The 14th Five-Year Plan Preaching. Interpretation|Why does RMB internationalization become the new key to Hong Kong's finance?

Dialogue with Zhang Ming, a national financial scholar: The importance of Hong Kong on the new journey of RMB international

Dialogue with financial scholar Ba Qing: Demand for RMB investment surges, Hong Kong's offshore market is following the trend

Exclusive dialogue with Cheng Shi, Chief Economist of ICBC International: Where is Hong Kong's Finance Going for a Century of Currency Changes

The first section of Chapter 40 of the National Fourteenth Five-Year Plan states that China should accelerate the advancement of “institutional opening up”. A new type of mutually beneficial cooperation based on the free use of the renminbi."

Ren Zhigang also noticed this sentence, but he was greatly disappointed because it did not explicitly mention the role of Hong Kong.

But precisely because of this "blank", Ren Zhigang has more room for in-depth thinking.

He first talked about a sentence in the "National Fourteenth Five-Year Plan": "Remove the institutional barriers that restrict economic cycles, and promote the circulation of production factors and the organic connection of production, distribution, circulation, and consumption."

The "14th Five-Year Plan" writes: "Remove the institutional barriers that restrict economic cycles, and promote the circulation of production factors and the organic connection of production, distribution, circulation, and consumption." (data picture)

"What are the factors of production?" Ren Zhigang asked and replied, "Three, land, manpower and capital." Among these three factors of production, Ren Zhigang is most concerned about what role Hong Kong should play in the "capital flow" in order to make The country makes full use of the two different financial systems and monetary systems under "one country, two systems" to learn from each other's strengths and create synergies.

"No one can replace Hong Kong's role in connecting the country's internal and external financial resources." Ren Zhigang pointed out that the mainland has foreign exchange controls, and the flow of funds is not as free as Hong Kong. If channels can be further opened up, such as through Qianhai or the Guangdong-Hong Kong-Macao Greater Bay Area Mainland funds will be able to invest in Hong Kong more freely. I believe that Hong Kong's role will be more unique. "I will not worry about this."

Ren Zhigang cites two examples that help the interoperability of monetary systems: First, "The renminbi has been circulated in Hong Kong, so can the Hong Kong dollar be circulated in the Mainland?" Second, the channels for capital and financial communication are opened up, namely, banks, bonds and stocks. The channel "makes a fuss."

Take banks as an example. "If Hong Kong banks can apply for a banking license in the Greater Bay Area, they can attract deposits and loans in the Greater Bay Area. If they can apply for a Hong Kong license, they can also develop business in Hong Kong."

Hong Kong continued to maintain the largest overseas counterparty area for RMB settlement of China's trade in goods last year.

(Photo by Deng Qianying)

Of course, Ren Zhigang also pointed out that there are risks in promoting financial liberalization in the Mainland, and Hong Kong must also take on the role of "risk management", which includes four levels: quota management. "For example, the Shanghai-Shenzhen-Hong Kong Stock Connect uses quotas to avoid capital flow. Too much pressure on the Mainland’s financial system”; unit management, “for example, only brokers can participate, or only certain companies or individuals can participate”; project management, “such as Bond Connect and Li Caitong”; regional management, “ Taking the Greater Bay Area as a pilot area will reassure mainland policymakers that they can open up to Hong Kong point-to-point"-then, "Hong Kong can truly integrate into the overall development of the country."

New approach: top-level design of dry-port communication mechanism

Imagination is of course beautiful, but how to turn "imagination" into "reality" is more important.

Ren Zhigang recalled the days when he went to Beijing to discuss policies when he was in a public office. "Go to the People's Bank of China, the Hong Kong and Macao Office, the China Securities Regulatory Commission, and the China Insurance Regulatory Commission with suggestions, and go all the way to ministries and commissions. After a year or two, the implementation can begin." The process was very painful.

Ren Zhigang believes that this is a "top-level design" problem.

At present, the Guangdong-Hong Kong-Macao Greater Bay Area Construction Leading Group is at a high level. It is chaired by Vice Premier Han Zheng. Hong Kong Chief Executive Carrie Lam and Macau Chief Executive He Yicheng are both core members. However, when Hong Kong makes suggestions, it cannot be directly approved by the leading group. Implementation, but requires cross-level and cross-department consultation with the central government, and the timeline is lengthened.

When Ren Zhigang was the president of the Hong Kong Monetary Authority, he led a team to Beijing to discuss the issue of "RMB internationalization".

(Profile picture)

In response to the obstacles to communication between dry and port officials, Ren Zhigang suggested that an "expert group" be established under the leadership group, taking finance as an example, to invite experienced and authoritative financial professionals, including his "friend" and former president of the People's Bank of China, Zhou Zhou. Xiaochuan, Chen Yuan, chairman of the China Financial Forty Forum, and others; on this basis, invite relevant government departments such as the People's Bank of China, Hong Kong and Macao Affairs Office to send ministries and commissions to the team, "it will be much easier to do."

"This expert group has three "specialties"." Ren Zhigang said, the first is "professionalism", without political considerations; the second is "special responsibility", which is decided by the leading group; the third is "exclusive power", "words" It doesn't sound very nice, but it means "have the exclusive power" to promote these things." He believes that if such a top-level cooperation mechanism can be built, it will speed up the integration of Hong Kong into the overall situation of the country.

New attitude: establish ideas and face the country squarely

Ren Zhigang was familiar with the "National Fourteenth Five-Year Plan" and outlined a different future for Hong Kong; however, he said at the end of the forum that he was not optimistic about the prospects.

"It's a pity that we have returned for so many years. Whenever we encounter difficulties, it is the central government that will take us out of the predicament." Ren Zhigang said, "Sometimes, Hong Kong has problems in the relationship between mainland and Hong Kong."

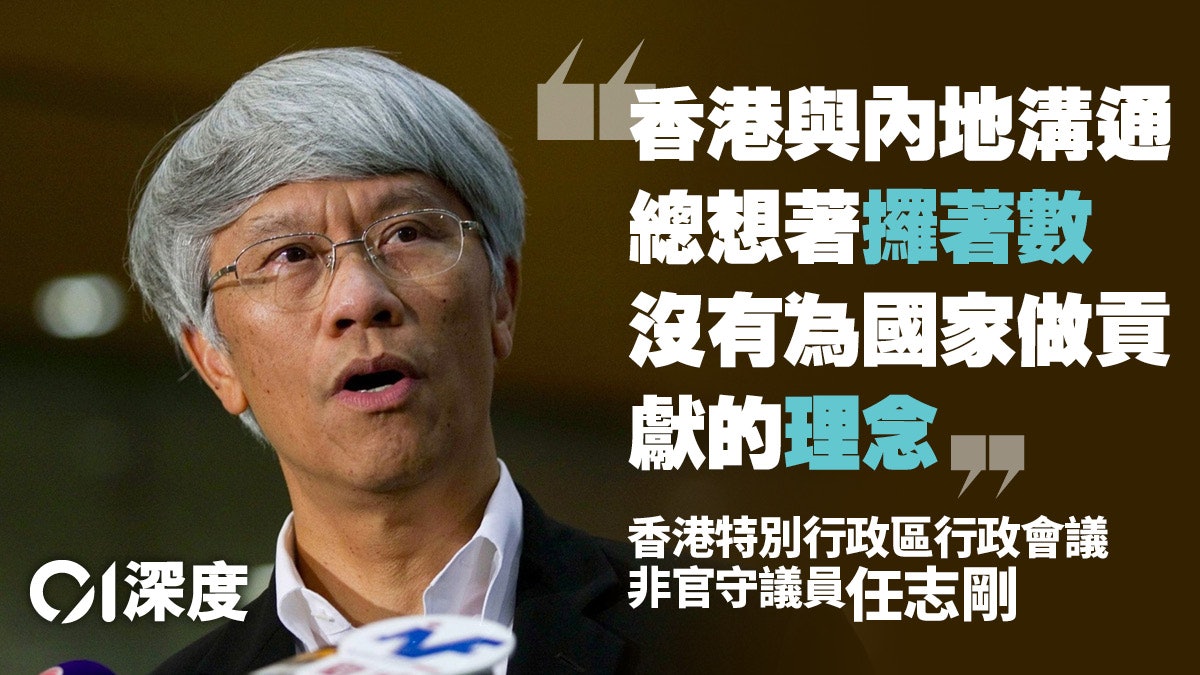

Ren Zhigang immediately said: "When Hong Kong wants to promote some development and communicate with the Mainland, many people just think about "taking the numbers" instead of thinking that Hong Kong has ideas to contribute to the country."

Ren Zhigang pointed out that Hong Kong lacks the idea of contributing to the country.

The picture shows President Xi Jinping attending the inauguration ceremony of the fifth SAR government and administering oaths for Chief Executive Carrie Lam and principal officials.

(Profile picture / Photo by Yu Junliang)

On the other hand, Hong Kong companies and Hong Kong people have insufficient understanding of the country's economic operations.

"The socialist market economy is a very new thing. We should be the closest to the mainland, the closest to this concept, but our understanding is not deep enough." Ren Zhigang said, in the Western context, "socialism" and "market "Economy" is antagonistic and cannot even coexist, but in the past 20 or 30 years, China has proved the success of this unprecedented economic development model.

Of course, "everything has pros and cons."

Ren Zhigang pointed out that although the policy transmission mechanism of the mainland government is very effective, if the local leaders have full power to decide how to allocate resources, the efficiency may not be high. That is why it emphasizes the need to "let the market play a decisive role in resource allocation."

Ren Zhigang also urged that China has been transforming, and Hong Kong people should learn more. "It is always good": "As a Hong Kong citizen, because of the colonial history and the changes after the reunification, we will lead our people, as well as young people. I'm used to enjoying it. I hope you can put your body down to understand."

"The countries to the north, including Hong Kong, will become the world's largest economic system. Many people may disagree with the country's brilliant development direction and model in the past 30 to 40 years, but successful examples can be seen by everyone. Ren Zhigang said that as long as everyone puts down their bodies and embraces the development of the country, Hong Kong will be able to give play to its strengths for the country.

Ren Zhigang hopes that Hong Kong people can lower their profile and embrace the development of the country, so that they can help Hong Kong give full play to its strengths.

(Profile picture)