The Secretary of Labor and Welfare Law Chi-kwong published a blog on Sunday (28th), citing data from the "Hong Kong Monthly Bulletin of Statistics" and "Life Table" published by the Census and Statistics Department in mid-month to infer the average life expectancy of a 65-year-old man in 2020 in Hong Kong. Up to 86.52 years old, the chance of living to 100 years old or above is about 12%. By 2055, the chance of living to 100 years old or above will increase to 40,610 people.

With regard to future population development, the average life expectancy of a boy born in 2020 has a chance to rise again, approaching 100 years old, and the probability of retiring in disguised form at 70 years old will be lower.

Based on the above two points, the Secretary believes that even if a 65-year-old citizen purchases an annuity that expires at the age of 90, he still has a good chance of facing the unsustainable living expenses after the age of 90.

He recommended that citizens buy life-long public annuities, because annuities can ensure that buyers can face the additional financial risks brought about by longevity, bring a stable monthly income, and even promote family harmony.

Annuity can be used as support but hard to be a pillar

The Secretary gave an example in the article. If a husband and wife each purchase a public annuity of 500,000 yuan at the age of 65, they will have received a total of 1,665,000 yuan by the age of 90. Even if they become a hundred-year-old with one in eight chances, they can still continue to receive it. Annuity.

But first of all, are there really so many people in Hong Kong who can use 500,000 current cash at any time to buy a public annuity in one lump sum?

If they can use 500,000 in one lump sum without pressure, do they really need to buy an annuity?

Secondly, a handful of calculations. Based on the public annuity of 500,000 yuan given by the Secretary as an example, the actual amount per person can only get 2,775 yuan per month. In fact, this amount can hardly be used as financial support for the elderly. On the contrary, it is more like a kind of daily life. Small support.

In addition, the annuity system will not hedge against inflation. In a disguised form, the guaranteed return of the annuity will depreciate with inflation.

It seems that the comprehensive consumer price index has never stopped rising since 1981, and it has risen nearly five times by 2020. From this trend, the prospect of protection that annuities can provide can be described as worrying.

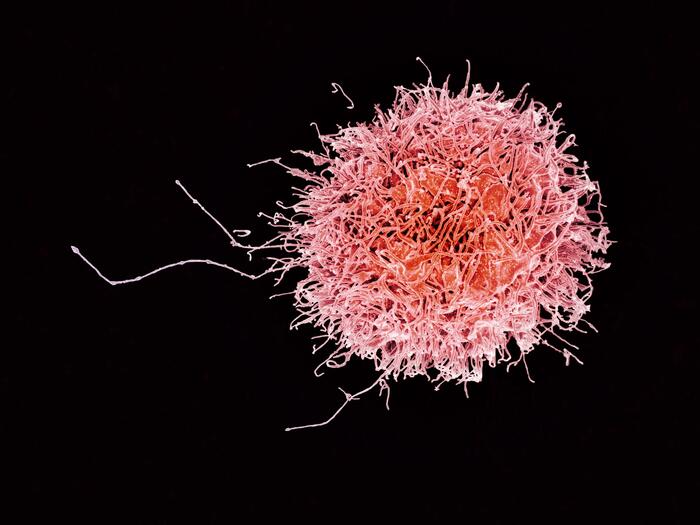

Luo Zhiguang expects that the chance of "post-20s" living to be 100 years old or above is about 12%, or about one-eighth.

(Photo by Gong Hui)

Coping with population ageing requires micro and macro

Although resorting to the economy can solve most of the problems of individual population aging, it still has its shortcomings to examine the problem from a micro perspective. It seems that a comprehensive countermeasure is still needed for the overall population aging problem.

Even if the current government intends to start with the district health center, cooperate with the improvement of the medical voucher policy, and use medical staff to make health assessments for the elderly, it is expected to change the social mentality of "emphasizing treatment, neglecting prevention", and at the same time focus on promoting home care to reduce medical pressure. However, it must be noted that both of them will actually involve a certain amount of caregiving manpower, and those manpower must be deployed from the working population, which has the opportunity to reduce the overall social productivity.

Population ageing is a complex structural issue. The government must implement and implement micro- and macro-policies before they can effectively deal with the problem and further solve the problem.

Specifically, the government should reform the economic structure and control property prices so that citizens can save more during their working days, and by expanding social security and benefits, the grassroots can also be protected.

The home-based elderly policy must also meet the non-material needs of the elderly. The MPF conversion to annuity will not change the poverty and plight of the elderly. Retirement protection is small and life makes Fei Daan enjoy the old age.