In recent years the internet has become the main workplace of many employees who work around the clock and are not bound by the office’s opening hours.

The advanced technology, which occupies a central place in our lives, makes the daily conduct of employees easier, but at the same time exposes the companies to hostile factors, especially in a threatened country like ours.

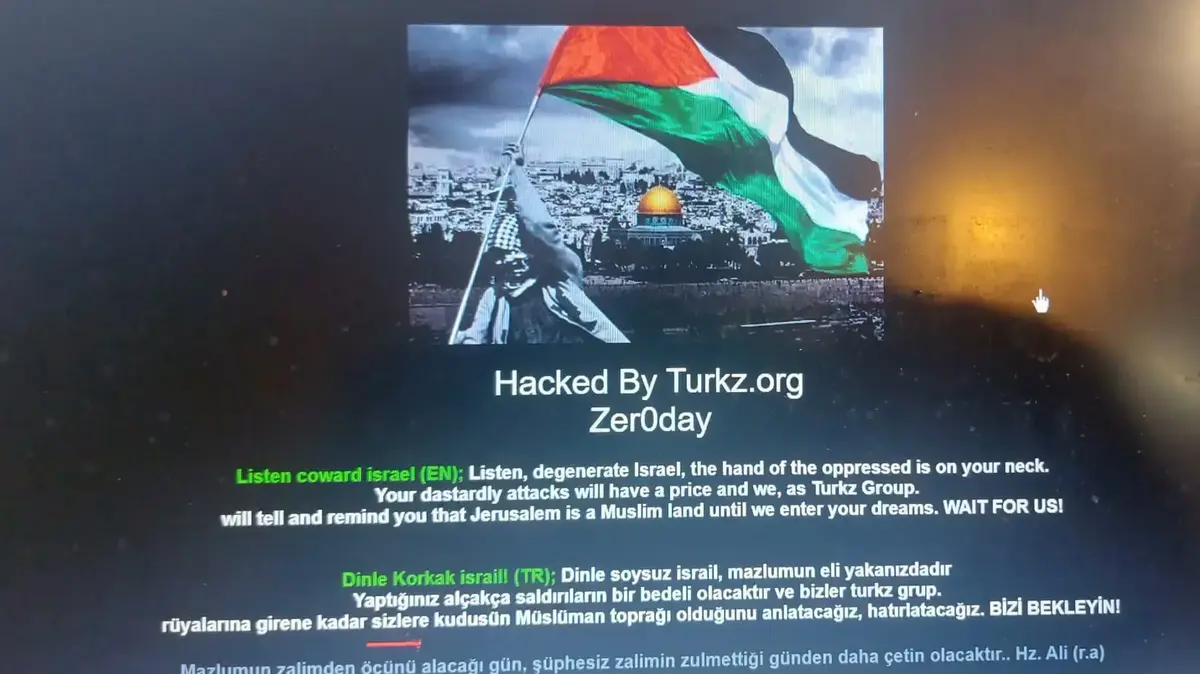

The main risk to which companies are exposed is a cyber attack that has become a coup d'etat and a real threat to businesses.

Evidently, in 2021 no less than 200 businesses fell victim to online extortion attacks.

Hackers who identified a loophole in the business, locked all the servers and demanded huge sums to free them.

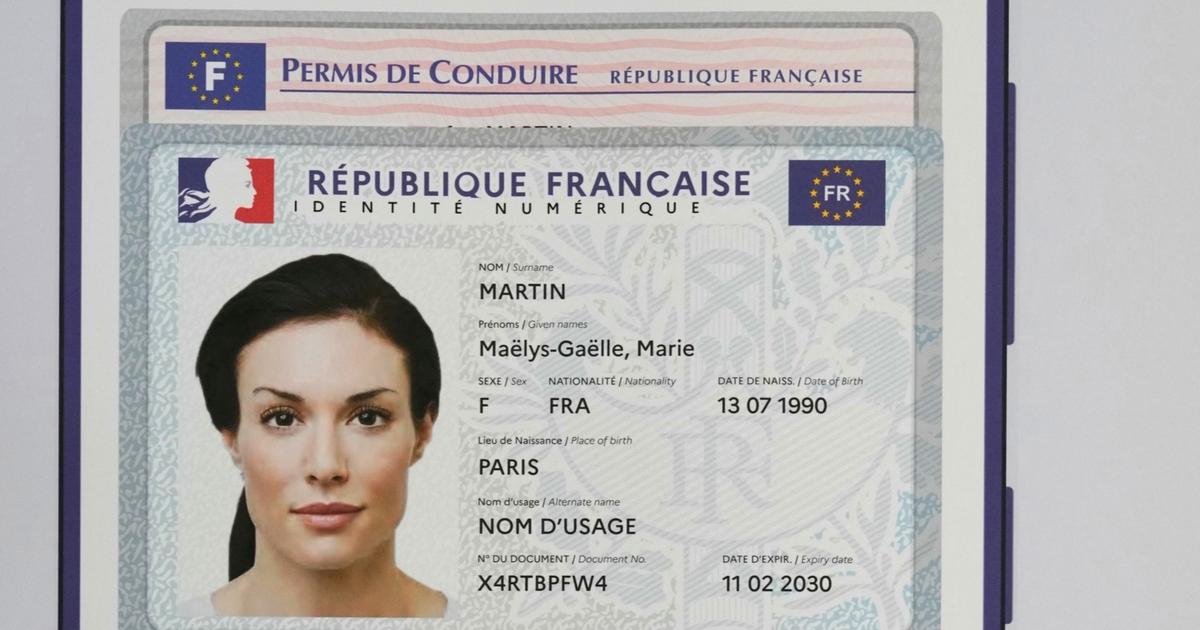

The most notable case is the BlackShadow Group's hacking of the Shirbit insurance company's website, which ended in a mass leak of ID photos, driver's licenses, employee cards, insurance policies and various letters.

Shirbit as mentioned is not alone.

Along with it can be named many companies that collapsed or were on the verge of collapse as a result of a cyber attack.

The most notable case occurred at Bank Leumi in 2014, when an anonymous email received by the bank's management from an unknown source caused a great deal of panic.

The source claimed to hold the details of the bank's 1.5 million customers, and demanded a ransom payment of $ 3 million.

The panic was so great that the 433rd Blade 433 cyber unit took over the management of the event that many feared could cause the bank to collapse.

Although this did not happen, it caused red lights to light up on the high floors of the most senior entities in the economy, led by high-tech companies that operate mainly in the network.

Against the background of the cyber attacks on the Atref website and Hillel Yaffe Hospital, Prime Minister Naftali Bennett recently said that "the threat is becoming real all the time, and accordingly the many investments in the field are gaining momentum. Since the beginning of the year More than last year. "

The understanding that has permeated the senior ranks of technology companies is that one must prepare for a scenario of hacking into the company’s servers.

One must know not only how to close all the loopholes, but also understand that in a reality where hackers are constantly perfecting there is no hermetic protection, so it is important that in the moment of truth senior security experts conduct the dialogue with hackers to minimize damage.

It is important to understand that the vast majority of cyberattacks can be prevented and the damages can be significantly minimized.

Every year, the national cyber system publishes tens of thousands of vulnerabilities that are exposed in the various programs, and the way to close them.

These are loopholes through which an attacker could log in and take over a computer.

In most cases, the vulnerability can be closed relatively easily, while updating software.

For the same reason it is also important that a company that owns digital assets will have insurance that will cover the immense damages that will cause a ransomware attack, theft of business information and deletion of databases.

This is called smart risk management and it is one of the main specialties of the "Touch Insurance" company from Udi Dagan, a veteran agency that has been operating since 1995.

Touch is in fact the digital arm of the veteran agency Udi Dagan, which is a revolutionary innovation in the insurance world: using the advanced platform, it is now possible to purchase custom insurance policies completely digitally.

How It Works?

Very simple - define the type of insurance you want, fill out a characterization questionnaire, get the most affordable offer both in insurance coverage and of course cost, and that's the end of the story and you can sleep soundly.

In light of the large number of attacks on businesses, which caused many of them to completely collapse and managers to face millions of shekels in claims (for invasion of privacy, intellectual property damage, copyright and reputation damage), Touch offers perfect insurance coverage, including executive liability insurance, professional liability insurance, employer liability insurance And special risks.

The highlight of Touch's insurance revolution is cyber insurance, which is intended for small and medium-sized businesses with a turnover of up to NIS 120 million in Israel.

Policy coverage includes, among other things, event management coverage.

During the first 48 hours of the event - which are known to be the critical hours - you receive full insurance, without deductible.

At this time, first-rate professionals will work on an appropriate response to the threat of extortion, which will decide the fate of the campaign.

The coverage also includes liability for breach of privacy and information leakage, electronic media liability and handling of notification and response.

In cases of attack, the business is also subject to the costs of investigating regulatory authorities.

Touch's insurance also covers these expenses, which can be very burdensome for the business, especially when they are unforeseen.

The insurance also includes expenses to prevent loss of income and indemnification for loss of income.

At the end of the day, Touch's insurance includes protecting the reputation of your hard-earned company over the years.

If one can learn one notable lesson in the Shirbit case is that the "Zobor" that the hackers caused to the company will stick to it long after the customer claims are clarified in court.

It is at the end of the day the loss of the most important asset of any living business: reliability.

Therefore, as part of preparing for "the day after" damages, the policy also includes third-party damages.

Whether it is claims that may reach suppliers, customers or employees, whose information has been leaked out with Touch's policy you are covered and prepared for any scenario.

Even if during the attack a virus penetrated from the home business computer to other computers and damaged them - you do not have to worry because Touch gives you full insurance coverage.

It is important to note that Touch's insurance for high-tech companies is tailored to every business - from a software house to an individual who wants to protect their product or patent.

If you are a manager of high-tech companies, small or medium-sized business owners whose main activity is in the network - you have an overall responsibility for your business.

Do not be complacent, do not say "it will not happen to me".

Large and veteran businesses, which rolled in turnover of hundreds of millions of shekels a year, collapsed in an instant and found themselves facing a broken trough and hundreds of lawsuits.

Call Touch's experts today and take care of the future of the business, controlling shareholders and shareholders, employees and their families.

One touch and you are protected.

Were we wrong?

Fixed!

If you found an error in the article, we'll be happy for you to share it with us