Enlarge image

Purchasing power is falling and falling:

The Turks keep half of their savings in dollars and gold for fear of further currency losses

Photo: CAGLA GURDOGAN / REUTERS

Inflation in Turkey is getting increasingly out of control: In December, the inflation rate jumped over the mark of 30 percent and reached 36.08 percent year-on-year, the highest level in around two decades, as the Turkish statistical office announced in Ankara on Monday.

Analysts were surprised by the strength of the price hike.

They had expected a good 27 percent.

The rate has more than doubled since the summer.

The increase in the cost of living has recently been driven by higher food prices.

From November to December alone, the rate of price increase was 13.6 percent.

The surprisingly strong increase put the Turkish lira under pressure again on Monday, as the dollar and euro appreciated by around two percent to 13.646 and 15.423 lira, respectively, according to the data.

"The key interest rates should be raised immediately and aggressively," said Özlem Derici Sengül, co-founder of the consulting firm Spinn Consulting.

"In March inflation is likely to reach 40 to 50 percent."

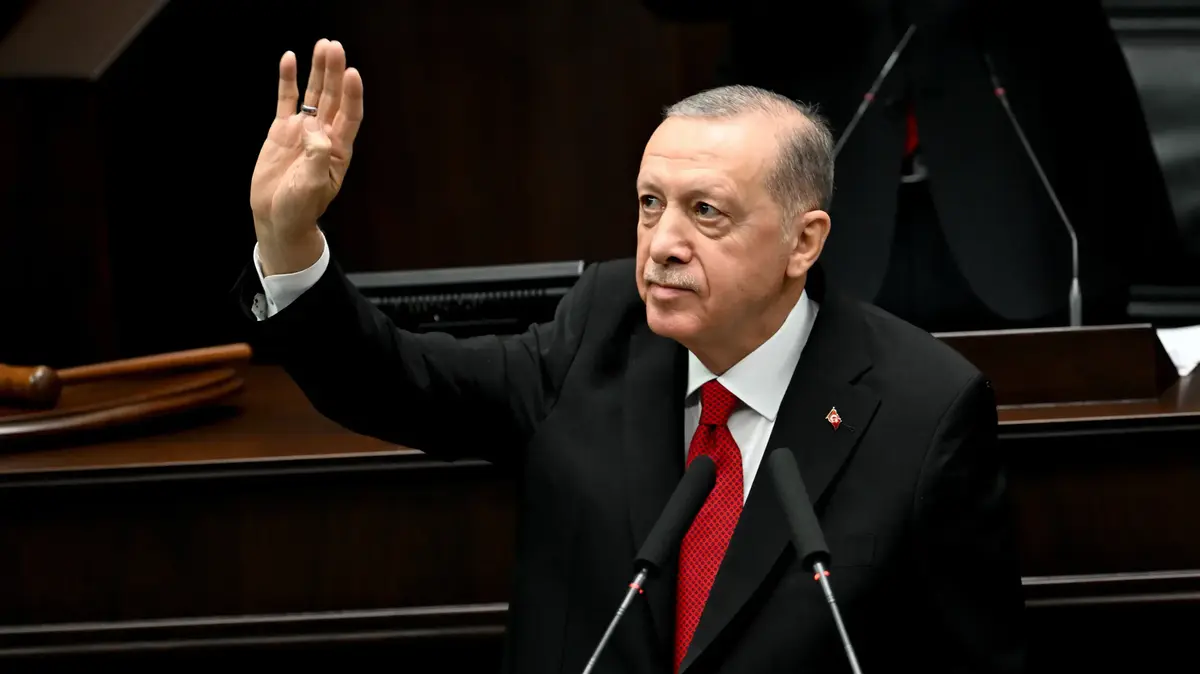

Turkish President

Recep Tayyip Erdoğan

rejects precisely that and only a few days ago defended his sharply criticized low interest rate policy.

At the same time, he called on his compatriots to keep their savings in Turkish currency, to part with foreign exchange and gold in order to support the national currency.

In December, producer prices even increased by 79.89 percent year-on-year.

The prices that producers charge for their goods will likely, with some delay, at least partially affect consumer prices.

The rapid decline in the rate of the Turkish lira, which goes hand in hand with inflation, makes imports of goods into the country more expensive. In addition, there are comparatively high raw material prices on the world market. This is one of the reasons why the country is in a difficult economic situation, which is reflected in high unemployment. Many people in Turkey suffer from the fact that they can barely pay for everyday necessities.

Erdoğan had announced that in order to protect savers, he wanted to settle the difference between lira investments and comparable dollar investments from the state treasury in the future.

According to analysts, however, it was unclear what money the government would use to settle the differences over the long term.

After Christmas, the lira lost value again: while one dollar cost 10.7 lira in the meantime, Turks had to pay 13.5 lira and more for one dollar in the end.

The situation has been worsened for months by the Turkish central bank, which, under pressure from Turkish President Recep Tayyip Erdogan, has recently continued to lower the key interest rate despite high inflation.

Central bankers are actually bracing themselves against galloping inflation with higher key interest rates.

rei / dpa-afx / Reuters