If you want to budget, or improve your existing budgeting method, there are plenty of apps that can do most of the work for you.

Using any of these apps to organize and track your spending will certainly help you stay on top of your finances.

And since many of today's most popular budgeting apps are available for free, there's no reason not to take advantage of them.

With so many budget apps available, we've picked from the most popular — 11 in all — and put them to the test.

We use our own financial data to see which apps helped us best keep our budget in order.

And while all of these apps have something to offer, we found three winners that can keep your finances and budget in check.

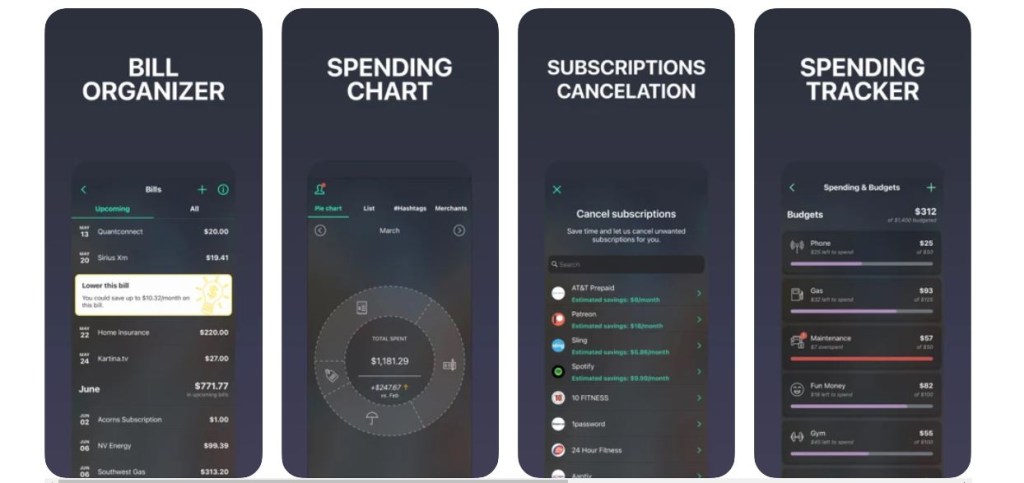

Best app for a general budget: PocketGuard

Available for iOS and Android

PocketGuard can link all of your checking and credit card accounts, along with other types of financial accounts, to help you build a solid budget.

You can also manually add any additional income you receive, such as cash or checks that don't arrive in your bank account.

To create an initial budget, the app shows you what you spent in previous months as a baseline, which you can adjust as you wish.

When creating the budget, PocketGuard offers many categories to choose from, as well as the option to create your own categories, a feature not all apps have.

The app automatically categorizes your transactions, but you can edit the category for any transaction if the system makes a mistake.

However, in our tests, PocketGuard's categorizations were quite accurate.

Once the initial setup is complete, you'll see how much money is left for the month, which the app calls "In My Pocket."

This helps you determine how much money you can save or spend on everything else.

The 6 best long-term investments to grow your money over time

Then, throughout the month, your budget updates in real time based on your transactions so you can see how much over or under budget you are in each category.

PocketGuard's budget tables also provide some great snapshots of your month-to-month spending habits.

A more recent feature is that you can set up

push

notifications to receive alerts regarding your finances, such as when a bill is due, income is received, or if you exceeded your budget.

The only downside to the app is that while the basic version is free, to get the full picture we recommend signing up for the paid version known as PocketGuard Plus, which costs $4.99 per month, $34.99 per year or $74.99 for a lifetime subscription. The main attraction of the paid version is that you have access to unlimited budgets and you can track your cash spending. While the fees can be expensive, the potential savings can quickly outweigh the cost. A great tip: sign up for the web version as the plans offered through the app are more expensive (prices mentioned here are website prices).

There is also a referral program that provides the opportunity to receive the PocketGuard Plus premium service for free.

Refer enough friends and family, which translates into points, and you'll earn free months of premium service.

Overall, if you want an easy to use app with great images and capabilities, PocketGuard is the way to go.

Just know that you'll probably want to splurge on the fuller version to get the most out of this app.

Best Budget App for Couples: Honeydue (Free)

Available for iOS and Android

With Honeydue, you and your partner can create a family budget by bringing all of your financial accounts together in one place.

The app allows you to link accounts from almost any financial institution, including credit card accounts, checking accounts, savings accounts, and more.

This allows you to toggle through the system to view individual and joint account activity.

And while Honeydue's goal is to get you guys on the same financial page, the app does offer the option to change permissions on what your partner can and can't see.

Therefore, you can decide if you want your partner to have access to both the balance and transactions, just the balance, or nothing at all.

The app also categorizes all of your transactions so you can monitor your household spending within each budget category.

You can set a spending limit for each category, and the app will send them a notification when they are close to reaching the limit.

You will also receive notifications when money comes in or goes out.

6 Ways to Pay Off Your Debt, Save, and Budget Responsibly

The real advantage of Honeydue is its communication features.

You can add comments to different purchases, or even send your partner a particular transaction through the chat function.

It even has fun emojis that you can use to make budgeting seem less of a chore.

All of these features will allow you to fully communicate about your finances and use the app to budget and keep everything in one place so nothing gets forgotten.

It might even help you avoid some of those difficult tabletop conversations.

Other great Honeydue features include adding bills and their due dates to a calendar so both you and your partner get reminders.

This can help them manage household expenses to ensure there is money in their accounts to pay upcoming bills.

While Honeydue doesn't have all the features of other apps on our list, for a completely free app, it's a great option.

With its communication capabilities and notification features, Honeydue will help couples not spend more than they can afford.

Best Budgeting App for Account Tracking: Mint (Free)

Available for iOS and Android

The Mint setup process is extremely easy, even for those who are not tech-savvy, as it includes all of your bank account, credit card, and investment account information.

At any time, you can check Mint and see how much money you have in all your accounts.

The app allows you to categorize your transactions across all of your accounts to paint a clearer picture of your spending habits.

Although the app provides a ton of information, one of Mint's most useful features is its budget tool. Based on your spending habits and average spend in each category, Mint will provide you with a monthly budget it thinks you should follow, which can help you not only budget better, but also save money. Of course, you can customize the quote based on your particular needs and wants, but having the system guide can be extremely helpful, especially if you're not sure where to start.

Once the budget is set, Mint will monitor your progress and send notifications if you go over budget in any category.

It's also very easy to log in to Mint on a daily basis, view your individual progress, and keep track of the goals you've set.

Ultimately, if you're looking to see all your finances in one place and venture beyond budget, Mint is a great option.

How we test

We download each app and go through the entire process of getting our personal data into the app as if we were a real-life user by linking our bank accounts, credit cards, and any other financial information (for apps that allow it).

We then experiment with each app to test all of its features.

We start with the basic version of each app and, if available, upgrade to the paid version to really understand the potential of each app.

We started our tests in 2020 and have updated this guide since then with new apps and new features annually.

We have continued to use the same criteria mentioned below and the same financial information.

The main criteria we evaluated were:

Usability:

We looked at many different aspects of each app when determining how easy each one was to use.

This included general usability, ease of setting up an account, availability of reports, the option to upload information from a variety of financial institutions, and any other unique capabilities.

Tracking and Goals:

This included the number of categories we could budget for, real-time tracking updates, and the option to set goals.

Availability:

Apps that were available to Apple and Android users scored higher in our tests, as did apps that offered a desktop version.

Cost:

We compare the cost of each app, as well as fees to upgrade app features.

Don't forget to join our Telegram group.

For more recommendations, offers and reviews read CNN Underscored in Spanish