Money is an act of faith.

In the system and, more specifically, in the banks, which manufacture almost all the money in the world.

Currency is both the most fragile institution (there is nothing to back it up except trust) and the least discussed: it is too useful for us to notice that it is a huge loophole.

Going a little further, as established by the sociologist Georg Simmel, our notion of money is very similar to our notion of God.

Money, this mysterious instrument that has accompanied civilization since its inception, is now entering a process of profound change full of unknowns.

Bitcoin and other cryptocurrencies, which were born as means of payment but have become above all speculative assets, are just a shaky start.

In a few years, almost all money can be digital.

That will create a different world.

The funny thing is that no specialist dares to predict what that world will be like.

More information

El Salvador de Bukele or how to live pending the price of bitcoin

“Just four years ago, the few of us who proposed the digital currency felt like the suffragettes who in the 19th century demanded women's suffrage: they considered us crazy.

Now it is being tested by the Central Bank of China and both the European Central Bank and the US Federal Reserve, in cooperation with the Massachusetts Institute of Technology (MIT), are working on their own projects”.

This is what Miguel Ángel Fernández Ordóñez says, former Governor of the Bank of Spain and former Secretary of State for Finance and Economy, one of the most enthusiastic promoters of digitization.

“If technology is transforming everything, why isn't it going to transform money as well?”

Xosé Carlos Arias, Professor of Applied Economics

There are also opponents.

Because the bet is big, and the risk is high.

Those who think that digital currency (a long computer code, similar in that to cryptocurrencies) will be more or less business as usual are the same ones who in 2008 considered the

smartphone

as a simple phone that also did other things.

The

iphone

was born less than 14 years ago and has changed our lives.

"We are in unknown territory and we are entering a world that we did not imagine," says Xosé Carlos Arias, professor of Applied Economics at the University of Vigo. "If technology is transforming everything," he adds, "why isn't it going to transform money as well?" According to Arias, the context of the change is marked "by an unprecedented situation, with a public and private debt that amounts to 360% of the world's gross domestic product, something never seen before."

Now we will explain possible advantages and disadvantages of the new revolution.

One of the consequences could be the destruction of the financial system as we know it today.

Can you imagine a world without banks?

It is conceivable.

Two Swiss bankers and investors, under the pseudonym Jonathan McMillan, describe it in their book

The End of Banking

(2014).

Fernández Ordóñez also sees that future as desirable, as he reflects in his book

Goodbye to the Banks

(2020).

But before explaining why, let's take a brief walk through the history of currency.

Or money, if you want.

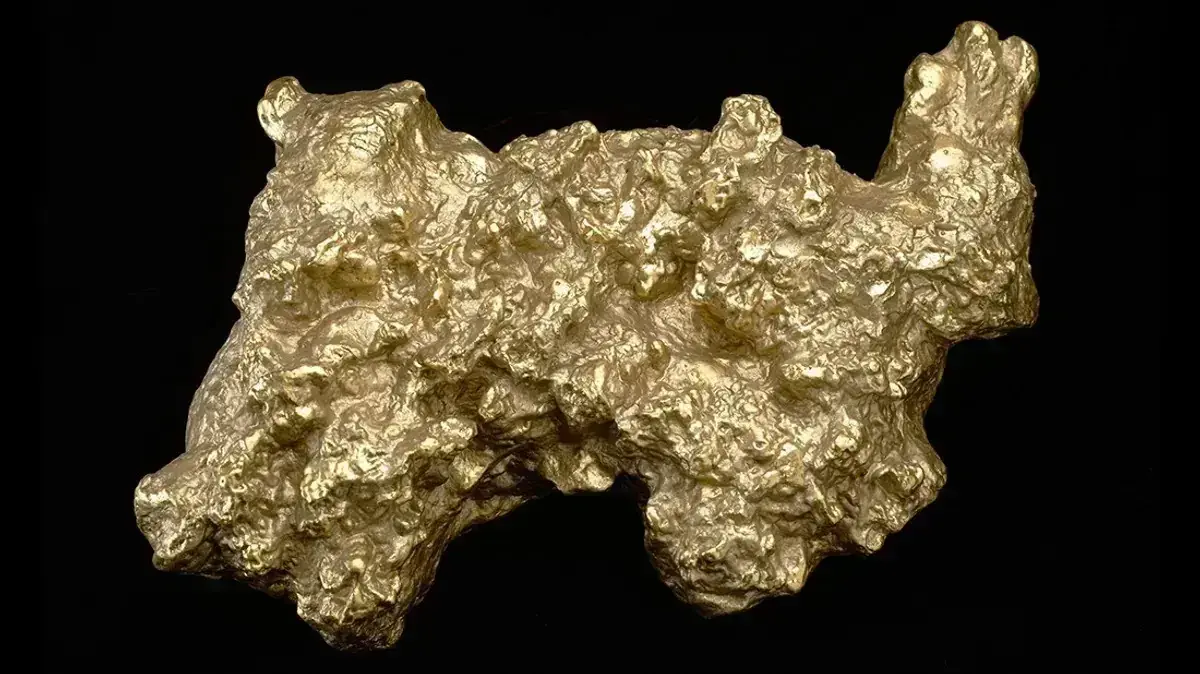

In the Mesopotamian societies of 3,500 years ago, precious metals were used as a form of payment.

Then, about 2,700 years ago, coins began to be minted (some in fanciful shapes, like knives) simultaneously in Asia Minor, China, and India.

In the 9th century, the Chinese monarchs issued the first paper banknotes, which did not reach Europe until the 17th century.

The paper was given value because some authority guaranteed its exchange for a certain amount of gold.

That system, the so-called "gold standard", worked until the First World War (1914-1918).

“It was a brake on growth, gold mining could not keep up with the pace of the industrial revolution and the money needs it generated”, explains Antoine Quero,

The UK wanted gold back after the war and thereby contributed to the financial catastrophe of 1929. In 1944, the United Nations Monetary and Financial Conference at Bretton Woods attempted to pretend that major currencies were backed by gold.

In 1971, Richard Nixon ended the fiction and declared that the dollar had no other support than public confidence.

And so until today.

All current currencies are

fiat

money (from the Latin for "let it be done"), also called money by decree: a State says that this piece of paper is money and, therefore, it is, because it is used to pay taxes.

We tend to think, however, that there is something behind the piece of paper, a mountain of gold bars or something similar. Actually there is nothing. We should forget even the idea of the “piece of paper” printed by a central bank and loosely sponsored by a public authority. Banknotes and coins constitute less than 10% of the total: more than 90% of the money is issued by private banks with their credit operations. But we also believe in that money; actually a bank debt. Our faith in the system gives for that and for more. How can we not believe in the system if the system is us? It is we, at least, who pay for it. There is no need to recall the successive bank bailouts across the planet and their cost to the taxpayer.When the abundant protection of the monetary authorities to the banking system (unlimited credit from the central bank, deposit guarantee, etc.) is insufficient, the citizen is there to do the rest.

The relationship between faith and money was made clear long ago. In the 16th century, the Order of Malta met the cost of its war against the Turks by replacing silver coins with copper coins bearing this inscription: “Non aes est fides”. Translation: It is not copper, it is faith. A faith that, according to the magnum opus of the German sociologist Georg Simmel,

The Philosophy of Money

(1900), deals equally with the notion of God and the notion of currency. It is no coincidence that the Government of the United States decided in 1956, in the midst of the Cold War, that the national motto would be

In God we trust

and that each bill of the national currency, the dollar, would henceforth bear the motto well visible: God and currency as ultimate symbols of social cohesion.

For Simmel, the human is a creator of tools and money is the purest tool, the one that makes all others accessible.

Money also allows us to understand the complexity of "civilized" societies (the Berlin sociologist directly connects "civilization" and "money"), since it reflects "the value of things without the things themselves".

And even more: money separates us from work and the impositions of matter, thereby making us freer.

The man with a lot of money, he says, feels "free and omnipotent."

There we have the mega-millionaires of today, people like Elon Musk or Jeff Bezos, with their space trips and their dreams of universal domination.

And his flirtation with cryptocurrencies, private money free from state ties as the ultimate fetish of the man-god.

Be careful, because Georg Simmel himself points out that money also "despiritualizes" societies and contributes to the alienation of the individual, especially when there are great economic inequalities between one individual and another.

What would Simmel say now, with a humanity more unequal than ever, with a planet in which there is more money than ever and in which the search for profitable refuges for the money surplus (populations age and consequently save) generates continuous bubbles speculative?

Mr Garcia

Let's go back to digital currency.

Let us distinguish it from cryptocurrencies, supposed payment units (for now, rather speculative assets such as shares) with an exceptional singularity: they are private currencies, without any regulation by the public authority and, therefore, high risk.

Bitcoin, pioneers of the matter in 2008, or ethereum are well known, but there are many other types of cryptocurrency in circulation.

More than 8,500.

In general, these are computer codes that chain one currency with another and whose emission (by the so-called “miners”) requires powerful computers and significant electricity consumption.

Cryptocurrencies attract numerous investors, especially young ones, and, despite sharp fluctuations in their price against the dollar and the euro, they have maintained a clear upward trend.

“That is where the demand for cryptocurrencies is fundamental.

And, in the case of bitcoin, the conviction that one day new units will stop being issued, which would tend to increase its value,” explains Óscar Jordá, economist and adviser to the United States Federal Reserve in San Francisco.

As in almost everything related to cryptocurrencies, there is a certain mystery in the limit of bitcoin.

Its inventor hides behind the pseudonym Satoshi Nakamoto.

Nakamoto may or may not actually be Australian Craig Wright.

In any case, Nakamoto assured that the program with which each bitcoin is produced established a limit of 21 million units.

And almost 19 million have already been issued.

"It is as if the Federal Reserve announced that it would not issue more dollars and that, therefore, there would be no more than those currently in circulation: the dollar would automatically revalue," says Jordá.

Cryptocurrencies are not, with few exceptions, a true means of payment, not even in countries like El Salvador, where bitcoin has been established as the official currency.

They work more as an investment: when their price rises, they are exchanged for dollars or euros.

Lately, another option that is designed as a means of payment has begun to take shape: the so-called “stable currency” that gigantic technology corporations such as Facebook are studying.

It would be a currency called diem whose value would depend on a regular “currency basket” (dollars, euros, renminbi and yen, for example), and which would be backed by the reserves created by exchanging a conventional currency for a diem.

In that sense, it would not encourage speculation.

Facebook is the

country

with the most

inhabitants

in the world (it has almost 2.9 billion users, compared to a Chinese population of 1.4 billion) and, if it were finally created, its currency would acquire immediate relevance. Could Facebook be in the credit business? Could you organize person-to-person lending platforms? In both cases, the answer is yes. That would constitute a serious threat to the current banks.

“Stablecoins are growing fast, there are already several platforms using them for fast international payments.

In 2020 there was $20 billion in stablecoin;

in 2021 they amounted to 120,000 million”, recalls Miguel Ángel Fernández Ordóñez, for whom the hypothetical currency of Facebook could drastically facilitate and reduce the cost of collections and payments.

"Imagine something free like WhatsApp to manage our accounts: a message would be equivalent to a collection or a payment, instantaneous and at zero cost."

That raises a delicate question: do we want a corporation like Facebook to also know our money and our debts, in addition to what we have already told it, which is practically everything?

“The financial sector looks like a remnant of the Soviet system”

Miguel Ángel Fernández Ordóñez, former Governor of the Bank of Spain

Let's go back to the project of the digital currency issued by the big central banks.

On the one hand, the handling of digital currencies would imply a reduction in privacy (only cash, banknotes, guarantees anonymity) and would require strict regulation to prevent abuse by the issuing power.

On the other, it could break a taboo: the current ban on private citizens holding (as commercial banks do) a checking account at the central bank.

The digital currency would directly connect the authority that manufactures it with the citizen who uses it and, according to all the experts consulted, would allow the central bank to function, in the sense of savings and credit, as a commercial bank.

If you have an account at the issuing bank, in authentic digital currency (electronically tangible and backed by a government, whatever that backing is worth), why should you save on accounting bits or notes like those offered by conventional banking?

Let us remember that the bank does not actually own the money it lends us and that, for every 10 euros it has, it lends more than 100. Each digital currency, on the other hand, is as physical (replacing paper with a code) and unique as a euro or dollar bill, although less anonymous.

The so-called "internal money" produced by private banks would be forced to compete with the "external money" minted by the public authority and, in principle, not exposed to bankruptcy.

That would be the biggest threat to the current private banking system.

There are voices that ask for a little calm.

Like that of the economist Óscar Arce, until now General Director of Economy at the Bank of Spain and henceforth General Director of Economy at the European Central Bank.

Arce believes that commercial banking effectively manages “the strong variations in the demand for money”, something that could be more difficult for central banks in an environment with multiple digital currencies.

And he points out that a proliferation of different digital currencies (including private cryptocurrencies) could add serious complication to the basic task of a central bank: maintaining price stability and a certain order in the financial system.

"Classical monetary policy, based on raising or lowering reference interest rates, is still valid," says Óscar Arce.

Óscar Jordá agrees with this,

But the new currencies have already delved into “classical finance”.

Many banks hold cryptocurrencies within their asset portfolio.

Remember that this is a fairly volatile investment whose value could plummet.

How not to speculate a bit?

Goldman Sachs, one of the largest investment banks on the planet (and one of the protagonists of the Great Recession), recently predicted that bitcoin would have a return of close to 18% in 2022 and that it was gaining ground on gold as a refuge value.

When such a large bank makes such a prediction, it is often a self-fulfilling prophecy.

A cryptocurrency exchange point in Kiev, Ukraine, on January 24.

NurPhoto (NurPhoto via Getty Images)

One detail reveals the fragility and importance of the conventional currency: it is the only political instrument (because, let us remember, it is

fiat

money , a simple political promise) that escapes democratic control.

Since the 1980s, despite strong opposition from leaders such as Margaret Thatcher, central banks have been run independently by professionals in the field.

"That's good because these are technically very complex issues, and it's bad because of the lack of democratic legitimacy," says Professor Xosé Carlos Arias, who stresses that central banks exceeded their official role of controlling inflation more than a decade ago. and, with the application of heterodox policies, they assumed the role of “central actors in the economy”.

Over the past decade, the big central banks have massively bought public and private assets and fattened their balance sheets at breakneck speed.

In 2008, the assets of the United States Federal Reserve did not reach a trillion dollars;

now it exceeds eight billion.

All this, not to maintain the purchasing power of the currency, but to keep the international economy going.

Mario Draghi, a man from Goldman Sachs and supposedly outside of politics, was as president of the European Central Bank (2011-2019) the man who prevented the collapse of the euro and who actually managed the continental economy.

With a digital euro, the power of it would have been even greater.

Miguel Ángel Fernández Ordóñez underlines a paradox: a digital euro is needed, that is, public money (as opposed to "internal money" produced by private banks) to "liberalize a sector such as the financial sector, so intervened and protected that it seems the last vestige of the Soviet system.

Subscribe here

to the weekly Ideas newsletter.

Exclusive content for subscribers

read without limits

subscribe

I'm already a subscriber

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/4YJMGVUCWNCTTD5PKRVXN5PUAI.jpg)