The new budget of the SAR government is about to be released. Financial Secretary Chen Maobo mentioned in his blog on Sunday (February 20) that the current epidemic is fierce and once again suppressing the local economy. Therefore, it is necessary to allocate sufficient resources to fight the epidemic with all-out efforts, and at the same time try to bail out citizens and small and medium-sized enterprises.

After the political turmoil and international incidents in the past few years, the concept of "economic security" has become more and more popular among financial officials of the Hong Kong government.

However, both mainland and international experience have shown that "economic security" is closely related to the protection of people's livelihood and social justice.

Especially in the relevant discourses of President Xi Jinping, people's food issues and concerns about the risk points of the real estate market are all considered in the "economic security" list, not limited to "financial security".

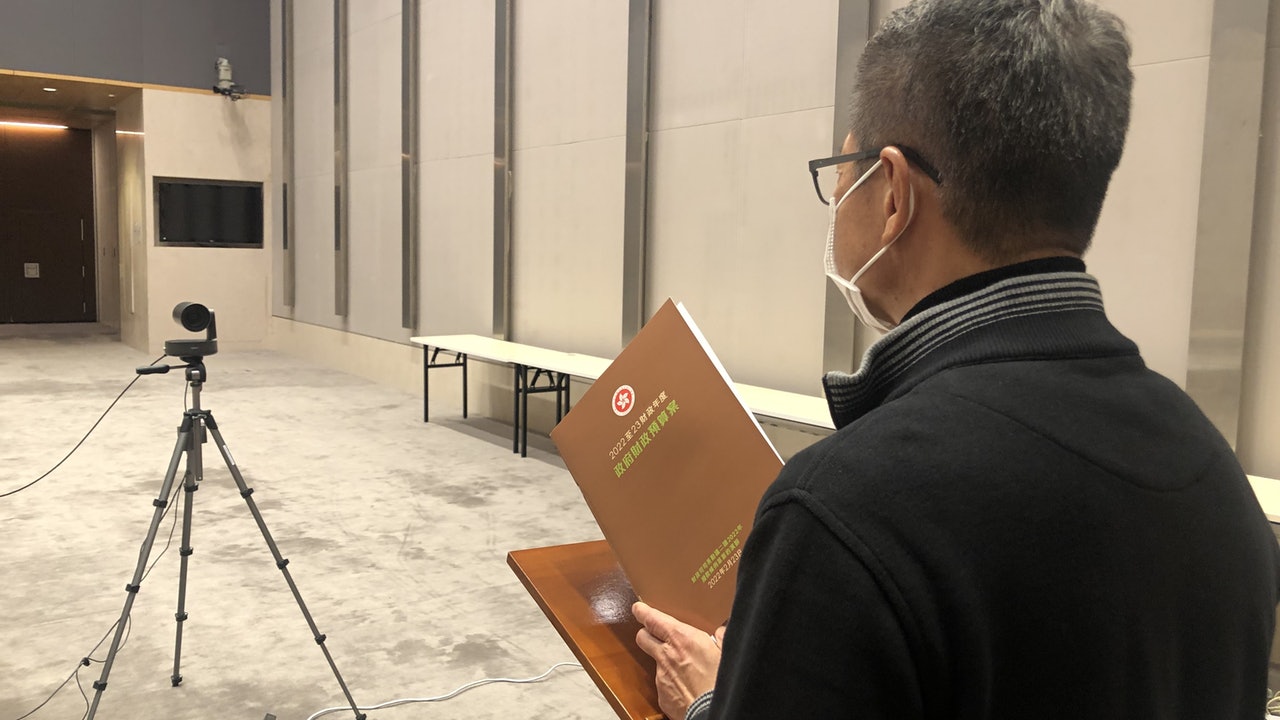

Chen Maobo released a new budget on Wednesday (February 23).

(file picture)

The rich need to take more responsibility

If Chen Maobo really wants to achieve local "economic security" in this budget, then he should first try to reduce the impact of ordinary citizens from the increase in the price of goods and rents during the epidemic, instead of focusing only on providing services for enterprises. Bail out and cope with international financial trends.

On the other hand, he also needs to promote reforms in the redistribution of wealth and income locally, especially requiring the rich and big corporations to take more responsibility.

Coincidentally, Singapore's Minister of Finance, Huang Xuncai, also released the local budget last Friday (February 18). His speech was titled "Jointly Planning Our New Path Forward", focusing on how to recover the post-pandemic economy. Government revenue should be increased to support health and social spending, a fairer and stronger tax system, and higher rates of personal income tax, property tax and luxury car tax.

Looking back at Hong Kong, although budgets in recent years have stated that they will consider opening up new sources of income or adjusting tax rates, last year they also said that they would study "whether to introduce a progressive rate system and provide permanent concessions for owner-occupied properties". But the result is always "only hear the stairs, no one comes down", the only exception is the slightly increased share stamp duty rate in August last year.

As for the standard tax rate applicable to most other taxes, it has basically remained at 15% since 1989.

Property tax can be partially increased

As for the biggest wealth inequality in Hong Kong, of course, it occurs between those who own or not own property.

The government has introduced a series of "hot tricks" to suppress the property market, including levying additional stamp duty on short-term resale in 2010, levying buyer's stamp duty on non-permanent residents and companies buying residential properties in 2012, and levying non-first-time home buyers or replacement transactions in 2013. Double stamp duty, and in 2016 it was converted to an ad valorem stamp of 15%.

However, under the pressure of the industrial and commercial sector last year, the "hot move" for non-residential properties was withdrawn, and there are even opinions that residential units can follow.

In contrast, in Singapore, which has a "spicy trick" arrangement similar to Hong Kong's stamp duty, the local property tax is originally levied annually regardless of whether it is self-use, rental or vacant, and an additional 20% income tax is required for real-time rental income. .

In the latest budget, Huang Xuncai proposed to increase the property tax rate in two stages, in which the progressive tax rate for self-occupied properties was increased from 4% to 16% of the assessed rental value to 6% to 32%, and the progressive tax rate for non-self-occupied properties was increased. More from 10% to 20% to 12% to 36%.

In order to suppress the "hype", the government has launched a number of "hot tricks" in the property market since November 2010.

(file picture)

Hong Kong’s rates collection rate is still uniform at 5% of the assessed rental value, and the property tax rate for net rental income is only 15%. From another perspective, it can be said that Hong Kong’s property market policy is actually too lenient for investment speculation.

In addition, statistics from the Inland Revenue Department indicated that the number of residential transactions and taxes paid by the "spicy tax" alone continued to rise last year. It can be seen that the agenda to be put on the agenda is not at all the repeal of the "spicy trick" according to some opinions in the market, but may be. Taxes related to other properties must also be partially increased in accordance with the same principle.

The Hong Kong government might as well consider referring to Singapore’s practice, introducing a hierarchical and progressive structure and distinguishing between self-occupation and non-ownership into rates collection, and must retain the design that the lowest level of assessed rental value is completely exempt, and in the long run, it must also cooperate with other renters. Regulatory measures to limit rent increases.

In this way, the government will be able to increase the financial resources and at the same time prevent the grassroots citizens who rent low-cost units from being victimized by the pressure of their owners to increase their rents, and it will not increase the burden on those citizens who buy homes for their own needs, thereby preventing the property market from becoming too hot. This can be said to help ensure overall "economic security".

The budget should explain the tax reform plan, the health care system collapsed under the epidemic, the budget must solve the problem