Large fund owners who manage more than $100 million in U.S. stock holdings disclose their shareholding list quarterly in accordance with U.S. regulatory requirements.

According to the latest data, Chinese stocks listed in the United States have experienced regulatory crackdowns and heated Sino-U.S. rivalry, which has shrunk by one-third of their total market value last year and their valuations have fallen to multi-year lows.

Every quarter, the U.S. financial markets publish a document called 13F, which is disclosed to the U.S. Securities and Exchange Commission (SEC) by institutions that manage more than $100 million in equity assets, including hedge funds, trust companies, pensions, insurance companies etc., will explain in detail in the document the holdings of the stocks listed in the United States and the whereabouts of the relevant funds.

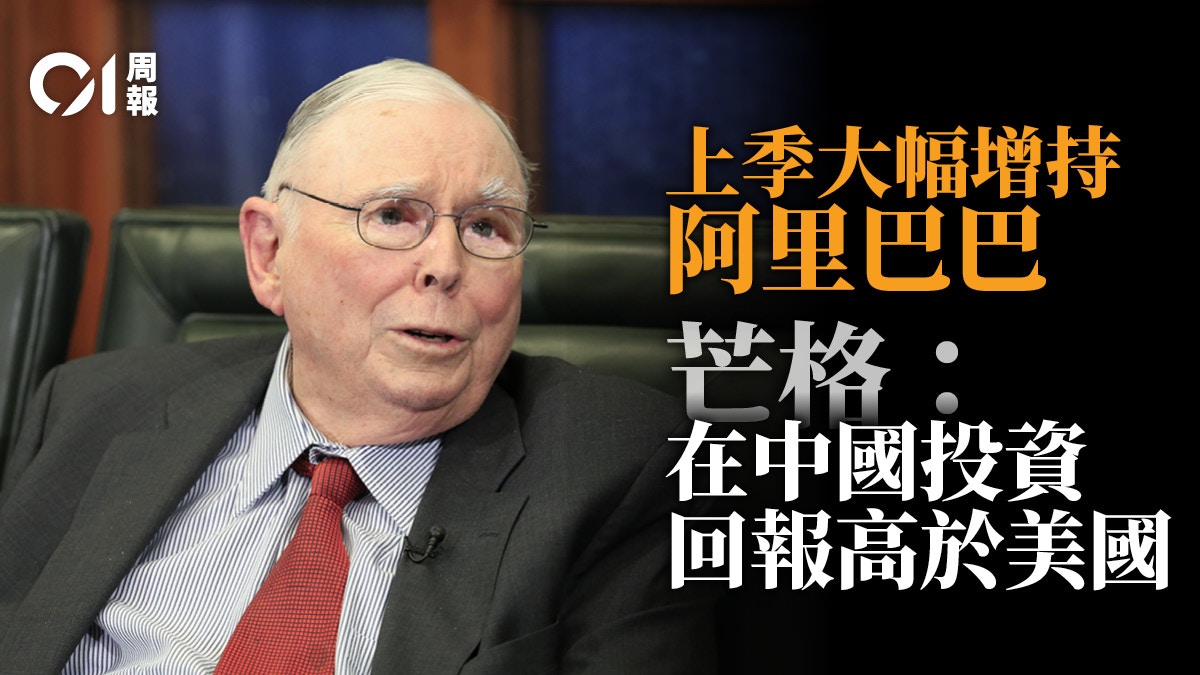

Munger pointed out that every dollar invested in China is more advantageous, and the companies invested in now are stronger than competitors, but the prices are lower.

(Getty Images)

According to the 13F document, the Daily Journal, an investment fund owned by Warren Buffett’s long-term partner Charlie Munger, bucked the trend and bought Alibaba last quarter, increasing its holdings to more than 600,000 shares, the third largest in 2021. Nearly tripled at the end of the first quarter.

Asked at the Daily Journal's annual conference this month why he chose to invest in China and buy Alibaba, Munger said: "China is a huge, modern country with a huge population that has grown over the past three decades. Quickly. We made some investments in China, because from the perspective of corporate strength and stock price, investing in China can get higher value than investing in the United States. Top investment institutions such as Sequoia Capital have made the same as us. decision.” He firmly believes that every dollar invested in China is more advantageous, and the companies he invests in are stronger than competitors at lower prices.

Wall Street bigwigs who hold similar investment philosophies to Munger have also gradually increased their holdings of Chinese stocks, including Bridgewater, the world's largest hedge fund.

Bridgewater liquidated large U.S. e-commerce stocks Amazon, Netflix, and Oracle during the period, and instead invested in Chinese-funded e-commerce stocks with depressed valuations, adding more e-commerce leaders Pinduoduo, JD.com, and Alibaba in one go Baba.

Pinduoduo has been increased by many large fund investors, and its annual active users have exceeded 800 million.

(file picture)

In terms of the number of shares held, among the three major Chinese e-commerce stocks, Bridgewater Fund still holds the most shares in Alibaba. During the period, the number of shares held increased by 30%, making Alibaba the seventh among the top ten holdings of the fund.

As for the holding list of another hedge fund Tiger Global Management, it also reflects the investment love for Internet and e-commerce stocks.

The top five heavyweight stocks are JD.com, Microsoft, Sea, a Latin American financial technology company NU, and a financial technology company Snow.

The fund increased its holdings by 5% in JD.com, the largest holding company, by 12% in Pinduoduo, and by 28% in video software Zoom.

Coincidentally, Singapore's sovereign fund Temasek, which has publicly stated that it continues to be optimistic about the Chinese market, also increased its holdings in Pinduoduo in the fourth quarter, and at the same time added JD.com to its holdings...

For details, please read the 305th issue of "Hong Kong 01" Electronic Weekly Newsletter (February 21, 2022) "

Optimistic about China's investment opportunities with billion-dollar US players adding to JD.com and Pinduoduo

".

Click here

to try out the weekly e-newsletter for more in-depth reports.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/FIJVMOBHZRWVDBKS3NAQ2M4JRE.jpg)