Musk's possible impact on Twitter 2:43

Editor's Note:

Dean Obeidallah, a former attorney, is the host of SiriusXM's daily radio show "The Dean Obeidallah Show" and a columnist for The Daily Beast.

Follow him at @DeanObeidallah.

The opinions expressed in this comment are his own.

See more opinion articles here.

(CNN) --

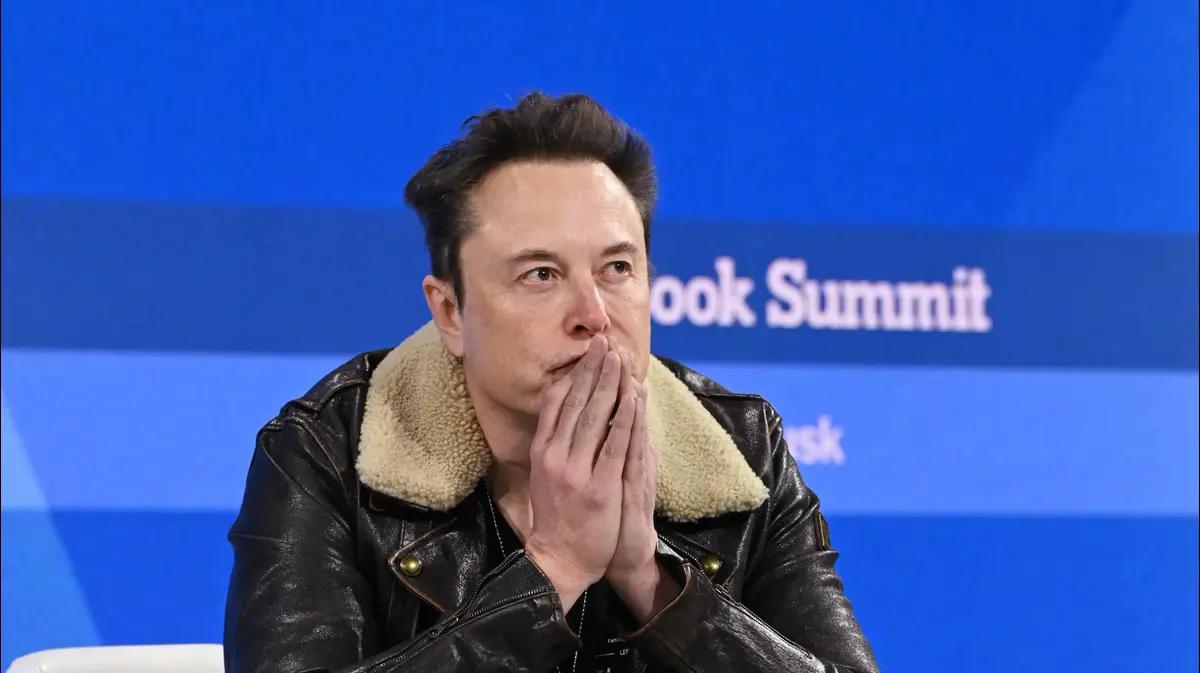

Elon Musk, the world's richest person, announced last week that he wanted to buy Twitter, instantly triggering an impassioned response.

We saw conservatives applaud while some progressives criticized the proposal, given concerns that Musk could allow Donald Trump, as well as others Twitter has banned, back on the platform.

Let's be frank: Musk's plan to buy Twitter is no big deal.

Twitter is just one of many social media platforms, and one that only 25% of American adults use.

Tax day in the US is this Monday.

Here's what you need to know about your 2021 return

Instead of fighting over Musk's purchase of Twitter, we should use the controversy over his $43 billion cash offer to ask how someone with so much money can't pay their fair share in taxes.

That must end.

We need a mandatory tax on the ultra-rich to ensure they can't escape paying taxes like the rest of us.

If not, we are on the way to becoming an oligarchy.

This question is important, especially when Americans file their tax returns before the April 18 deadline.

Dean Obeidallah

During the pandemic, as unemployment soared and Americans with fewer means risked their lives working simply to put food on the table, Musk grew richer.

The owner of Tesla and other companies saw his wealth grow by nearly $118 billion in 2021. That's an increase of more than $300 million a day.

But as ProPublica reported, last year, while Musk's wealth grew by nearly $14 billion from 2014 to 2018, he paid relatively little in taxes over that period.

For example, in 2017, he reportedly paid just $65,000.

And what's worse, in 2018, she paid zero income taxes.

That means if you paid a dollar in income taxes in 2018, you paid more in taxes than this billionaire.

You think it is fair?

As ProPublica also noted, the average American household – earning about $70,000 a year – paid 14% in federal taxes.

What was Musk's tax rate between 2014 and 2018?

According to ProPublica, just over 3%!

After that report surfaced, Musk responded by lashing out at critics and claiming he would pay billions in taxes by 2021. But that tax payment was necessary because he exercised stock options that gave him billions in profits. last year.

Elon Musk's top 5 investments 0:56

Even then, Musk's Tesla company made $5.5 billion in net income but won't pay any taxes in the United States, according to a CNN report, likely because of tax loopholes that allow a company to claim its profits are earned. obtained in foreign places.

To be fair, Musk isn't the only member of today's billionaire class to get richer during the pandemic.

Since the arrival of covid-19, American billionaires have seen their collective fortunes soar by more than 70%, to exceed $5 trillion, according to a report by Americans for Tax Fairness and the Institute for Policy Studies Program. on Inequality, which uses data collected by Forbes.

And the 10 richest men in the world – with Musk at the top of the list – have seen their collective wealth double, increasing by $1.3 billion a day.

Yes, up to date.

Like Musk, some other billionaires have paid low amounts of taxes, as detailed by ProPublica.

Amazon founder Jeff Bezos paid zero taxes in 2007 and repeated that amazing feat in 2011. Warren Buffett—whose wealth grew $24 billion between 2014 and 2018—paid a 0.10% tax rate.

Buffet has even called for higher taxes on the ultra-rich, saying he pays a lower rate than his secretary.

Meanwhile, back in the world not defined by rockets of vanity and capricious desires to buy a social media platform, the pandemic has resulted in an estimated 100 million people descending into extreme poverty.

The result is an even bigger gap between the super-rich and the rest of us.

Elon Musk about to get richer for these reasons 1:13

The worst thing is that this tax evasion is apparently legal.

The richest pay the best lawyers and accountants, who employ tools such as lending, shell companies, complex trusts, and other means to shield the wealthy from tax liability.

The real-world impact is that you and I have to fund our nation's schools, military, police, environmental policies, etc.

All the things that these rich people use, but for which they pay as little tax as possible.

Polls show that Americans are "very" upset that the wealthy don't pay what we consider their "fair share" of taxes.

There are proposals to fix this injustice.

Last month, President Joe Biden proposed that people with assets greater than $100 million pay a federal tax rate of at least 20% on their income, including unrealized gains on assets that are not currently taxed.

Musk, Bezos and Zuckerberg tax data leaked 0:53

Sen. Elizabeth Warren of Massachusetts and other Democrats last year introduced a "wealth tax" on the ultra-rich that included a 3% tax on billionaires.

In total, some 100,000 American families would be subject to the tax, which, according to an analysis provided to lawmakers, would raise $3 trillion over a decade.

People are in favor of the idea that Musk and other super-rich should pay their fair share of taxes every year, not just when one of them exercises stock options.

However, I'd bet people like Musk would rather pit the left against the right than have us argue over whether he should own Twitter.

Instead, we should join forces to demand that elected officials close loopholes and make sure the rich pay their fair share.

Elon Musk

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/BTHDUOM6GSCJU5BVV7CBEATLYQ.jpg)