Deputies of the Chamber of Chile with banners against the withdrawal of pension funds. Johanna Zárate Pérez (EFE)

The Chilean Congress has rejected two bills on Monday night that sought to authorize new withdrawals from pension funds, a highly popular initiative in an adverse economic context, despite the inconveniences that technicians have warned about the future of retirement .

They were not rejected because of the responsibility of the congressmen in the face of a complex scenario for social security – the pension fund system has suffered severe damage since the first of the three authorized withdrawals was made in 2020 – but because the atomization of Parliament it does not allow basic agreements to be reached on substantial issues and the construction of majorities is complex, even for a recently elected government like that of Gabriel Boric.

Chile has a complex problem with its pension system that has been going on for decades.

In the first government of Michelle Bachelet (2006-2010) it was Mario Marcel himself – Boric's current Finance Minister – who led a presidential advisory commission for a reform of the pension system.

In the second term of the socialist (2014-2018) there was another attempt, in a commission led by the economist David Bravo.

According to the analysis of that time, the pensions would be insufficient: the replacement rates –the pension in relation to the salary that the workers obtain in their working lives–, would be of the order of 35%, when the average of the countries of the Organization for Economic Cooperation and Development (OECD) reaches 66%.

The challenge, therefore, aimed to strengthen the savings for the pension system,

both through state contributions and through increased personal savings.

In Chile, with a system based mainly on individual capitalization, only 10% of wages are quoted.

In October 2019, with the social outbreak, the demands for better pensions were once again strongly installed on the political agenda.

The darts were aimed above all at the system in force since 1981, based above all on individual capitalization in accounts managed by the Pension Fund Administrators (AFP), private companies that collect, pay pensions, manage the funds and are key to the system. Chilean financial

The pension system, however, since 2008 has a second pillar, with State resources focused on people with fewer resources who did not have savings.

Chile was in that discussion until the pandemic in 2020 turned the tables and Congress opened the door to withdraw pension savings, which was strongly criticized by specialists, such as Marcel himself, then president of the Central Bank.

Although Parliament by law cannot take measures that involve fiscal spending or that affect social security, through legislative figures it managed to promote three consecutive withdrawals in the Government of Sebastián Piñera, which allowed savers to withdraw 10% of their resources for the old age.

If the system had 250,000 million dollars, with the three withdrawals some 52,000 million dollars were withdrawn, that is, about a fifth (something similar to what Chile spends socially in a year).

Today, specialists, like Bravo himself, speak of a kind of collective suicide.

Because after the consecutive withdrawals, the pensions that can be paid with those funds fell by around 38%, according to the economist.

According to January data from the Superintendence of Pensions, "34.5% of the members who have requested a withdrawal have been left without a balance in their mandatory individual savings account."

What is at stake, therefore, is not only aimed at the private individual capitalization system, which has strong critics, but at the Chilean social security system itself.

The expected pending reform, which the Boric government seeks to promote this 2022, is an unknown with fewer resources.

Because regardless of the system that exists in the future – probably a mixed one – money will be needed to try decent retirements.

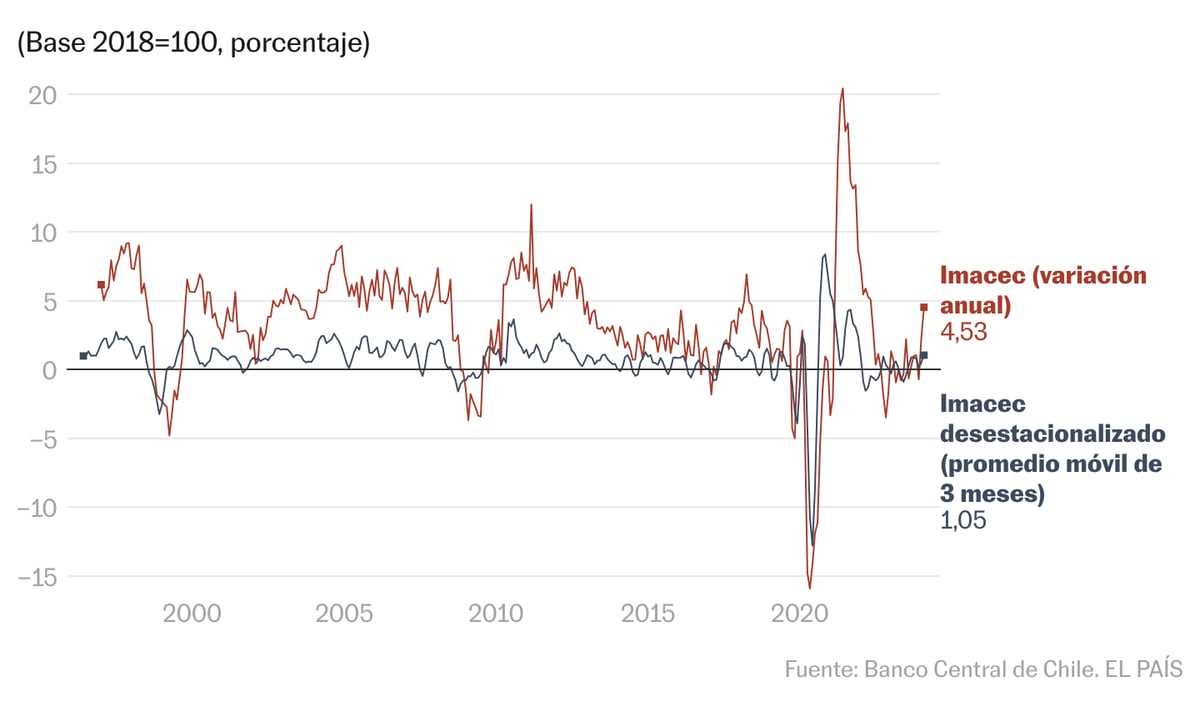

It was the context in which the Congress reopened the discussion for a new retirement, to which the Minister of Finance refused until a week ago, precisely because of the consequences on pensions and on the macroeconomy: the increase in consumption has contributed to the increase of inflation, in a country like Chile little accustomed to this phenomenon in the recent past.

The Boric government, having serious difficulties in ordering its own parliamentarians, had to give in and proposed a limited project to allow a withdrawal of savings for old age, but only intended for people to pay certain debts.

According to Minister Marcel, it would have an impact of one fifth with respect to a withdrawal without further conditions.

Important formations of the ruling party, such as the Communist Party,

In Congress, however, both bills were rejected last night.

What happened in Parliament gives the Government a break, due to the strong economic blow that a new bleeding of the pension system would have implied and the difficulties that would have implied to carry out its transformation program.

But Boric's Executive has been politically wounded, because a month after coming to power, his serious difficulties have become evident not only in ordering his coalition, but also in defending, persuading and explaining an unpopular position on which he is convinced, as analyzed by another of the respected economists of the Chilean square, the socialist Óscar Landerretche.

Subscribe here to the EL PAÍS América newsletter and receive all the key information on current affairs in the region