Some users who share Netflix passwords will have to pay extra 1:06

(CNN) --

Netflix shares are imploding after the company reported its first quarterly subscriber loss in more than a decade, a performance well below expectations and worrying investors who had been betting that a handful of big tech companies continue to grow at a fast pace.

Shares of Netflix fell 30% at the open on Wednesday, wiping more than $45 billion off the value of the company in an instant.

Netflix said it lost 200,000 subscribers in the first three months of the year, when it was expected to add 2.5 million.

The streaming

giant

, whose shares have already fallen more than 40% so far this year, blamed the situation on increased competition and the Russian invasion of Ukraine.

Netflix said its decision to pull out of Russia cost it 700,000 subscribers.

But the economy doesn't help either.

advertising

Inflation is forcing households to reevaluate their budgets.

In Britain, for example, around 1.5 million

streaming

subscriptions were canceled in the first three months of 2022. More than a third of citizens did so to save money, according to a new report from media consultancy Kantar.

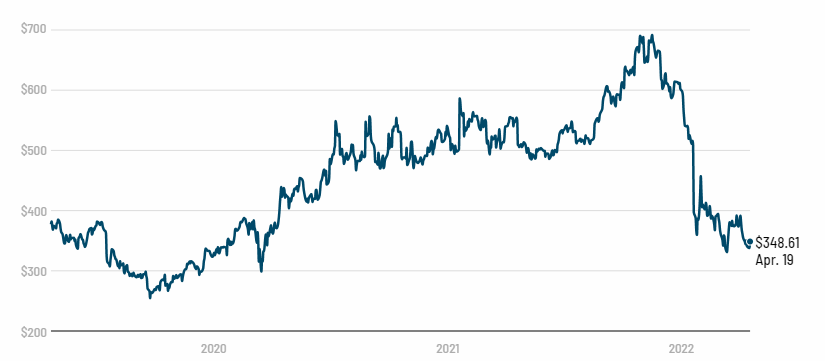

This has been the performance of Netflix shares, which fell below US $ 350 on April 19.

Source: Refinitiv

Graphic: CNN's Julia Horowitz

"Food and electricity are people's priorities right now, not watching 'Stranger Things,'" CMC Markets chief market analyst Michael Hewson told me.

Netflix studies possible cheaper subscription with advertising

Netflix has signaled that it could make big changes to its business to try to stem the bleeding.

The company is looking again at how to deal with password sharing.

CEO Reed Hastings also told analysts that the company will consider a lower-priced, ad-supported subscription option.

"I've been against the complexity of advertising and I'm a big fan of the simplicity of subscription," Hastings said Tuesday.

"But as much as I'm a fan of that, I'm a bigger fan of consumer choice," he explained.

Hewson said the stock plunge shows Netflix was grossly overvalued, and that investors -- flush with cash during the pandemic recovery -- fueled a huge rally.

Netflix shares are up 86% from the end of 2019 to 2021, while the S&P 500 is up 48%.

"They were assuming that people were going to be locked down forever," Hewson said, adding that unlike Apple and Amazon, Netflix doesn't have many alternative sources of revenue.

Netflix discontinues its services in Russia 0:37

The market mood has clearly changed.

The strong reaction could set the stage for another season of turbulent earnings, at a time when investors are already on edge after disappointing results from the big banks.

When companies reported fourth-quarter numbers earlier this year, Netflix and Facebook took huge losses on their shares, as investors signaled growing sensitivity to gloomy predictions for the future.

This was because the Federal Reserve was going to start raising interest rates, a move that would weigh on high-growth companies.

Facebook's disastrous results led to the largest loss in market value ever recorded for an S&P 500 company.

Now, rates are officially on the rise, and whether the Fed could be even more aggressive than expected is debated daily.

The war in Ukraine also impacting confidence.

This could lead to big swings for major stocks as results are released.

Netflix

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KMEYMJKESBAZBE4MRBAM4TGHIQ.jpg)