Enlarge image

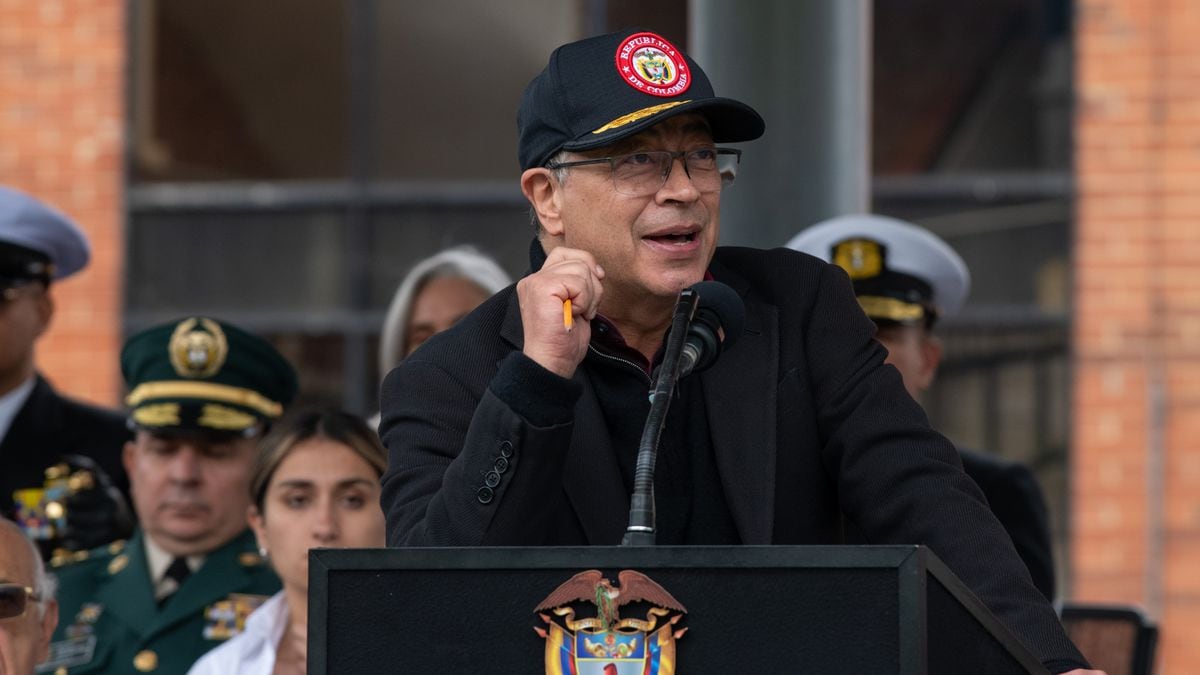

Finance Minister Lindner and Economics Minister Habeck in the Bundestag

Photo: Sean Gallup/Getty Images

The cost of living in Germany is rising significantly – heating, driving and groceries have become significantly more expensive.

New measures are intended to help those affected and reduce the tax burden.

The Bundestag passed the corresponding laws today, which will cause the federal government to lose around 4.46 billion euros in tax revenue in the current year alone.

Citizens also have this money at their disposal.

By 2026, the costs will add up to around 22.5 billion euros.

The planned resolutions at a glance:

The basic allowance increases by 363 euros

The so-called basic allowance for income tax is to be increased

from the current EUR 9,984 to EUR 10,347

.

As a result, all taxpayers have to pay less income tax – retrospectively as of January 1 of this year.

The basic allowance is the limit above which income tax is due in Germany in the first place.

If you have an income below this amount – after all deductions such as income-related expenses – you do not have to pay any taxes.

If you get over it, you will pay taxes on income from 10,348 euros in the future.

Advertising fee is increased

The flat-rate employee allowance is also to increase retroactively to January 1st.

This is the so-called income-related expenses flat rate, which is automatically taken into account in the tax return for all employees if they do not state higher income-related expenses themselves.

So far, the taxable income could be reduced by 1000 euros, in the future it should be

1200 euros

.

Long-distance commuters receive a higher commuter allowance

Those who have a long commute to work are particularly affected by the rise in fuel costs.

Therefore, the increase in the flat rate for long-distance commuters, which is actually only due in two years, should be brought forward to this year.

A long-distance commuter is someone who has to drive 21 or more kilometers to work.

Retroactive to January 1, long-distance commuters should be able to count

38 cents per kilometer

, three cents more than before.

However, this should only apply until 2026 for the time being.

The commuter allowance is part of the income-related expenses in the tax return.

However, long-distance commuters usually get slightly more than the lump sum, so they benefit directly from the increase.

The coalition emphasizes that those who have to commute less far will also be relieved by a higher flat-rate income tax allowance.

However, the commuter allowance is controversial, especially among the Greens.

Although it can also be credited to train or bicycle trips, they see it as a promotion of car traffic.

The coalition therefore agreed to reorganize the lump sum in this legislative period and to take better account of ecological and social concerns.

Assistance for beneficiaries

In the afternoon, Parliament had already decided on surcharges for some poorer citizens: children and young people in families who depend on social benefits will receive

20 euros more per month

from July .

The maximum child allowance increases from up to 209 to up to 229 euros per month per child.

The surcharge is primarily intended to support parents whose income is not sufficient for the entire family.

Adult beneficiaries in the social minimum security systems should receive a

one-time payment of 200 euros

in July .

Anyone who receives unemployment benefit I receives a

subsidy of 100 euros

.

The money should also be paid out in July.

Klingbeil promises further relief

The aid is part of a larger relief strategy of the federal government.

Finance Minister Christian Lindner defended the package in the "Morgenmagazin" that it should not be viewed in isolation.

Among other things, Lindner referred to the abolition of the EEG surcharge planned for the middle of this year and the nine-euro ticket for local and regional transport.

However, given the high inflation, the package does not go far enough for the opposition.

The Union criticized that the basic allowance was not raised high enough.

In addition, the money will reach the citizens far too late, namely after the tax return for 2022 in the coming year.

The government must act faster, especially when it comes to cold progression.

This is a kind of creeping tax increase, when a salary increase is completely eaten up by inflation, but still leads to higher taxes.

more on the subject

Cheaper mobility and bonus payments: This is what the energy relief package brings

Dispute over commuter assistance: what happens next with the nine-euro ticket?

Compensation for high fuel prices: How the new nine-euro ticket should work

SPD leader Lars Klingbeil has already promised further relief for the future.

It is uncertain how energy prices will develop, said Klingbeil on Wednesday.

Among other things, he spoke of possible help for older people.

Although there was just the highest pension increase in decades, »but I am fully aware that we have to pay particular attention to pensioners, who are also severely affected by inflation, and that we can also take further relief steps if necessary have to go".

Lindner sees it similarly.

He can imagine an adjustment of the basic security standard rate, the tax-free basic amount and the wage and income tax.

As Minister of Finance, he "does not want to be the winner of inflation," said Lindner.

This year, however, the state has “little leeway”.

slue/dpa/AFP