A low-interest loan fraud group conspired with two licensed finance companies to use the customer information provided by the finance companies to conduct Cold Call (telephone sales) and lure customers to borrow money with low-interest offers, thereby defrauding loan deposits.

The police targeted a fraud syndicate and arrested 22 people, including the mastermind and key members.

The group was involved in at least seven low-interest loan scams, with victims losing more than $1.9 million in total.

The police said that in the past investigations into low-interest loan fraud cases, it was rarely found that the fraudsters obtained customer information from the financial company, and will investigate whether the financial company charges a fee to provide the customer information.

The Chief Inspector of the Commercial Crime Investigation Division, Ou Yongen, explained the case that the police received reports from different citizens between September and October 2021 that they had received calls from scammers who falsely claimed to be employees of a local bank or financial company, and were promoting "a settlement" for low prices. interest loan program.

When the victim expresses interest, the scammer will ask the victim to deposit 10% of the loan amount into a designated bank account as a security deposit.

But after the victim deposited the money into the account, the scammer lost contact, and the promised low-interest loan plan would not materialize.

After in-depth investigation and intelligence analysis, the police targeted the mastermind and key members of the fraud group, as well as a call center located in Kwai Chung Industrial Building.

The police believe that the fraudulent syndicate conspired with two licensed financial companies to conduct Cold Calls using customer information provided by the financial companies. Some customers were defrauded of money because they could not afford the loan offers.

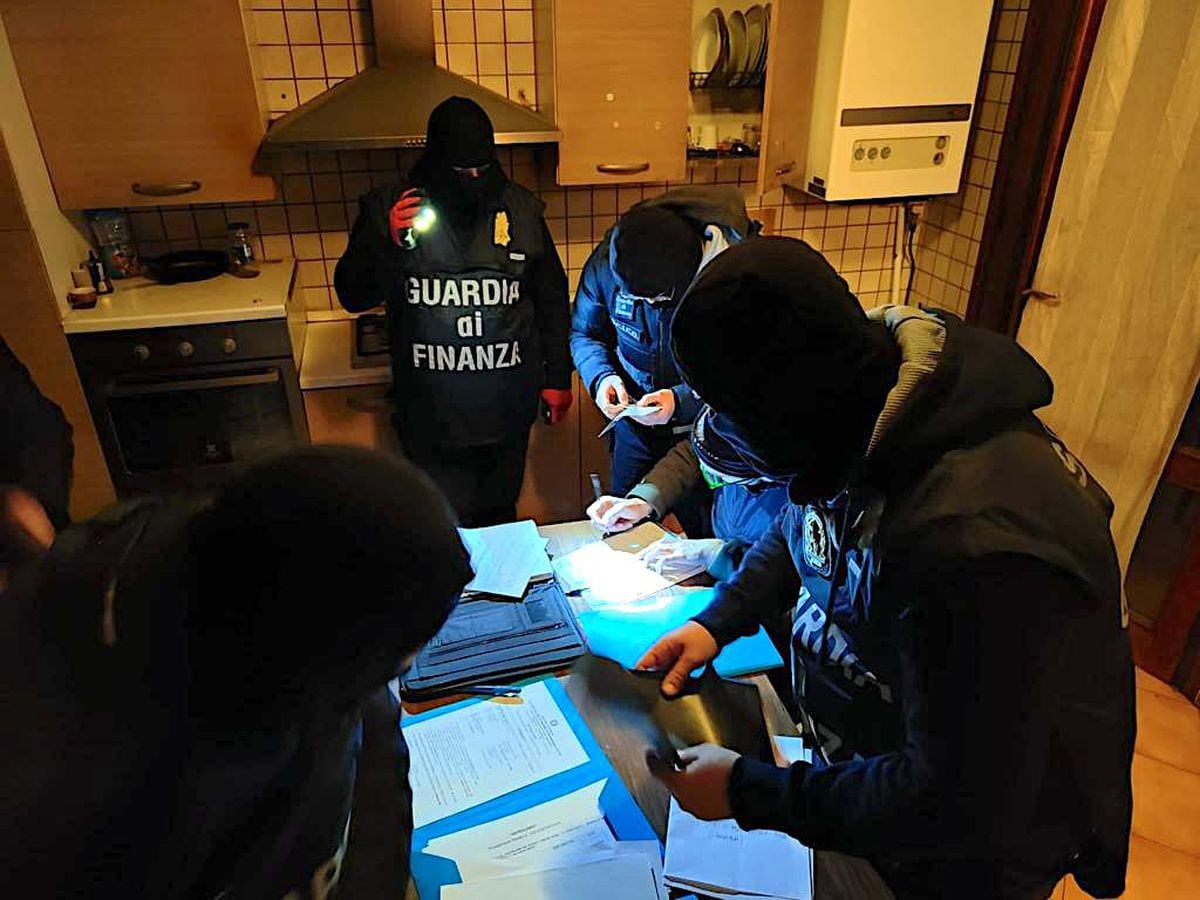

Senior Inspector Wu Zhenyao of the Commercial Crime Investigation Bureau pointed out that the officers of the Commercial Crime Bureau took an arrest operation code-named "SPIKEHOLDER" from May 12 to 13 and raided many places in Hong Kong, Kowloon and the New Territories, including a call center in Kwai Chung, Two licensed finance companies in Mong Kok arrested 17 men and 5 women, aged between 19 and 38, including a mastermind, a key member, 2 directors from two finance companies, and 14 call center staff And 4 puppet account holders, some of whom have a triad background.

The arrested person is suspected of "conspiracy to defraud" and "money laundering" and is being detained for investigation. The case is still under investigation. It is not ruled out that more people will be arrested.

During the operation, detectives seized 60 mobile phones, 10 computers, phone cards, speeches promoting low-interest loans, borrower application forms, as well as cash, watches, gold utensils and other items worth 1.2 million yuan.

The police believe that the group has been operating for more than half a year and has been involved in at least 7 low-interest loan fraud cases. The victims are between the ages of 23 and 46, and the losses ranged from 30,000 to 1.36 million, with a total loss of more than 1.9 million.

Senior Inspector of the Anti-Fraud Coordination Center, Lin Pei Hang Shui, said that in recent low-interest loan scams, scammers often claim to be employees of banks or financial companies, and ask victims to deposit loan deposits into third-party accounts without ever showing up.

However, the police found that sometimes the scammers would also take the initiative to interview the victims to explain the low-interest loan scheme, and then asked the victims to deposit money into a third-party account as proof of assets.

Lin Peiheng reminded the public that if they receive a call from a bank or financial company employee, they can verify the identity of the employee with the relevant institution.

In addition, the bank or financial company will not ask customers to deposit money into a third-party personal bank account, nor will they refer customers to law firms or other financial companies for loans, or even go to non-branch locations for interviews and signing documents.

If the public needs to borrow money, they can apply to a reputable bank or a licensed financial company, and they should read the terms of the contract before signing the documents. If they suspect that they have been deceived, they can immediately call the anti-fraud hotline 18222 and contact the staff of the Anti-Fraud Coordination Center.