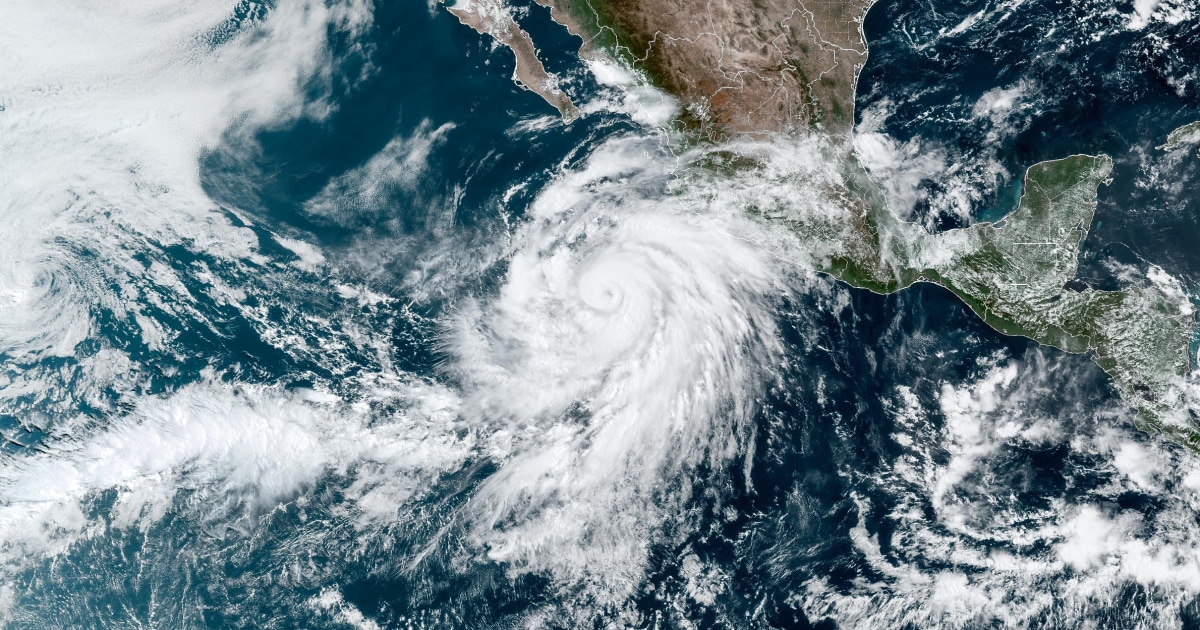

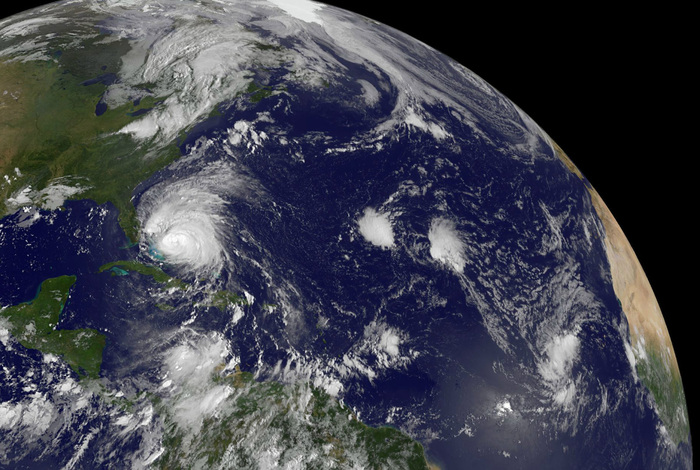

A new and threatening plague, the daughter of those that had already been hitting the world, is gaining strength like a hurricane on the global horizon.

It is inflation, the direct result of the pandemic and Russia's war in Ukraine, which, with prices galloping at an alarming rate in much of the planet, opens the way for fearsome ghosts.

Erosion of purchasing power, abrupt halt in advanced economies, cycles of restructuring or bankruptcy in fragile countries, social unrest that offers fertile ground for populism in all latitudes: this is the scenario that the world is facing, while geopolitical turbulence and climate change shake the foundations.

The causes of the birth of the inflationist monster are evident.

The pandemic has caused strong disruptions in supply chains and promoted fiscal and monetary stimulus policies with upward collateral effects on prices.

The war in Ukraine has exacerbated negative dynamics that were already taking place in the fundamental energy and food markets.

The result is inflation rates unheard of in decades in two of the three largest economies in the world - the United States and the European Union -, very high thresholds in large countries such as Russia or Brazil, or directly exorbitant rates in countries such as Argentina or Turkey, which this week reached 73% interannual rate.

China is saved from this drift, but for terrible reasons:

The consequences are serious.

In its latest World Economic Outlook, published in April, the IMF already spoke of the flare-up as a new "great transformative

shock

", pointing out in particular the weak position of emerging and developing countries.

The rise in rates in the advanced economies, especially the US, will in all likelihood lead to a flight of capital from the most fragile countries, a fall in the value of their currencies and enormous difficulty in paying dollarized debts at a time when In addition, many are especially indebted after the ravages of the pandemic.

But the stage has darkened abruptly since that report.

Widespread forecasts according to which inflation was a one-time phenomenon have been denied, and it is already clear that the suffering will not be exclusive to emerging economies.

Jamie Dimon, CEO of JPMorgan and a veritable totem of the investment universe, said last week that storm clouds were gathering on the horizon.

This week, he directly called them a hurricane.

In an email to Tesla executives and known on Friday, Elon Musk proposed cutting the company's global workforce by 10% for a "super bad hunch" about the economy.

The president of the Federal Reserve (the Fed, the US central bank), Jay Powell, acknowledged that the adjustment will involve "some pain".

Only time will tell how much, how hard the impact will be on citizens and businesses in different economies, and how this will translate into politics.

It may be that many achieve a soft landing, but the premises are not encouraging.

OPEC has announced its willingness to increase the rate of increase in its production, but the 220,000 barrels added are minimal relief in the great energy storm.

In terms of food, there are many initiatives under way, but the prospect of normalization is doubtful to say the least.

There is also no sign that allows us to trust that the conflict in Ukraine will end soon.

In China, the regime claims to have brought the situation in Shanghai under control, but the specter of new outbreaks is around every corner and hardly anyone expects a V-shaped revival.

History, on the other hand, shows the potential for political turmoil that inflationary cycles have.

It is not necessary to look at extreme cases, such as the famous Weimar Republic that led to Nazi Germany.

In parameters of democratic normality, the demolition of political projects can be observed, as happened with the Democrats in the US at the end of the 1970s.

Jimmy Carter's presidency was hit by an inflationary cycle and growth difficulties.

This was a key factor, although not the only one, in political defeats from which the Democrats did not substantially recover until 1992, with Bill Clinton.

A study published in 1999 by Professors Harvey D. Palmer and Guy D. Whitten in the

British Journal of Political Science

which investigated the political evolution of 19 industrialized nations between 1970 and 1994 —a period of special interest in terms of inflation— highlights the electoral impact of economic turmoil caused by upward trends.

In a telephone conversation, Whitten, a professor of Political Science at Texas A & M University, points out his conclusions.

“Inflationary phenomena have a political impact, especially when they are unforeseen.

When there are upward but expected dynamics, it is easier for there to be structural adjustment mechanisms that mitigate the consequences.

On the other hand, when they are unforeseen, they tend to have a greater impact on salaries or savings, and that is when social unrest grows and moves to the polls.

The current scenario is clearly one of unforeseen dynamics”, he points out.

The central sociopolitical aspect is the transmission belt between inflation and loss of purchasing power and its potential to exacerbate inequality.

It is a very complex dynamic, which depends on multiple factors that prevent resounding and general statements.

But it is possible to point out some substantive and contextual considerations.

Basically, according to Grégory Claeys, a researcher at the Bruegel think tank, "inflation is a phenomenon that tends to corrode purchasing power and does so proportionally more intensely with those with low incomes, because for them spending on goods such as energy has a higher relative weight, because they tend to have unprotected savings from the corrosion of inflation and less capacity for contractual negotiation than the more educated”.

On the other hand, the current inflationary cycle occurs at a time of suffering – and debt – accumulated in the pandemic period.

In some cases, inflation can have a positive effect for the indebted, when they are private with fixed interest rate regimes or countries with a stable currency.

The escalation of prices reduces the real weight of the debts.

But this is not the case if they are linked to variable rates or in fragile countries with volatile currencies and dollarized debts.

In the labor market there are also two contradictory factors.

On the one hand, Claeys points out, the vigor of employment in many countries – as shown by the data released this week in the United States or Spain – puts workers in a good position.

For the other,

In monetary terms, the big central banks not only face the already difficult task of finding the sweet spot between cooling dangerous inflation without hibernating the economy;

rather, they do so in a completely new context, after a long stage of applying tactics without a history of

quantitative easing .

.

Landing from that sky doesn't have many proven manuals.

“Right now, the position of central bank governors is not easy at all, it is a situation with multiple variables and quite dynamic.

I am concerned that, due to the obsession with the 2% inflation target, rates will be raised too soon, too quickly, and that in the end, not only will there be a severe contraction in developed countries, but there may also be debt payment problems in emerging countries”, comments Miguel Otero, main researcher at the Elcano Royal Institute.

The reconfiguration of supply chains for geopolitical reasons complicates the whole scenario.

Globalization has been for decades a force to contain inflation, lowering production costs.

The ongoing decoupling process due to political mistrust is synonymous with rising costs.

The scene is turbulent.

Emilio Ontiveros, founder and president of the International Financial Association firm, shows his concern.

“I think we are not seeing the same inflationary infection as in the 1970s.

But I am very concerned about overlapping geopolitical crises.

That complicates everything so much,” he says.

Most institutions and experts continue to believe that, despite developing more intensely and for a longer period of time than was expected a few months ago, the inflationary cycle should ease in the coming months.

Catastrophic spirals similar to those of the seventies are generally ruled out.

But the geopolitical scenario in profound change, as Ontiveros points out, casts a long shadow of unpredictability.

And the vigor of populist proposals in many places does not bode well either.

The good growth data of recent quarters may soon deteriorate, and in many countries the good employment data does not rule out popular frustration with the low purchasing power of wages.

Below are some notes on the status of some cases of special interest.

Euro zone

The euro zone is facing the current turbulence with specific features of weakness.

In May, prices rose by more than 8% from a year earlier, an unprecedented increase in the monetary union.

"There is an element that causes me a point of concern: that the European Central Bank (ECB) is under pressure to raise rates, but in the euro zone a large part of the inflation is imported, it depends on external factors such as energy", comments Ontiveros.

"The risk is that we get into a vicious circle of rate hikes that do poorly on inflation and meanwhile depress the economy," he says.

According to the latest Eurostat bulletin, 39% of inflation in the euro zone is due to energy;

and another 7.5% to food and tobacco.

The current circumstances, in addition, can revive demons from a decade ago and placated for a long time: the differences between members of the monetary union.

The first signs of distance between some countries that want an intense reaction from the ECB and others that prefer a more gradual attitude are already being detected.

The gap runs along traditional North/South lines.

“The tension between creditors and debtors is always there, at all levels, citizen, business, state, and it will surely be noticed in the euro zone.

Some want low inflation, others benefit from a higher one.

The problem of the euro zone is that it still does not have all the transnational mechanisms to resolve these tensions, which are specific to each monetary space, in the most democratic and efficient way possible”, says Otero.

The most indebted countries can benefit from a dynamic that lowers the correlation between debt and GDP.

However, in parallel, the ghosts of risk premiums are already being unleashed.

After having been tame for many years thanks to the expansionary policy of the ECB, the change in cycle is promoting a noticeable rebound.

The Italian 10-year bond is already sailing a couple of points above the German.

USA

The inflationary escalation in the US is taking place in different circumstances, with a smaller share of imported stress and a much greater weight of internal factors.

The labor market is overheated, with new data released this Friday continuing to portray a powerful dynamic.

This boosts wages, thereby reducing the impact of inflation on purchasing power, but at the same time fuels the spiral.

The Fed has already embarked on a path of intense intervention in rates, with a first hike of half a point in one fell swoop, which will in all probability be followed by others of the same type throughout the summer months.

This scenario is the one that, to a large extent, explains the fear of an abrupt braking, as Dimon and Musk anticipate.

In political terms, the issue promises to be absolutely central in the legislative elections scheduled for November.

US President Joe Biden and the Democrats not only face the risk of being held responsible for the turbulence – like all forces in a position of power – but must also weather the charge that they have fueled it with fiscal stimulus policies promoted during the pandemic.

If mid-term elections are usually privileged terrain for punishing votes, they seem especially difficult for Democrats.

The polls have worsened significantly for them in recent months.

“I think the Democrats will take a tough punishment vote,” Whitten says.

Emerging and developing countries

One of the most worrying elements of the current crisis is the effect on emerging and developing economies.

The IMF points to the risk of a capital outflow as the Fed raises rates, and the activation of a vicious circle of deterioration in the currency exchange rate, new inflationary impulses, difficulties in servicing dollarized debts at a time when that, after the pandemic, many suffer from high levels of indebtedness.

In this context, the prospect of complicated restructuring processes opens up, in which the scenario of creditors will be quite different from the usual ones in past decades and even in the last great crisis, that of 2008. China, for example, has acquired a greater protagonism, and it is to be hoped that in restructuring processes it will play a new role with a geopolitical background of consolidation of ties.

Russia

The Russian economy is under intense pressure from international sanctions linked to its invasion of Ukraine.

Russian authorities forecast an 8% contraction of the economy this year.

So far, the damage has been significant, but it has managed to prevent a collapse of the currency, the financial system, and the production system.

President Vladimir Putin needs to mitigate the impact to avoid social unrest at a very sensitive political moment.

A scenario of global economic cooling and domestic inflation hovering around 20% does not help.

The Russian leader ordered at the end of May a 10% rise in pensions and the minimum wage.

China

The Asian giant represents, together with Japan, the great exception in the framework of a strong upward cycle.

Ontiveros points out that this is largely due to the fact that its economy is in a cooling process due to all the restrictions linked to the pandemic.

Consumer spending contracted 11% in April compared to the same month last year.

The sale of real estate contracted 40% compared to the same month of the previous year.

Where others are hyperheating, China is in hibernation.

But this also represents a factor of concern in global perspective.

The pandemic situation and the containment strategy of President Xi Jinping prevent a robust and constant reactivation of the Chinese economy that can act as a strong counterweight, while the Western ones will slow down.

Brazil

The Latin American giant, which has a bitter memory of runaway inflationary episodes in times as recent as the 1990s, is heading towards an important electoral date with the presidential elections in October.

The Brazilian authorities have reacted to the rise in inflation with consistent rises in interest rates, which in all likelihood will lead the country to the polls in an environment of a stagnant economy.

After the pandemic and the war in Ukraine, while climate change advances and geopolitical decoupling destabilizes, an unstable world faces the onslaught of a worrying inflationary cycle.

Jamie Dimon has advised everyone to put themselves in a shelter.

Follow all the international information on

and

, or in

our weekly newsletter

.

Exclusive content for subscribers

read without limits

subscribe

I'm already a subscriber

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/K2NW52OOARH6VFXDPLZYJJM24Y.jpg)