"TerraUSD/UST", which is an "algorithmic stablecoin", and its fellow cryptocurrency Luna fell to nearly $0 earlier, plummeting by more than 99%.

Even though Do Kwon, the founder of the coin, recently proposed "Luna 2.0", the price of the coin still fluctuated sharply, which shows that the market has not returned confidence in it.

Some people in the industry bluntly said that stablecoins have a role in hedging risks. This time, UST was pushed into a death spiral, and its reliability was questioned. However, it is believed that after experiencing the storm, it will instead play a role in eliminating the weak and retaining the strong, allowing the market to develop healthily. In the previous bull market, even if you push the garbage out, it will explode.”

The Terra blockchain platform was established in 2018 by Korean Do Kwon.

(twitter image)

Terra blockchain platform was established by Korean Do Kwon in 2018. It gradually emerged at the end of last year, and the currency price began to rise. It was close to US$120 at one time, with a market value of more than US$40 billion. It is the third largest stablecoin and once ranked among all cryptocurrencies. fifth.

UST is an "algorithmic stablecoin" issued by Terra, and its sister currency Luna maintains the 1:1 price of UST against the US dollar by issuing or burning Luna. However, the "linked exchange rate" expired earlier, and UST was pushed into a "death spiral". ”, the market value of 40 billion US dollars evaporated in just a few days.

In fact, stablecoins have always given people the feeling of being "stable". They are a type of cryptocurrency that are bound with other assets to maintain price stability. They are mainly divided into three categories.

The first is "fiat currency stablecoins", such as Tether (USDT) and USDC, which are issued through equal dollar reserves; the second is stablecoins linked or mortgaged with other encrypted assets; and the "algorithmic stablecoin" that happened this time. ", through the "destroy and minting" algorithm to maintain the price level, there is no real asset mortgage.

Ou Weizhi pointed out that the adjustment of the currency market has instead played a role in eliminating the weak and retaining the strong.

(provided by respondents)

Is it a scam?

Or get shot?

Some investors questioned that UST is a scam. The DeFi platform Anchor Protocol uses a high interest rate of 20% as a selling point, attracting people to pledge UST and then lend it out. However, the supply exceeds demand, and it is necessary to not stop new investors to deposit funds to pay dividends. The criticism is a "Ponzi scheme"; some people estimate that snipers spotted the loopholes, and the large-scale selling caused market panic and caused the earthquake in the "currency circle".

Later, the blockchain analysis platform Nansen reported that the collapse of UST was not due to an attack, but that individuals with a large number of USTs believed that it was too risky to keep UST and decided to sell it, which eventually led to "decoupling".

Regardless of the truth of the incident, the incident did affect market confidence. Au Weizhi, co-founder of the Hong Kong Digital Asset Society and investment director of Shibi Investment (Hong Kong), stated in an interview with Hong Kong 01 that for the market, stablecoins provide people with a safe haven However, this time UST was pushed into a death spiral, which proved to be ineffective and its reliability was questioned.

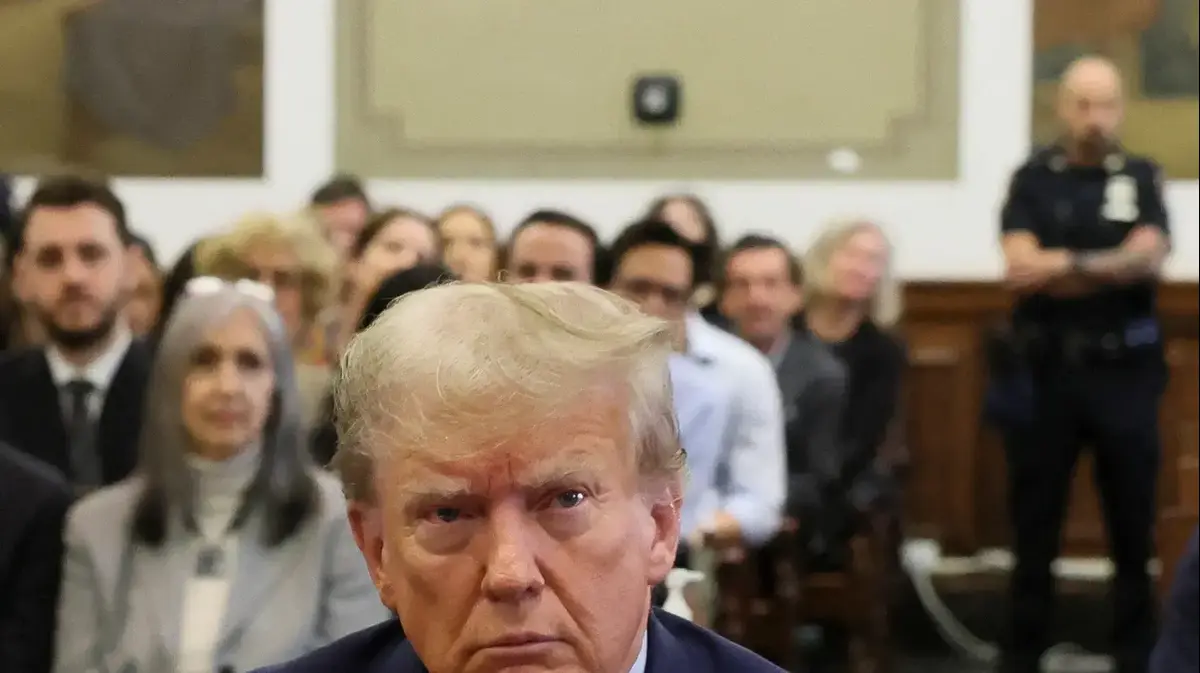

Experts believe that the price of cryptocurrencies has fallen sharply, just like the performance of technology stocks in recent days.

(file picture)

However, he mentioned that after the incident, the application level of cryptocurrencies has not been hindered, but the investment level has been dragged down by many negative factors.

Indeed, due to the recent interest rate hike by the US Federal Reserve and the ongoing war between Russia and the Birds, the market is worried that the global economy may enter an era of "stagflation" with high inflation and low growth, and the capital market has plummeted. For the first time since 1923.

Coupled with the UST explosion, the entire cryptocurrency market plunged. Bitcoin (Bitcoin) fell sharply from a high of more than $69,000 to a level of $28,000, and only recently recovered to a level of about $30,000.

According to CoinMarketCap statistics, the market value of the entire cryptocurrency market has dropped from a peak of nearly $2.9 trillion in November last year to about $1.2 trillion recently.

Au Weizhi: The market re-evaluates the valuation

Ou Weizhi described that the cryptocurrency market has plummeted, and the situation is the same as the recent performance of technology stocks, "It seems that there are some Internet companies that are not making money in the US stock market. The valuation was so high in the past, because the market believes that they are an ecosystem. The future growth will be very strong, but Yijia has to re-evaluate and is not willing to go higher (valuation).”

Au Weizhi pointed out that the sharp drop in the price of the currency has played a role in eliminating the weak and retaining the strong. It is estimated that some concepts are good and the scale of the ecosystem is sufficient, and the currency price is expected to return to a relatively stable level, but in the future In one or two years, it is still difficult for the price to return to the previous high level. "I believe there will be a healthy development, and there will be no bull market before, even if the garbage is pushed out, it will explode."

Ou Weizhi pointed out that the sharp drop in the price of the currency has played a role in eliminating the weak and retaining the strong, but the crazy bull market is unlikely to appear again.

﹙ Profile picture ﹚

Now is not a good time to "fish for the bottom"

As for how investors should choose cryptocurrencies for investment?

He bluntly said that Solana, once accused of being an "Ethereum killer", has also experienced downtime several times this year, and reports even said that some users were "exploded" as a result. Therefore, he believes that the market still needs time to observe. , it is not a good time to "fish the bottom".

Ou Weizhi reiterated that cryptocurrencies are always high-risk investments, investors should manage their positions carefully, do not have "FOMO" (Fear of missing out), and control their emotions, "There are many things in the market that cannot be predicted. , and also because of the lack of monitoring, sometimes there will be human operations or fake news.”

If they are determined to enter the market, he suggests that young investors can be aggressive, "(worst case) losers have a chance to get back quickly", but those with family burdens can consider controlling the proportion to about 5%.

Li Zhaobo said empty-handedly that cryptocurrencies are just speculation, and construction investors must be self-disciplined, "it's better to leave if you make less money."

(file picture)

Li Zhaobo: Speculation, not investment

Li Zhaobo, an honorary teaching and research scholar at the Asia-Pacific Business Institute of the CUHK Business School, also said that the current global financial market is relatively turbulent, and it is not ruled out that bookmakers are eager to cash out, coupled with stricter regulatory policies, which has caused cryptocurrencies to plummet.

He believes that cryptocurrencies are speculation rather than investments. With the introduction of measures to regulate cryptocurrencies around the world, once cryptocurrencies are related to criminal incidents, the entire currency market may be implicated.

He also pointed out that although Hong Kong has not yet adopted strict supervision on cryptocurrencies, if there is money laundering and violation of laws such as the National Security Law, it is enough to sanction related crimes. Therefore, he believes that investors should be self-disciplined, "Earn less and go! "