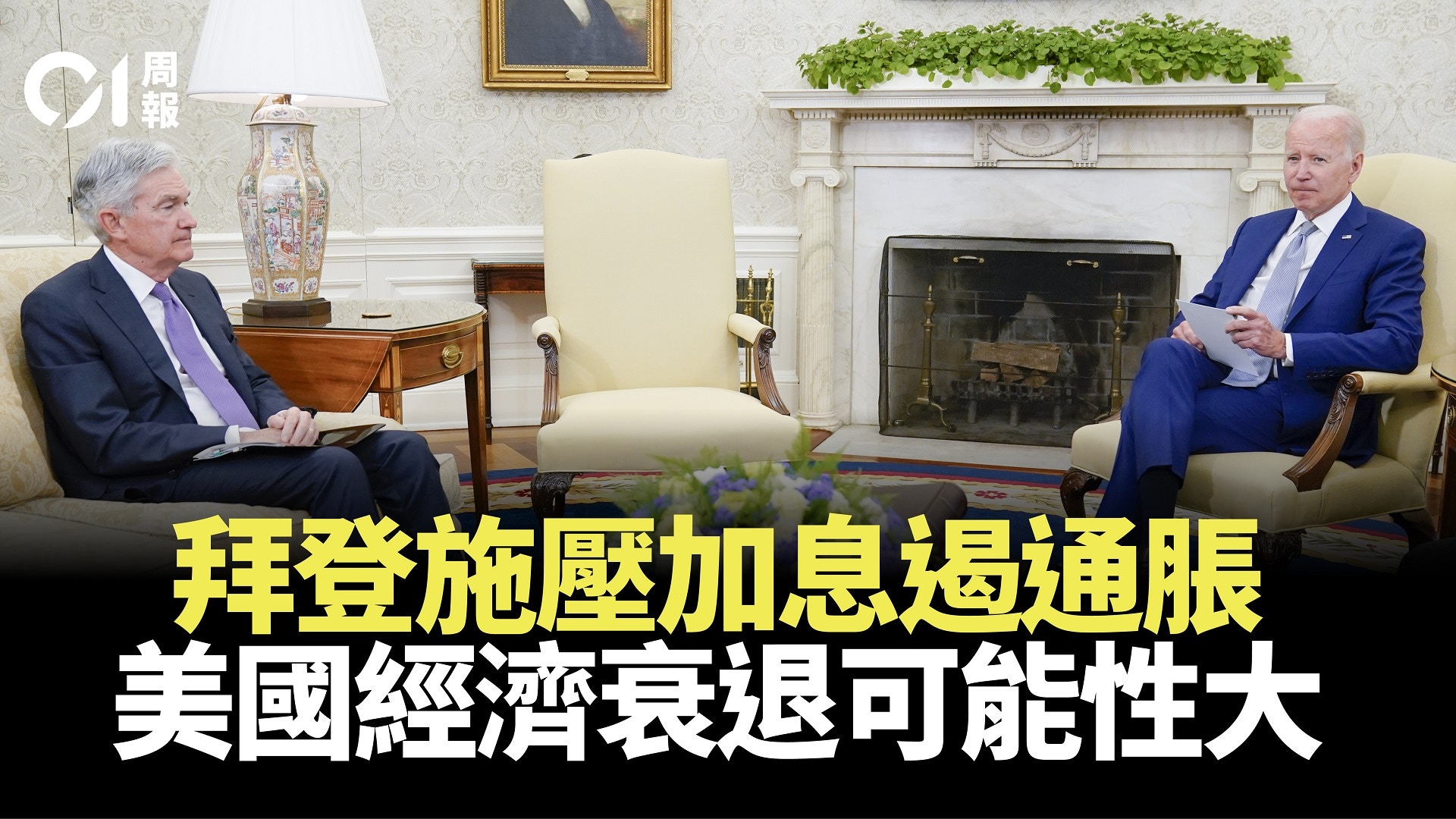

Last Tuesday (May 31), U.S. President Biden met with Federal Reserve Chairman Jerome Powell to discuss the U.S. and global economy, especially dealing with high inflation.

Expert analysis pointed out that this move is to reverse the market speculation that the Fed has the opportunity to raise interest rates in September since the end of last month.

Six months later, U.S. President Biden, Federal Reserve Chairman Powell and Treasury Secretary Yellen met again.

(Associated Press)

Recently, the market has begun to speculate that the Fed has the opportunity to slow down the pace of interest rate hikes. First, it is based on the core core personal consumption expenditure (PCE) inflation data released by the United States last week, which is also the Fed's preferred inflation measure, falling for two consecutive months.

In addition, the mid-term elections will be held in November. Recently, there has been some speculation in the market that the Federal Reserve may suspend interest rate hikes in September after successive interest rate hikes in June and July, and then observe inflation and economic conditions at that time. Avoid raising interest rates too quickly and damage the economy, which is not conducive to the election of the current government.

Hang Seng Bank chief market strategist Wen Zhuo-pei believes that Biden's remarks are precisely to reverse the above-mentioned market expectations, indicating that the current priority is to suppress inflation, not to stimulate the economy to maintain growth before the election.

This will put more pressure on the Fed to control prices by raising interest rates.

Regarding the prospect of U.S. inflation, Wen Zhuopei pointed out that based on the current high energy prices, such as the U.S. natural gas price at a 13-year high, as for international oil prices, even though the U.S. has now released 1 million barrels of oil per day from its strategic oil reserves, the price of oil Still hovering at the level of 110 to nearly 120 US dollars, I believe that in the summer travel season in Europe and the United States, energy prices will increase. Therefore, he believes that inflation in the United States will be difficult to fall, and the pace of Fed rate hikes will also continue to increase the dollar and US bond yields. The 10-year U.S. bond yield is expected to return to 3 percent this month.

The final value of the personal consumption expenditures (PCE) price index in the first quarter of the United States rose by 3.1%, which is expected to rise by 2.8%; the final value of the core PCE price index rose by 5.1%, compared with the expected increase of 5.2%.

(Xinhua News Agency)

Fed Governor Christopher Waller has signaled hawkishness, supporting a half-point rate hike in "next meetings," stressing that he will keep raising rates at each meeting until U.S. inflation falls close to his 2 percent target half point of view.

On the issue of keeping inflation in check while avoiding a recession, Powell acknowledged that doing so hinges on factors beyond the Fed's control, including global energy markets under the Russia-Ukraine conflict and chaotic supply chains under the Covid-19 pandemic.

Powell has previously said in interviews with the media that achieving a "soft landing" is challenging, a task made more difficult by the global events of the past few months.

The so-called "soft landing" is when the central bank guides an economic slowdown by raising interest rates after the economy overheats, without bringing about a recession.

Historically, it is rare for the Fed to raise interest rates to lead a "soft landing".

From 1960 to 2020, the Federal Reserve has carried out a total of 11 rounds of interest rate hikes, of which only three achieved a "soft landing", and the other eight have experienced recessions.

Former US Treasury Secretary Larry Summers pointed out in a recent study that historically high levels of wage inflation have a high positive correlation with recessions in the next one to two years: when wage growth exceeds 5%, future The probability of a two-year recession is higher than 60%; when wage growth exceeds 5% and unemployment is below 5%, the probability of a recession in the next two years is 100%.

He concluded from this that the "soft landing" was very difficult.

On the issue of avoiding recession while containing inflation, Powell acknowledged that doing so depends on factors beyond the Fed's control.

(Xinhua News Agency)

This round of downturn is different from the past. Under the impact of global supply, it is more difficult to balance economic growth and inflation.

The Fed's desire to control inflation may require economic growth to pay more, which will increase macroeconomic and financial volatility and lead to higher risk premiums.

CICC expects U.S. economic growth to slow in the next six to 12 months.

For details, please read the 320th issue of "Hong Kong 01" Electronic Weekly Newsletter (June 6, 2022) "

Biden's first meeting with Powell in half a year intends to put pressure on whether the US economy will have a soft landing?

".

Click here

to try out the weekly e-newsletter for more in-depth reports.