Enlarge image

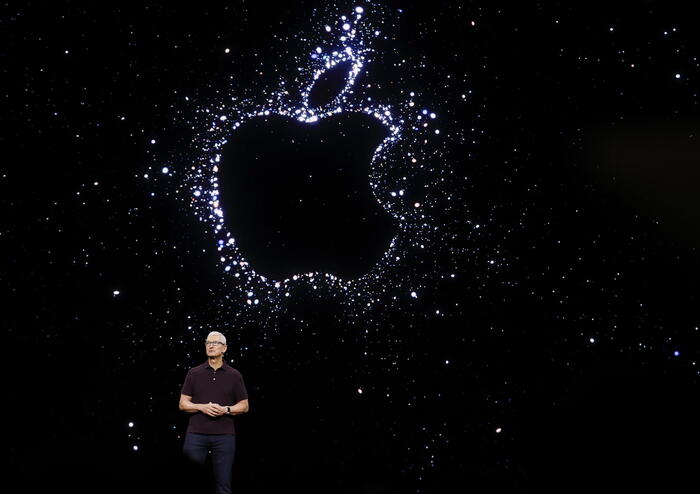

Pay Later:

Apple manager

Corey Fugman

introduced the new service in early June

Photo: Apple Inc. Handout/EPA

It was news that caused shock waves in the already stressed fintech industry: At the beginning of June, the most valuable company in the world announced that it would compete with the digital newcomers in a billion dollar business.

In the future, Apple will offer so-called “buy now, pay later” services that users can use to spread their payments over a longer period of time.

The offer under the name "Apple Pay Later" should apply everywhere where the company's own payment system is already accepted, manager

Corey Fugman praised

at the presentation at the developer conference.

Starting this fall, users in the US will be able to split sums of money between 50 and 1,000 US dollars into up to four individual payments within six weeks – without interest or fees.

Simply via your iPhone.

Apple boss

Tim Cook

(61) is thus interfering in a recently booming market that has so far been dominated by young companies such as the Swedish start-up Klarna or the US companies Affirm and PayPal.

During the Corona crisis, the installment payment business had grown significantly.

More and more retailers are collaborating with the payment processors and offering the BNPL services through their websites.

Now Cook also wants to get involved - and that's probably just another step in gaining a foothold as a big player in the financial business.

The change in the banking industry has so far been driven primarily by smaller fintechs and neobanks.

In the long term, however, the large tech companies will probably be in good positions.

"Apple is one of the real winners in payment - if you look far ahead," said tech investor

Philipp Klöckner

(42) recently in an interview with "Capital".

Banking should be implemented as simply and digitally as possible.

And Apple and Google with their end device operating systems now have ideal conditions.

No wonder that Google has long been experimenting with its payment function.

Apple's path to becoming a financial services provider

Apple has been providing financial services for many years.

For example, iPhone owners in the US have been able to pay with Apple Pay since 2014;

since the end of 2018, the service has also been offered in Germany.

According to a GfK study commissioned by Mastercard, almost one in three Germans now prefers to pay with Apple Pay.

Because of its market power, the group has already been targeted by the European antitrust authorities;

With Apple Pay, it blocks third-party access to key technologies and thus violates competition law, said EU Commissioner

Margrethe Vestager

(54) in May.

In the USA, however, CEO Cook has long since taken the next steps.

The group has been offering a credit card there as an extension of Apple Pay since 2019.

This allows users to monitor their finances in the wallet app or online.

Cook had announced that the Apple Card should also come to Germany.

Exactly when is still unclear.

And most recently, the tech giant also added the ability for third-party payment services to use the built-in NFC chip in the devices to accept the contactless payment method.

So later this year, US merchants will be able to accept Apple Pay simply by using iPhone and a partner-supported iOS app.

According to the company, the payment service provider Stripe will be the first service to use the new function.

BNPL market increasingly popular

Apple Pay Later is now the next step.

It should come in line with the iOS 16 iPhone update in the fall and complement the existing service.

BNPL services, also known as point-of-sale loans, allow buyers to pay for their items in installments.

They don't carry out any tough credit checks before issuing a loan, which is why they are particularly popular with the younger clientele.

The offers are not undisputed, consumer advocates warn of the risk of over-indebtedness.

During the Corona crisis, total online sales increased significantly, to a total of 4.6 trillion US dollars, according to a Wordpay report.

Almost two percent of this was paid by BNPL, around 97 billion US dollars.

The volume is expected to double by 2024.

So far, the business has been dominated by start-ups such as Klarna, Afterpay, Affirm and PayPal.

Recently they have been under considerable pressure, Klarna boss and co-founder

Sebastian Siemiatkowski

(40), for example, has announced mass layoffs and the valuation fell from $ 45 billion to allegedly only a third.

Financially independant

In contrast to its competitors, Cook is already gaining a clear advantage: while the BNPL services usually only act as intermediaries, Apple wants to handle the lending itself.

There are reserves for this, the group sits on 200 billion dollars in cash and has a solid cash flow.

Without a banking partner, the group can initially expand the offer almost indefinitely, while the other BNPL apps mostly lend money to consumers themselves.

Apple does not have a banking license.

The tech group relies on a payment authorization issued by Goldman Sachs.

Together with Wall Street Bank, Apple had already released a credit card in the USA.

The subsidiary Apple Financing LLC is responsible for processing and credit checks.

Apple's risk

The BNPL business is not without risks.

How high the default rates for short-term loans are is only now becoming apparent in the looming recession.

So far, the algorithms of the BNPL providers were trained with data from a boom phase.

But unlike Apple, they've been collecting data for years.

According to Klarna, for example, 200,000 online retailers in 17 countries use the BNPL service, meaning that 90 million end consumers use the company's payment methods.

Affirm currently has 12.7 million customers.

Apple does not initially have comparable data sets.

However: According to a recent analysis report by Counterpoint, the group has vast amounts of transaction data through Apple Wallet – and thus already has a healthy risk management model.

If Apple were to link all data from its own customers in the future, the quality should be significantly higher than that of its rivals.

In addition, Apple customers tend to be among the more affluent, or as one observer puts it: "The iPhone already serves as proof of creditworthiness."

First of all, the tech giant also limits its risks structurally.

The group does not want to collect any fees from defaulting debtors, but only exclude them from future transactions.

But Apple Pay is only valid for a maximum of six weeks.

For comparison: With the Klarna installment purchase, it is possible to spread the costs of the purchase up to 36 months.

Affirm's financing can also be paid off in up to 12 months.

Apple has also announced that it will only award small amounts at first, while Klarna has no predetermined spending limit and automatically checks the amount of the respective loan.

billion Apple devices on the market

In any case, the potential is enormous.

There are more than 1.8 billion Apple Watches, iPhones, Macs, Apple TVs and iPod Touches worldwide, as Cook recently announced.

The number of Apple Pay users was estimated at 507 million in September 2020, and it is likely to be significantly more by now.

For

Ben Bajarin

, chief analyst at Creative Strategies, Pay Later for Apple is more than just a "buy now, pay later" program anyway: "It's a deepening of the ecosystem," he says.

It helps Apple to strengthen customer loyalty to the platform - and thus the value of the group.

Apple will not necessarily make money with the offer, but will increase customer loyalty.

This is not a good prospect for fintechs.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/MUTRAEQZHBADNCTJ7OTNDGNVTA.jpg)