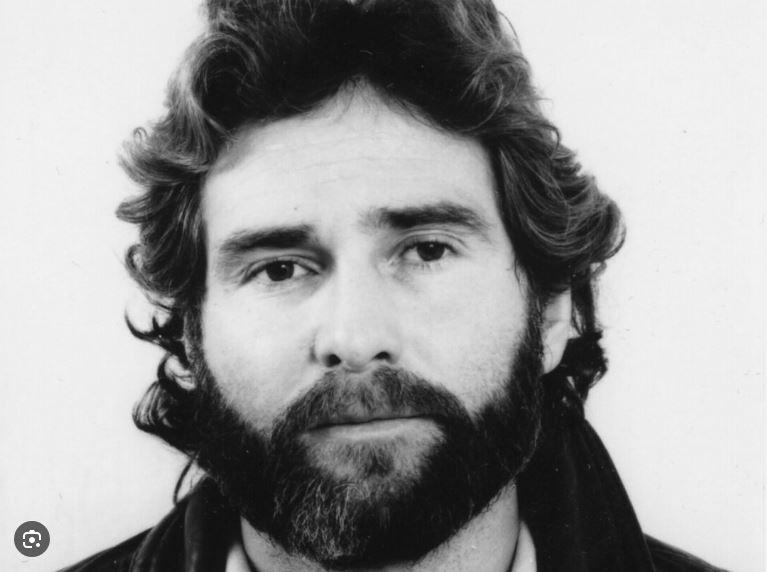

Robin Rivaton, former economic adviser to Bruno Le Maire and Valérie Pécresse, is a member of the scientific council of the Foundation for Political Innovation. His latest book is entitled

Smile, you are filmed!

(Editions of the Observatory).

If there is one book that has synthesized the dominant economic vision of the past decade, it is Stéphanie Kelton's

The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy

published in June 2020 in the United States and translated in French nine months later, a performance rare enough for an American economic essay, proof if it were needed of its extraordinary impact.

Stephanie Kelton is a professor of economics and public policy.

She served as the chief economist for the U.S. Senate Budget Committee and advised former presidential candidate Bernie Sanders in the 2016 and 2020 primaries.

While the Covid-19 pandemic lacerated our economies, questions about the vast recovery plans, causes of a sharp increase in the deficit and public debt, were quickly dismissed in the name of Stéphanie Kelton's theses.

The fundamental idea of the book is that, while economic agents such as households or businesses must collect money before spending, this is not the case for sovereign states.

These can simply spend money to live.

The Federal Reserve can thus electronically credit the bank accounts of households and businesses with new dollars.

The government then taxes this additional currency or exchanges it for treasury bills.

Spending therefore comes before taxes and borrowings, not after.

To quote the author:

“The deficit adds to wealth: it is a financial contribution that enriches other sectors of the economy.

The government deficit becomes our surplus.

The public debt is a snapshot that shows the contributions that have been made by the government to the economy”.

Assuming that central banks would constantly overestimate how low the unemployment rate can fall before inflation reappears, the modern theory of money implies guaranteed employment via government hiring.

Robin Rivaton

This means that the usual worries about the state's inability to repay public debt are meaningless.

Instead, the concern should be inflation, the government spending too much when prices get out of control.

The limits of its action are therefore the real resources of the economy, workers, materials, machines, not budgetary rules.

Yet Kelton believes that there are unused resources that the United States could put to work.

The employment rate there remains ten points lower than that of the euro zone.

Assuming that central banks would constantly overestimate how low the unemployment rate can fall before inflation reappears, the modern theory of money implies a guarantee of

employment through government hires.

The risk is obviously to have public jobs with very low productivity.

These are the 300,000 Civilian Climate Corps jobs demanded by left-wing Congresswoman Alexandria Ocasio-Cortez, also a vocalist of the modern theory of money, as part of the Green New Deal.

They should

“ensure land protection and improve community resilience”

.

A nice metaphor for ending up planting trees and picking up litter.

The past two years have provided an empirical framework for the dissemination of modern monetary theory.

A year ago, Kelton appeared on a Bloomberg podcast titled "

How Modern Monetary Theory Won the Fiscal Policy Debate. "

".

But the sudden return of inflation is its real ordeal.

In July 2021, Kelton described soaring inflation as “temporary growing pains.”

Now it claims to distinguish modern monetary theory from current fiscal policy, arguing that deficit spending requires an assessment of its inflationary effect by an independent body.

One could argue that the US government and the Federal Reserve had concluded that the Cares Act of March 2020 ($2.2 billion), the Tax Credits Bill of December 2020 ($900 billion) and the plan March 2021 US bailout ($1.9 billion) were not going to cause inflation.

Why would this committee have come to a different conclusion?

As for the argument that

However, burying modern monetary theory as a political concept seems like a risky bet.

Throughout the world, there is a growing demand for greater state interventionism.

Without even talking about current expenditure in the name of the fight against inequalities, military rearmament, economic sovereignty, energy transition, construction of infrastructures will inevitably translate into additional investment expenditure and therefore deficits.

Unless we go back to the time of the sequestration of private savings, the central banks' toolbox will necessarily come to have to distinguish between the cost of private and public debt, the first being regulated by the key rate, the second controlled by purchases of government bonds.